Vat Filing Template Uae - Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. You must file for tax return electronically through the fta portal:

How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days.

How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through the fta portal:

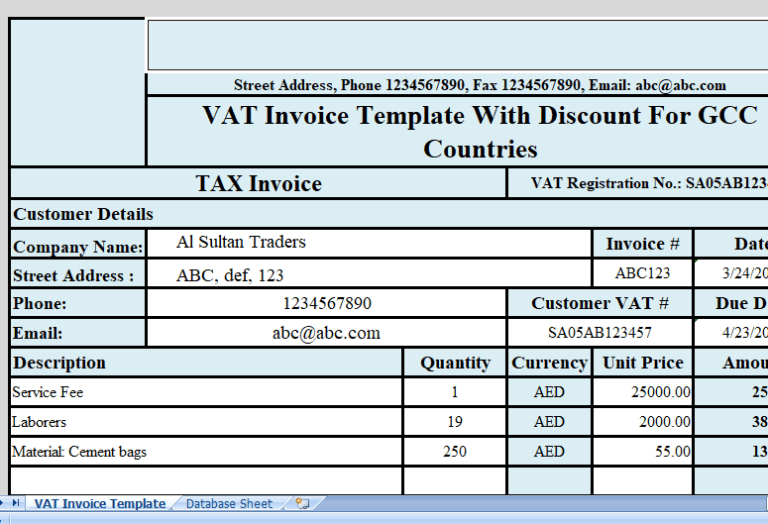

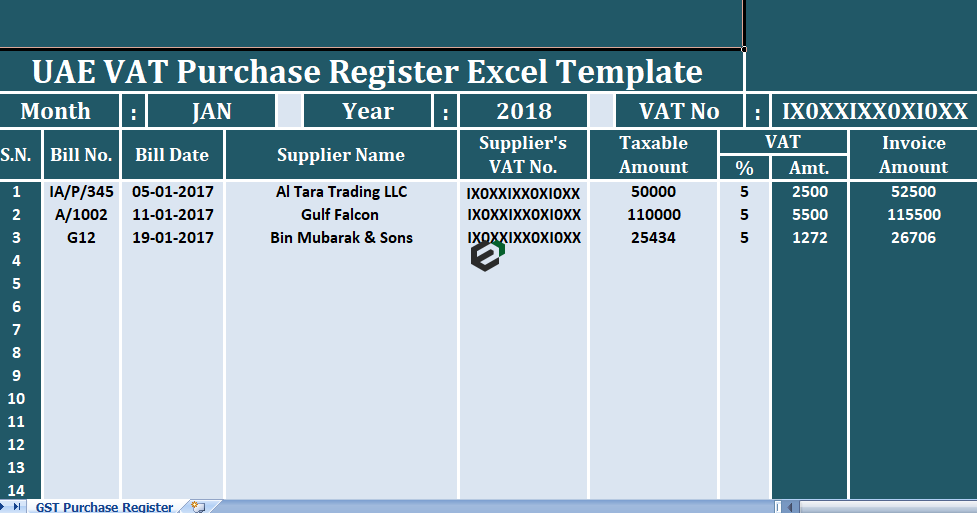

UAE VAT Archives Excel templates

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. You must file for tax return electronically through.

