Vat Return Filing In Uae - To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through the fta portal. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. This form is divided into. Learn how to file vat returns electronically through the fta portal and pay your vat liability. The vat return form, known as 'form vat 201,' is the primary document used for vat filing in the uae. Find out the requirements, deadlines, and.

Find out the requirements, deadlines, and. The vat return form, known as 'form vat 201,' is the primary document used for vat filing in the uae. This form is divided into. To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through the fta portal. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Learn how to file vat returns electronically through the fta portal and pay your vat liability.

Find out the requirements, deadlines, and. The vat return form, known as 'form vat 201,' is the primary document used for vat filing in the uae. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Learn how to file vat returns electronically through the fta portal and pay your vat liability. To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through the fta portal. This form is divided into.

Filing Vat Return in UAE Vat Return UAE How to file VAT Return in

Learn how to file vat returns electronically through the fta portal and pay your vat liability. To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through the fta portal. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments.

PPT VAT Return Filing Service in UAE pptx PowerPoint Presentation

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Learn how to file vat returns electronically through the fta portal and pay your vat liability. To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through.

How to File a VAT Return in the UAE

This form is divided into. To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through the fta portal. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Find out the requirements, deadlines, and. The vat.

VAT Return Filing in UAE A Detailed Guide Audit Firm in Dubai

This form is divided into. The vat return form, known as 'form vat 201,' is the primary document used for vat filing in the uae. Learn how to file vat returns electronically through the fta portal and pay your vat liability. Once you have registered for vat in the uae, you are required to file your vat return and make.

PPT A Guide Manual of VAT in UAE AdamGlobal PowerPoint Presentation

Find out the requirements, deadlines, and. This form is divided into. Learn how to file vat returns electronically through the fta portal and pay your vat liability. To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through the fta portal. Once you have registered for vat in the uae, you are.

VAT Filing in UAE, Dubai VAT Return UAE VAT Submissions

Learn how to file vat returns electronically through the fta portal and pay your vat liability. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Find out the requirements, deadlines, and. To file value added tax return in the uae, businesses can complete the.

VAT Return Filing Process In The UAE N R Doshi and Partners

The vat return form, known as 'form vat 201,' is the primary document used for vat filing in the uae. This form is divided into. To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through the fta portal. Learn how to file vat returns electronically through the fta portal and pay.

VAT Return Filing Period in UAE VAT in UAE

To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through the fta portal. Learn how to file vat returns electronically through the fta portal and pay your vat liability. Find out the requirements, deadlines, and. The vat return form, known as 'form vat 201,' is the primary document used for vat.

PPT Vat Return Filing In UAE PowerPoint Presentation, free download

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through the fta portal. This form is divided into. Find out the requirements, deadlines, and. The vat.

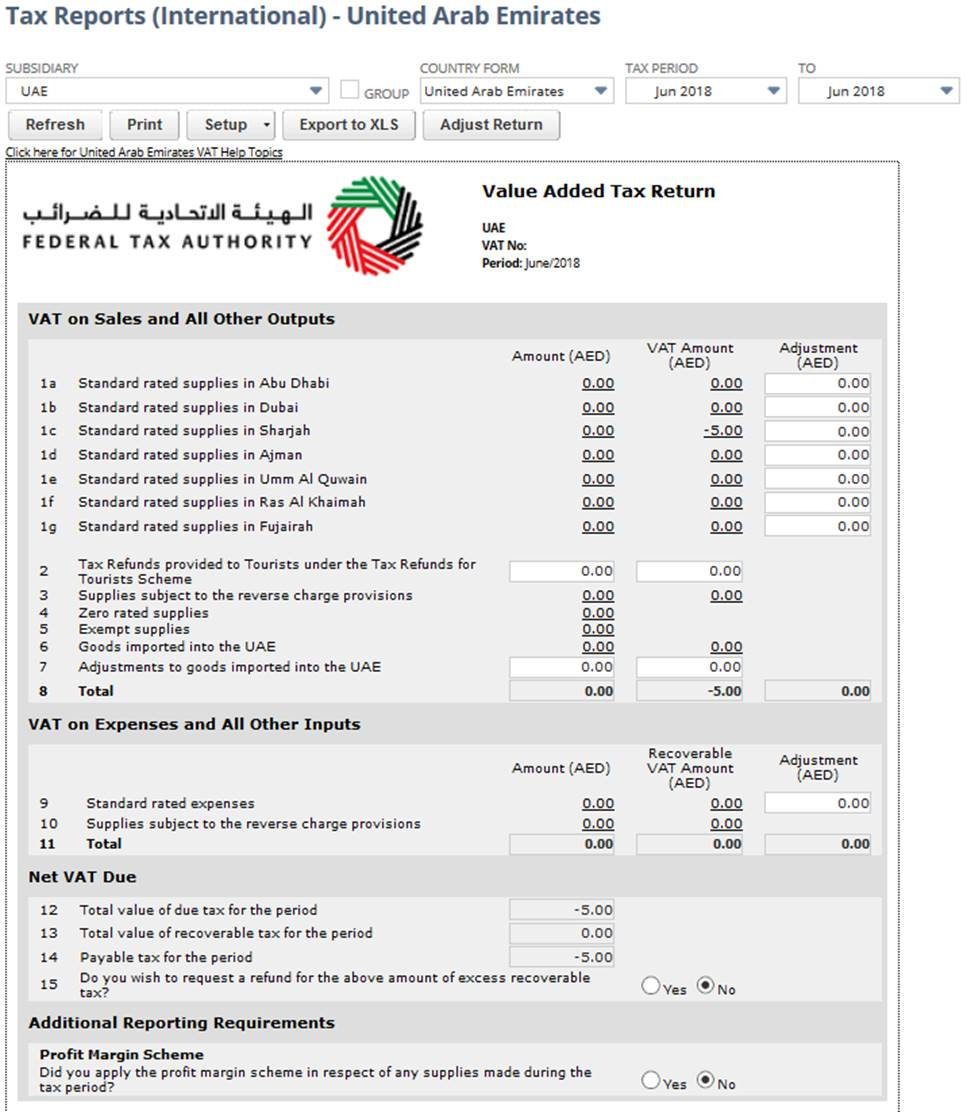

NetSuite Applications Suite United Arab Emirates VAT Report

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. This form is divided into. To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through the fta portal. Learn how to file vat returns electronically through.

This Form Is Divided Into.

The vat return form, known as 'form vat 201,' is the primary document used for vat filing in the uae. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Learn how to file vat returns electronically through the fta portal and pay your vat liability. To file value added tax return in the uae, businesses can complete the necessary vat form uae electronically through the fta portal.