What Is Standard Deduction In Salary Slip - This particular slip can be either a. The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing. It contains a detailed summary of an employee’s salary and deductions for a given period.

The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing. It contains a detailed summary of an employee’s salary and deductions for a given period. This particular slip can be either a.

It contains a detailed summary of an employee’s salary and deductions for a given period. The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing. This particular slip can be either a.

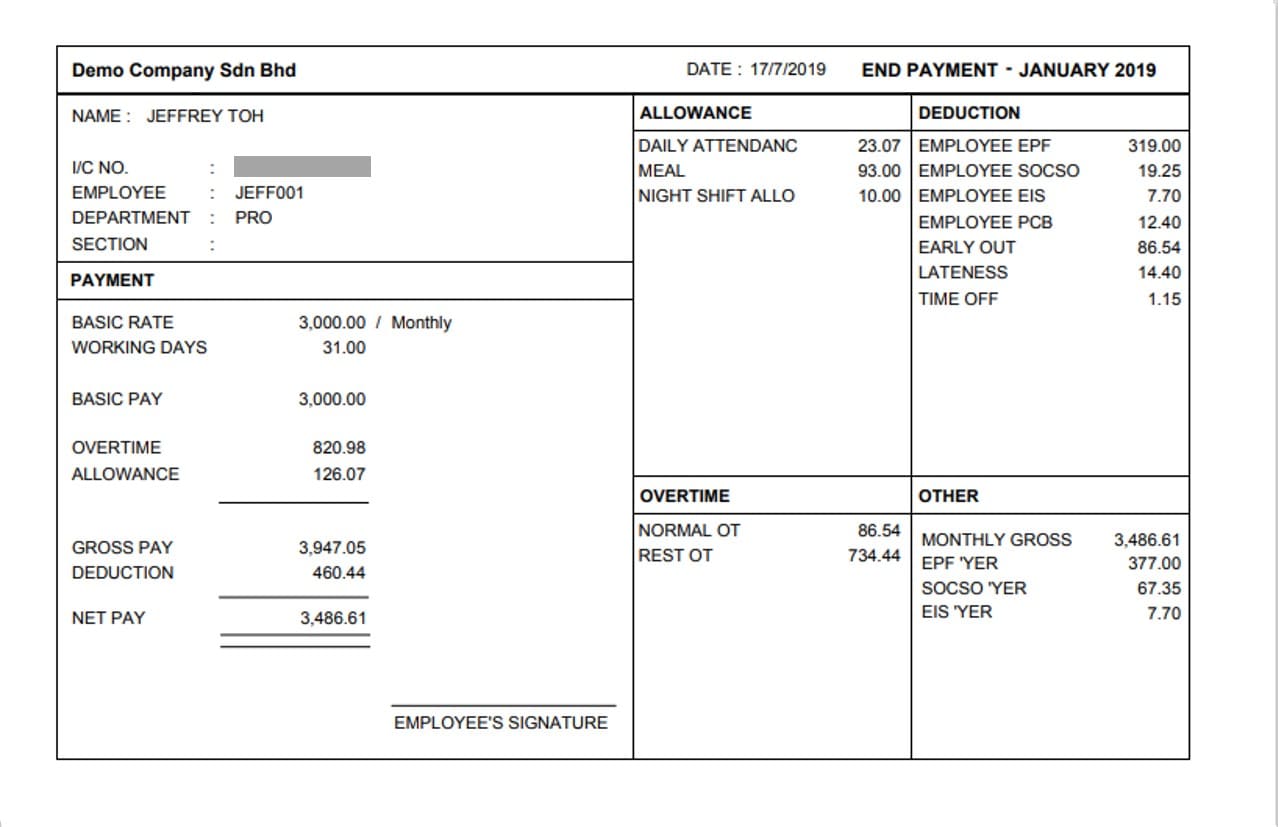

What Is Payslip? Understanding The Salary Slip, 51 OFF

This particular slip can be either a. The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing. It contains a detailed summary of an employee’s salary and deductions for a given period.