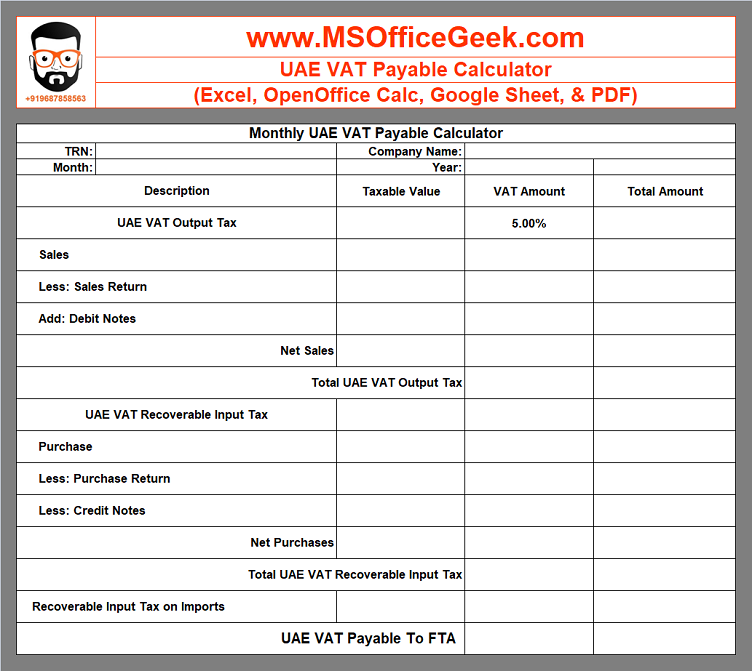

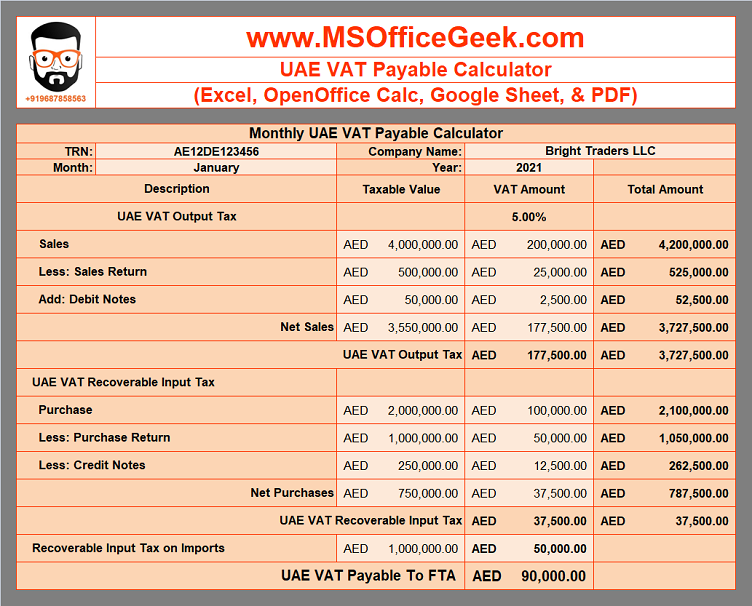

ReadyToUse UAE VAT Payable Calculator Template MSOfficeGeek

You must file for tax return electronically through the fta portal: You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments.

