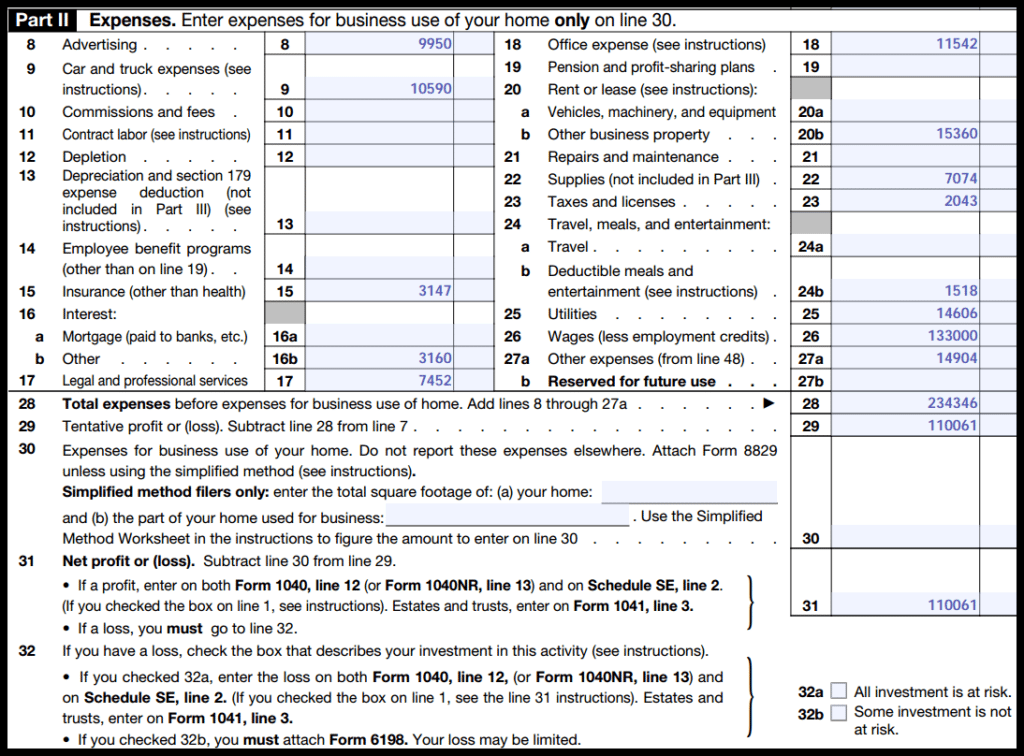

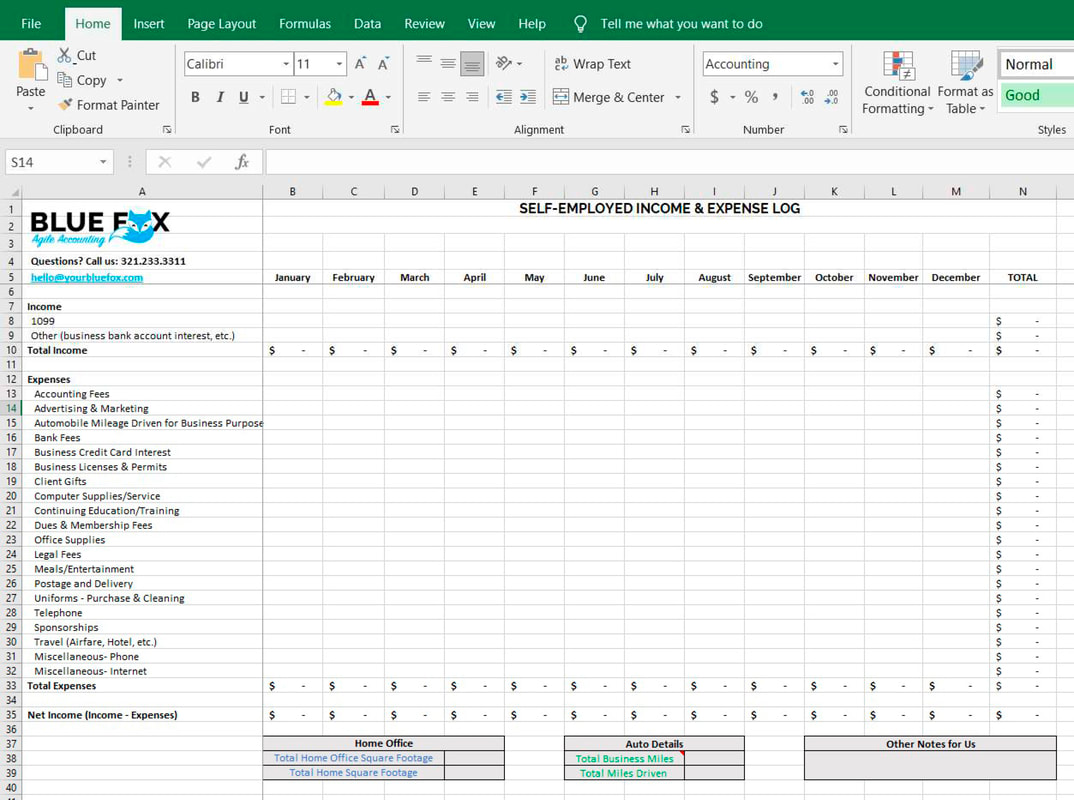

Schedule C Expenses Worksheet 2023 - For real estate transactions, be sure to. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you have your own way of giving us your expense numbers, you can stop here! Expenses for busines use of your home (we will calculate) (b) income and deductions of certain qualified joint. Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. Business expenses (ordinary and necessary).

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If you have your own way of giving us your expense numbers, you can stop here! (b) income and deductions of certain qualified joint. Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. Business expenses (ordinary and necessary). For real estate transactions, be sure to. Expenses for busines use of your home (we will calculate) If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written.

For real estate transactions, be sure to. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you have your own way of giving us your expense numbers, you can stop here! Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. (b) income and deductions of certain qualified joint. Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. Business expenses (ordinary and necessary). I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Expenses for busines use of your home (we will calculate)