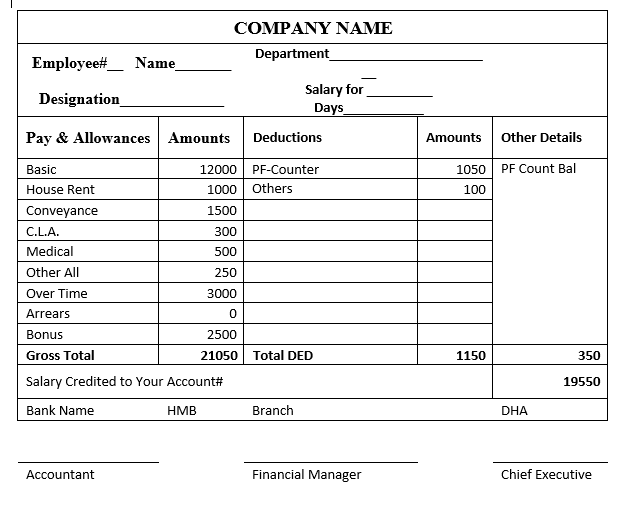

Salary pay slip excel format nolfresults

It contains a detailed summary of an employee’s salary and deductions for a given period. The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing. This particular slip can be either a.

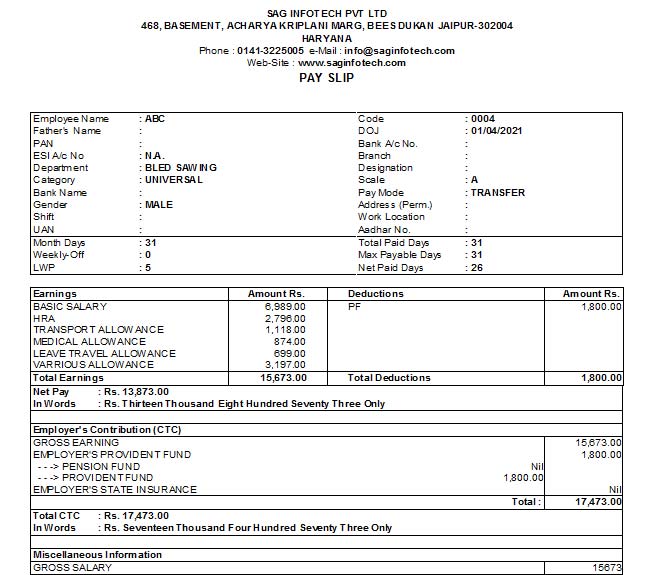

8 Essential Components Of Salary Slip That You Should Know A

The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing. This particular slip can be either a. It contains a detailed summary of an employee’s salary and deductions for a given period.

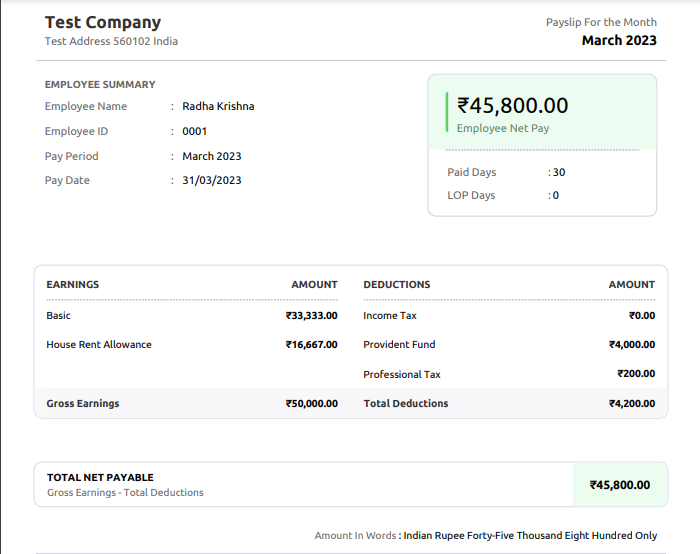

Salary Slip Meaning, Format and Components

The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing. This particular slip can be either a. It contains a detailed summary of an employee’s salary and deductions for a given period.

EXCEL of Salary Slip Template.xlsx WPS Free Templates

It contains a detailed summary of an employee’s salary and deductions for a given period. This particular slip can be either a. The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing.

All About Salary Slip with Format and Its Important Parts

The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing. This particular slip can be either a. It contains a detailed summary of an employee’s salary and deductions for a given period.

Simple Salary Slip Template In Excel Salary Slip Format In Excel eroppa

The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing. It contains a detailed summary of an employee’s salary and deductions for a given period. This particular slip can be either a.

Salary Slip Or Payslip Format Validity Importance And Components Eroppa

It contains a detailed summary of an employee’s salary and deductions for a given period. This particular slip can be either a. The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing.

Employee Salary Slip What is Earnings & Deductions?