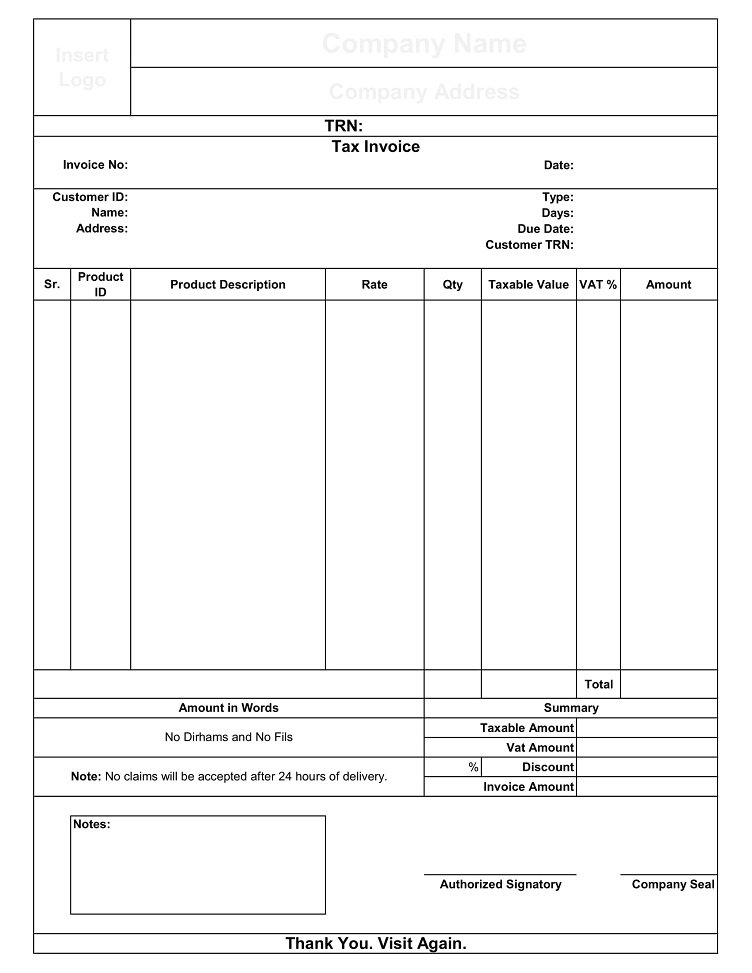

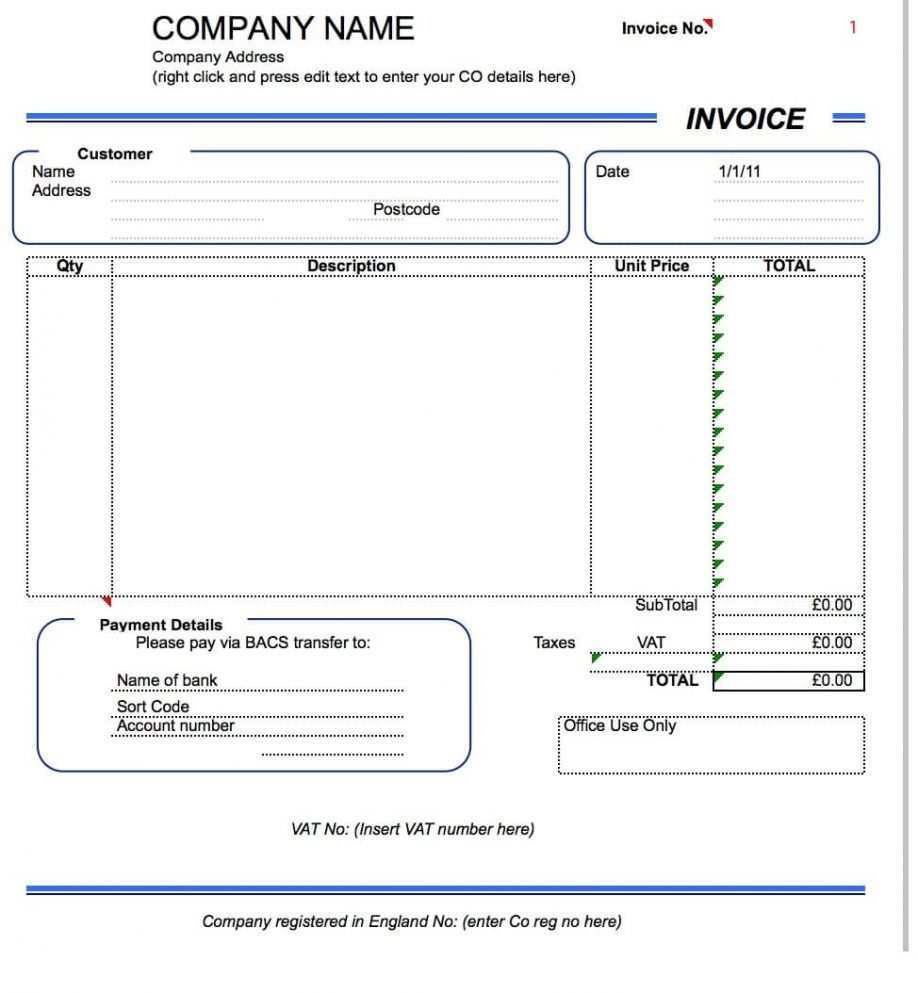

Fully Automated UAE VAT Invoice Template MSOfficeGeek

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. You must file for tax return electronically through the fta portal: How to.

ReadyToUse UAE VAT Payable Calculator Template MSOfficeGeek

You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. How to.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

You must file for tax return electronically through the fta portal: You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

How to file vat return? You must file for tax return electronically through the fta portal: You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments.

Download Free UAE VAT Purchase Register and Tracking

How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. You must file for tax return electronically through.

32 Creative Uae Vat Invoice Template Formating with Uae Vat Invoice

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. How to file vat return? You must file for tax return electronically through.

Once You Have Registered For Vat In The Uae, You Are Required To File Your Vat Return And Make Related Vat Payments Within 28 Days.

You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. How to file vat return? You must file for tax return electronically through the fta portal: