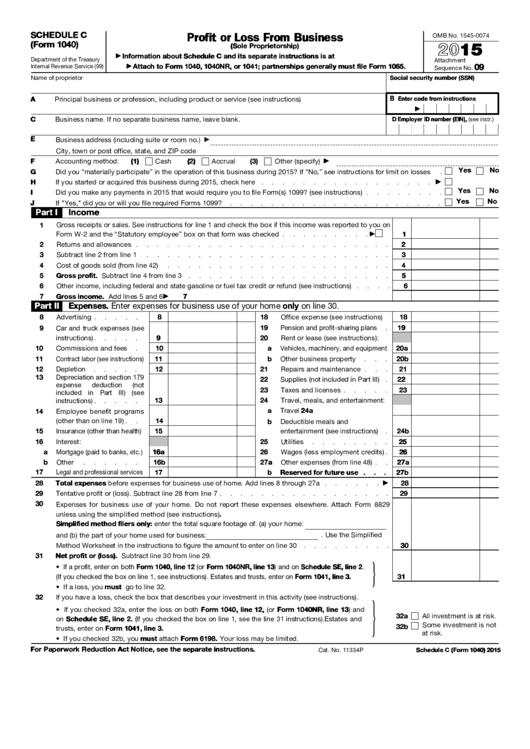

Schedule C Fillable Form 2022 - The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate asset valuationconvenient for clients Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Business address (including suite or room no.) city, town or post office, state, and zip code

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate asset valuationconvenient for clients Business address (including suite or room no.) city, town or post office, state, and zip code Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Business address (including suite or room no.) city, town or post office, state, and zip code Accurate asset valuationconvenient for clients Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship.

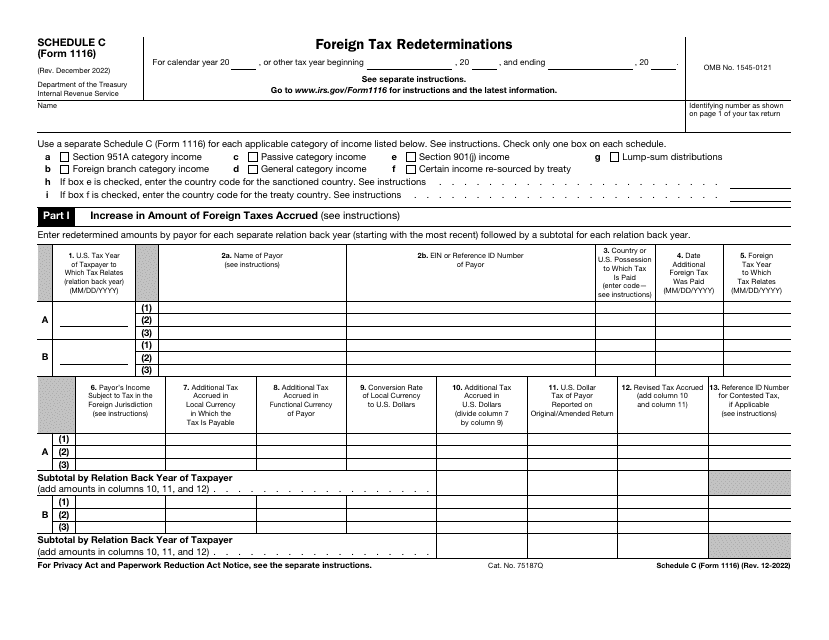

IRS Form 1116 Schedule C Download Fillable PDF or Fill Online Foreign

Accurate asset valuationconvenient for clients Business address (including suite or room no.) city, town or post office, state, and zip code Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. The primary purpose of schedule c (form 1040) is to report income or loss from.

