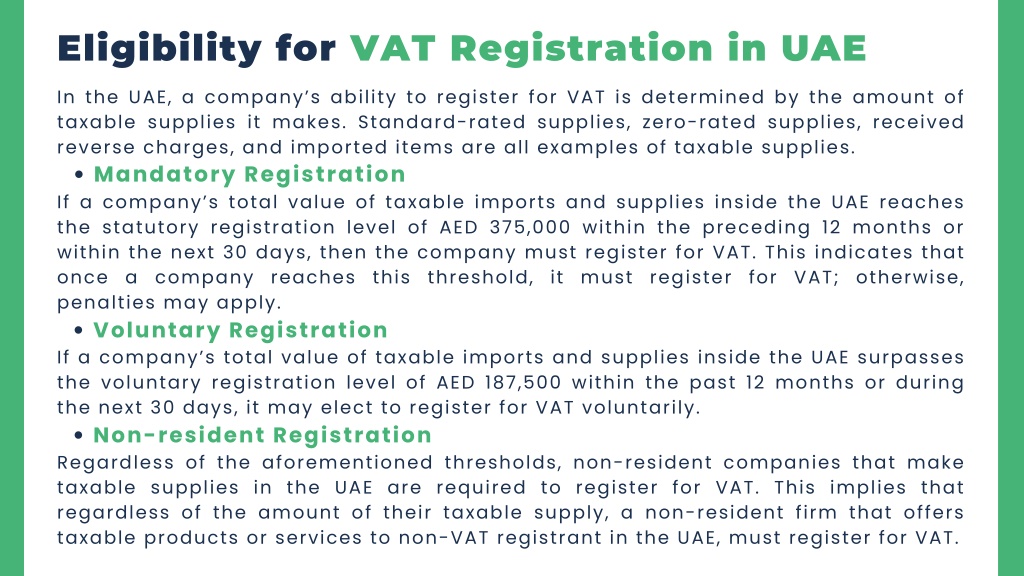

Vat Registration Criteria In Uae - In the uae, the mandatory vat registration level is aed 375,000. It is mandatory for businesses to register for vat in the following two cases: Come and review the facts about those who can apply for vat registration. According to tax legislation, a company’s proprietors must proceed with uae. Understand who needs to register,. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for.

In the uae, the mandatory vat registration level is aed 375,000. According to tax legislation, a company’s proprietors must proceed with uae. Understand who needs to register,. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. It is mandatory for businesses to register for vat in the following two cases: A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Come and review the facts about those who can apply for vat registration.

It is mandatory for businesses to register for vat in the following two cases: Understand who needs to register,. Come and review the facts about those who can apply for vat registration. In the uae, the mandatory vat registration level is aed 375,000. According to tax legislation, a company’s proprietors must proceed with uae. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for.

Who Needs to Register for VAT in the UAE? Key Criteria Explained

In the uae, the mandatory vat registration level is aed 375,000. According to tax legislation, a company’s proprietors must proceed with uae. Understand who needs to register,. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. Uae businesses must register for vat if their taxable supplies and imports exceed aed.

PPT Understanding the Latest VAT Registration Requirements in the UAE

Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. Come and review the facts about those who can apply for vat registration. It is mandatory for businesses to register for vat in the following two cases: A business must register for vat if the taxable supplies and imports exceed the.

Comprehensive Guide UAE VAT Registration Criteria

It is mandatory for businesses to register for vat in the following two cases: A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. According to tax legislation, a company’s proprietors must proceed with uae. Understand who needs to register,. In the uae, the mandatory vat registration level is aed 375,000.

VAT Registration Criteria for Different Business Types

In the uae, the mandatory vat registration level is aed 375,000. Understand who needs to register,. Come and review the facts about those who can apply for vat registration. It is mandatory for businesses to register for vat in the following two cases: Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed.

PPT Documents required for vat registration in dubai PowerPoint

According to tax legislation, a company’s proprietors must proceed with uae. Understand who needs to register,. In the uae, the mandatory vat registration level is aed 375,000. It is mandatory for businesses to register for vat in the following two cases: Come and review the facts about those who can apply for vat registration.

Apply For VAT Registration in UAE Tulpar Team is Here To Help

Understand who needs to register,. It is mandatory for businesses to register for vat in the following two cases: Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. In the uae,.

PPT VAT Registration in UAE PowerPoint Presentation, free download

In the uae, the mandatory vat registration level is aed 375,000. Come and review the facts about those who can apply for vat registration. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. Understand who needs to register,. According to tax legislation, a company’s proprietors must proceed with uae.

VAT Registration Requirements in UAE ALNABAHA CONSULTANCIES

In the uae, the mandatory vat registration level is aed 375,000. According to tax legislation, a company’s proprietors must proceed with uae. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for. Understand who needs to register,. It is mandatory for businesses to register for vat in the following two cases:

Importance of VAT Registration in UAE

A business must register for vat if the taxable supplies and imports exceed the mandatory registration threshold of aed. In the uae, the mandatory vat registration level is aed 375,000. According to tax legislation, a company’s proprietors must proceed with uae. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for..

Corporate Tax In The UAE Everything You Need To Know

According to tax legislation, a company’s proprietors must proceed with uae. In the uae, the mandatory vat registration level is aed 375,000. Understand who needs to register,. It is mandatory for businesses to register for vat in the following two cases: Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for.

Understand Who Needs To Register,.

It is mandatory for businesses to register for vat in the following two cases: In the uae, the mandatory vat registration level is aed 375,000. Come and review the facts about those who can apply for vat registration. Uae businesses must register for vat if their taxable supplies and imports exceed aed 375,000 annually (aed 187,500 for.

A Business Must Register For Vat If The Taxable Supplies And Imports Exceed The Mandatory Registration Threshold Of Aed.

According to tax legislation, a company’s proprietors must proceed with uae.