The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing. This particular slip can be either a. It contains a detailed summary of an employee’s salary and deductions for a given period.

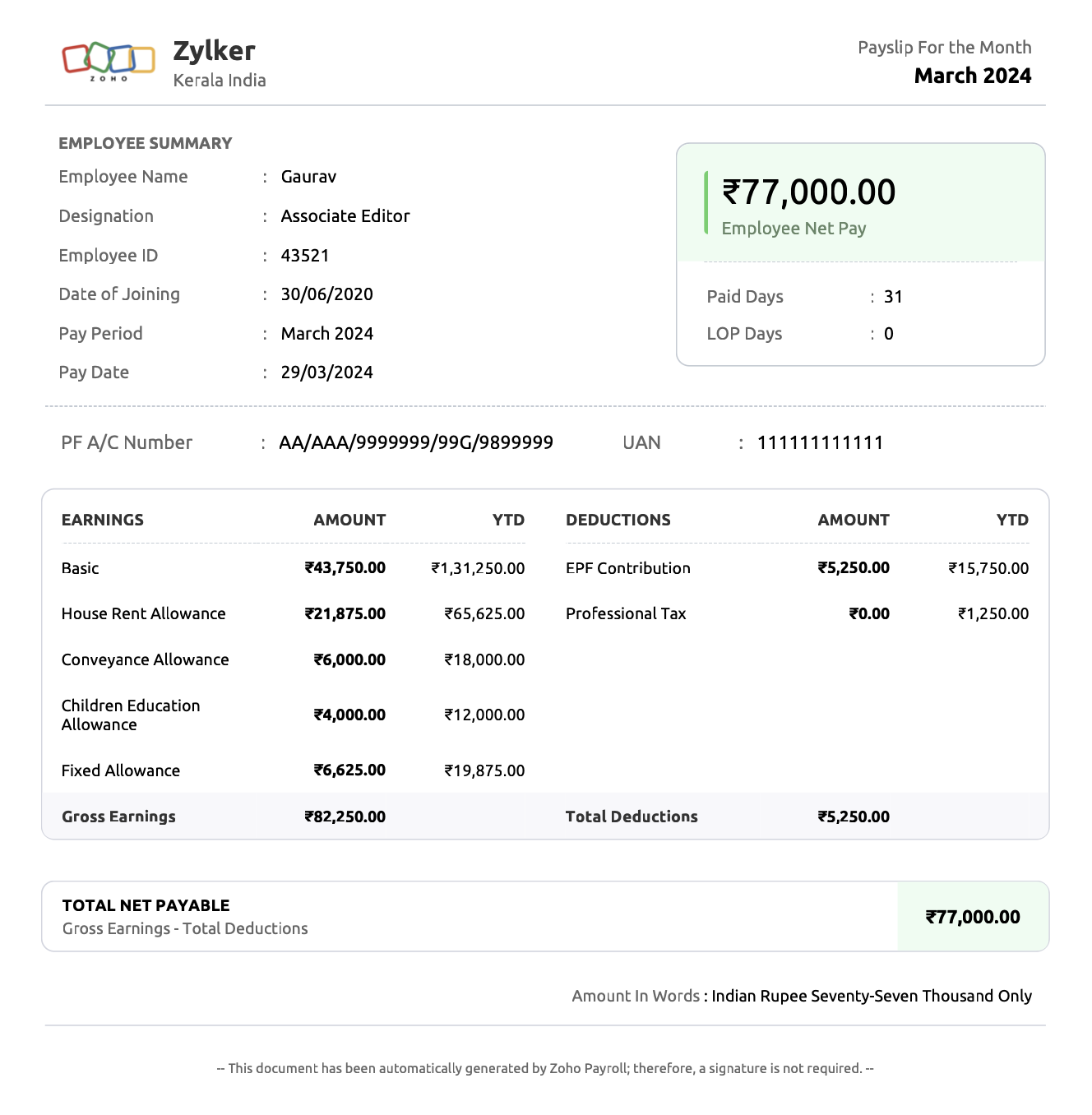

What is salary slip or payslip? Format & components Zoho Payroll

It contains a detailed summary of an employee’s salary and deductions for a given period. This particular slip can be either a. The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing.

This Particular Slip Can Be Either A.

The standard deduction on salary is a vital tax benefit for salaried individuals, reducing taxable income and simplifying tax filing. It contains a detailed summary of an employee’s salary and deductions for a given period.