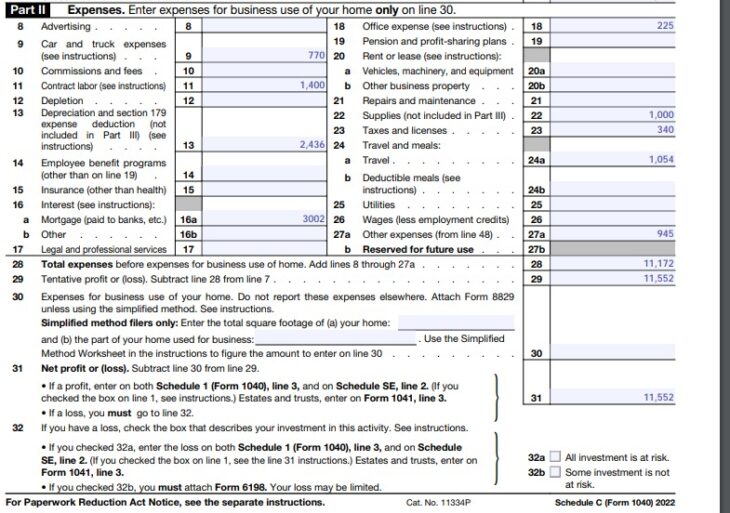

How To Fill Out Your 2022 Schedule C (With Example)

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. The primary purpose of schedule c (form 1040) is to report income or loss from a.

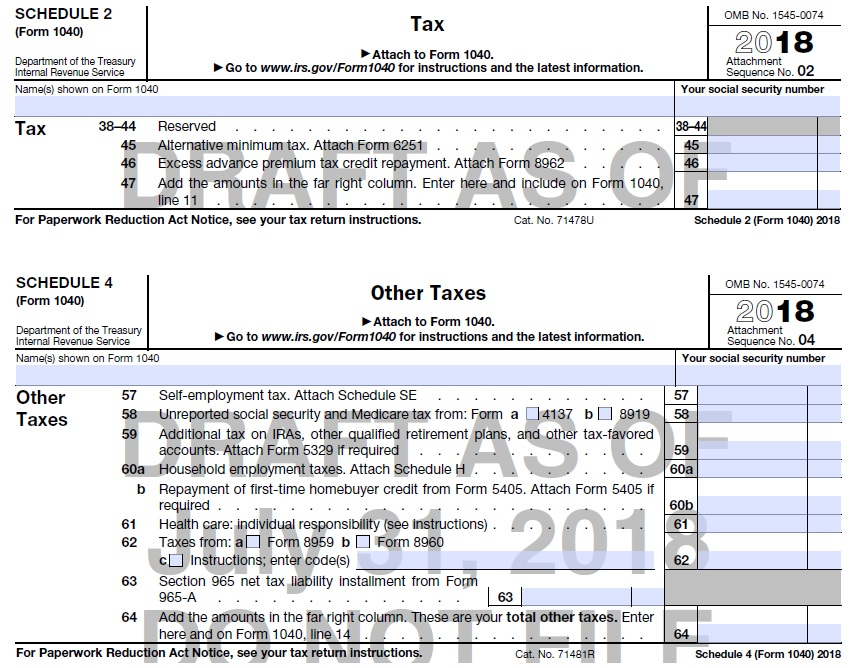

2022 Form IRS 990 or 990EZ Schedule C Fill Online, Printable

Business address (including suite or room no.) city, town or post office, state, and zip code Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Accurate asset valuationconvenient for clients Use schedule c (form 1040) to report income or (loss) from a business you operated or.

2022 Form 1040 Schedule C Fillable PDF Fillable Form 2025

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Accurate asset valuationconvenient for clients Use schedule c to report income or loss from.

schedule c form Schedule c instructions anacollege

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c to report income or loss from a business or profession.

What Is Schedule C of Form 1040?

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Business address (including suite or room no.) city, town or post office, state, and zip code Accurate asset valuationconvenient for clients Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you.

IRS Form 1040 Schedule C (2022) Profit or Loss From Business

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Business address (including suite or room no.) city, town or post office, state, and zip code Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or.

Schedule c 1040 form 2022 Fill out & sign online DocHub

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. The primary purpose of schedule c (form 1040) is to report income or loss from a business.

Printable Schedule C Form

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Accurate asset valuationconvenient for clients Use schedule c (form 1040) to report income or (loss) from a business.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Accurate asset valuationconvenient for clients Business address (including suite or room no.) city, town.

Information About Schedule C (Form 1040), Profit Or Loss From Business, Used To Report Income Or Loss From A Business Operated Or Profession.

Accurate asset valuationconvenient for clients Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship.

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)