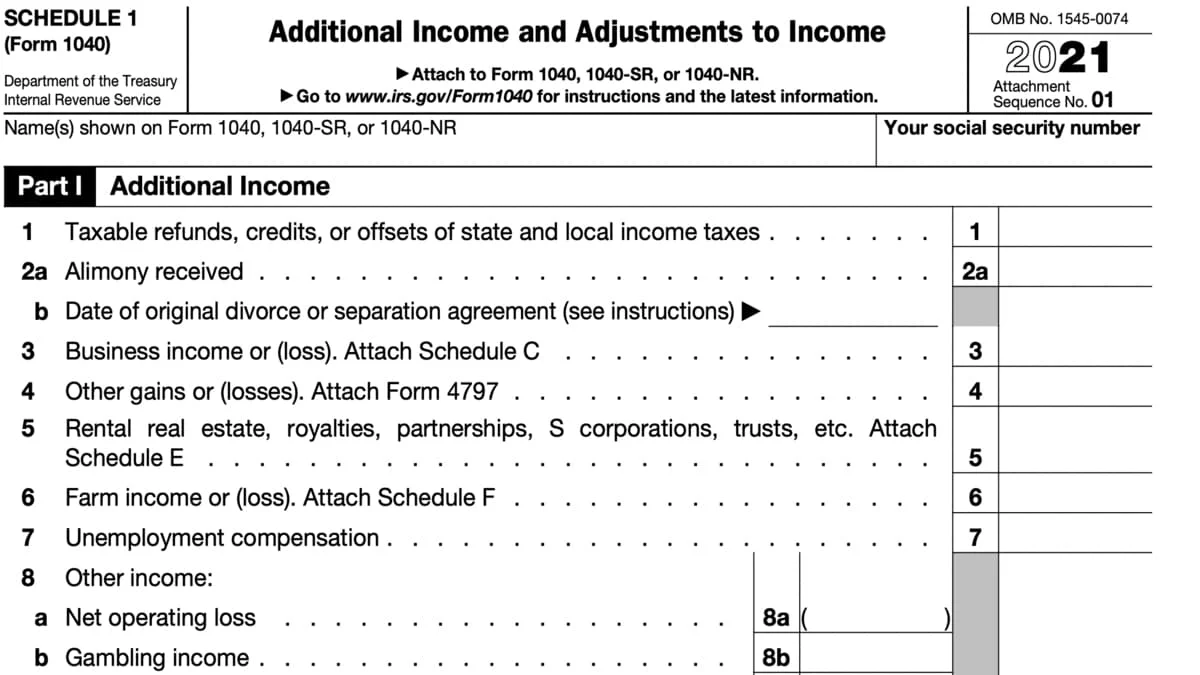

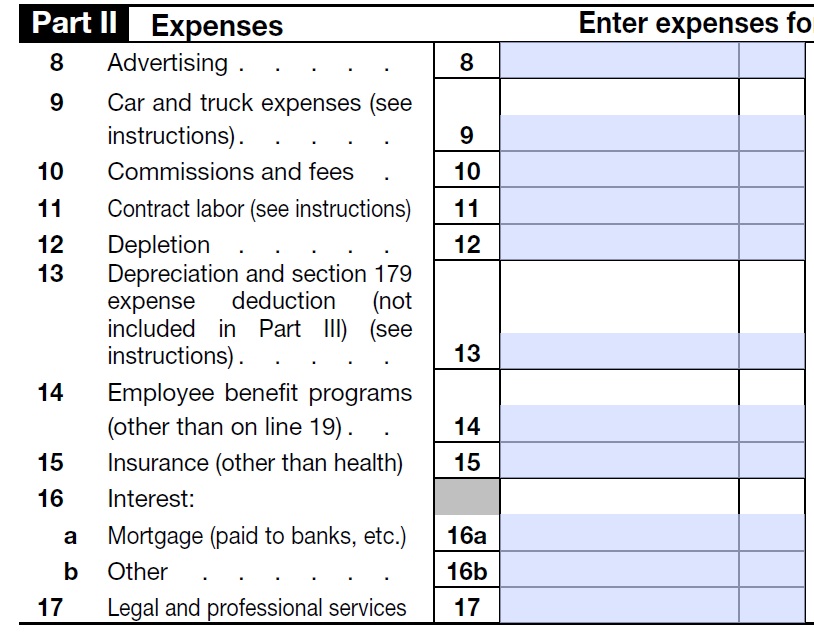

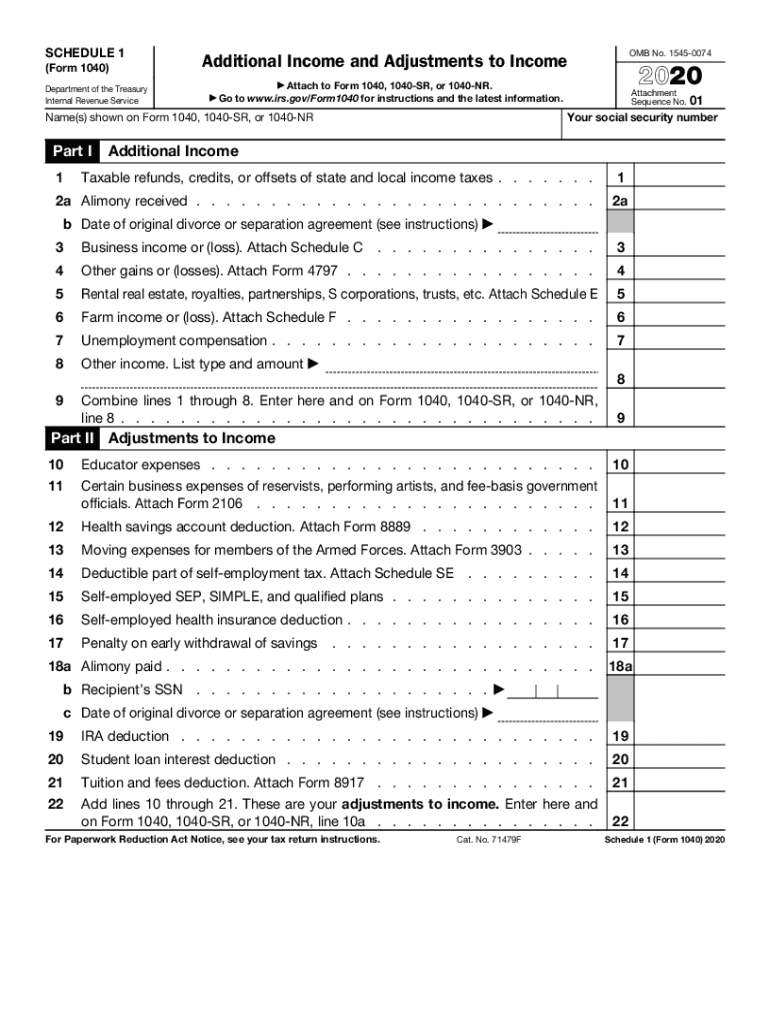

Printable Schedule C 2023

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you have your own way of giving us your expense numbers, you can stop here! Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. (b) income.

Printable Schedule C 2023

Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. If you have your own way of giving us your expense numbers, you can stop here! I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Business expenses (ordinary and necessary). Expenses for busines.

Schedule C Expenses Worksheet 2023

Business expenses (ordinary and necessary). If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you disposed of any business assets in 2023, please enter date sold, sales price,.

Schedule c expenses worksheet Fill out & sign online DocHub

For real estate transactions, be sure to. If you have your own way of giving us your expense numbers, you can stop here! Expenses for busines use of your home (we will calculate) Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If you disposed of any business assets.

Schedule C Expenses Worksheet 2023

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. (b) income and deductions of certain qualified joint. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Expenses for busines use of your home (we will calculate) Schedule c worksheet for self.

Printable Schedule C 2023

(b) income and deductions of certain qualified joint. Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. For real estate transactions, be sure to. Expenses for busines use of your home (we will calculate) Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to.

Schedule C (Form 1040) 2023 Instructions

Business expenses (ordinary and necessary). Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Expenses for busines use of your home (we will calculate) If you have your own way of giving.

Schedule C Expenses Worksheet 2023

Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. Business expenses (ordinary and necessary). For real estate transactions, be sure to. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If claimed, business miles can be found on either line.

Schedule C Expenses Worksheet 2023

Expenses for busines use of your home (we will calculate) If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. (b) income and deductions of certain qualified joint. If you have your own way of giving us your expense numbers, you can stop here! Advertising $ _________ car/truck $ _________ total.

Schedule C Expenses Worksheet 2023

(b) income and deductions of certain qualified joint. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If claimed, business miles can be found on either line 44a of the.

Schedule C Worksheet For Self Employed Businesses And/Or Independent Contractors Irs Requires We Have On File To Support All Schedule.

Business expenses (ordinary and necessary). Advertising $ _________ car/truck $ _________ total miles for year _____ total business miles ____ commissions $ _________. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you have your own way of giving us your expense numbers, you can stop here!

I Hereby Verify That The Income And Expense Information Set Forth On This Worksheet Is Substantiated By Written.

If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Expenses for busines use of your home (we will calculate) For real estate transactions, be sure to. (b) income and deductions of certain qualified joint.