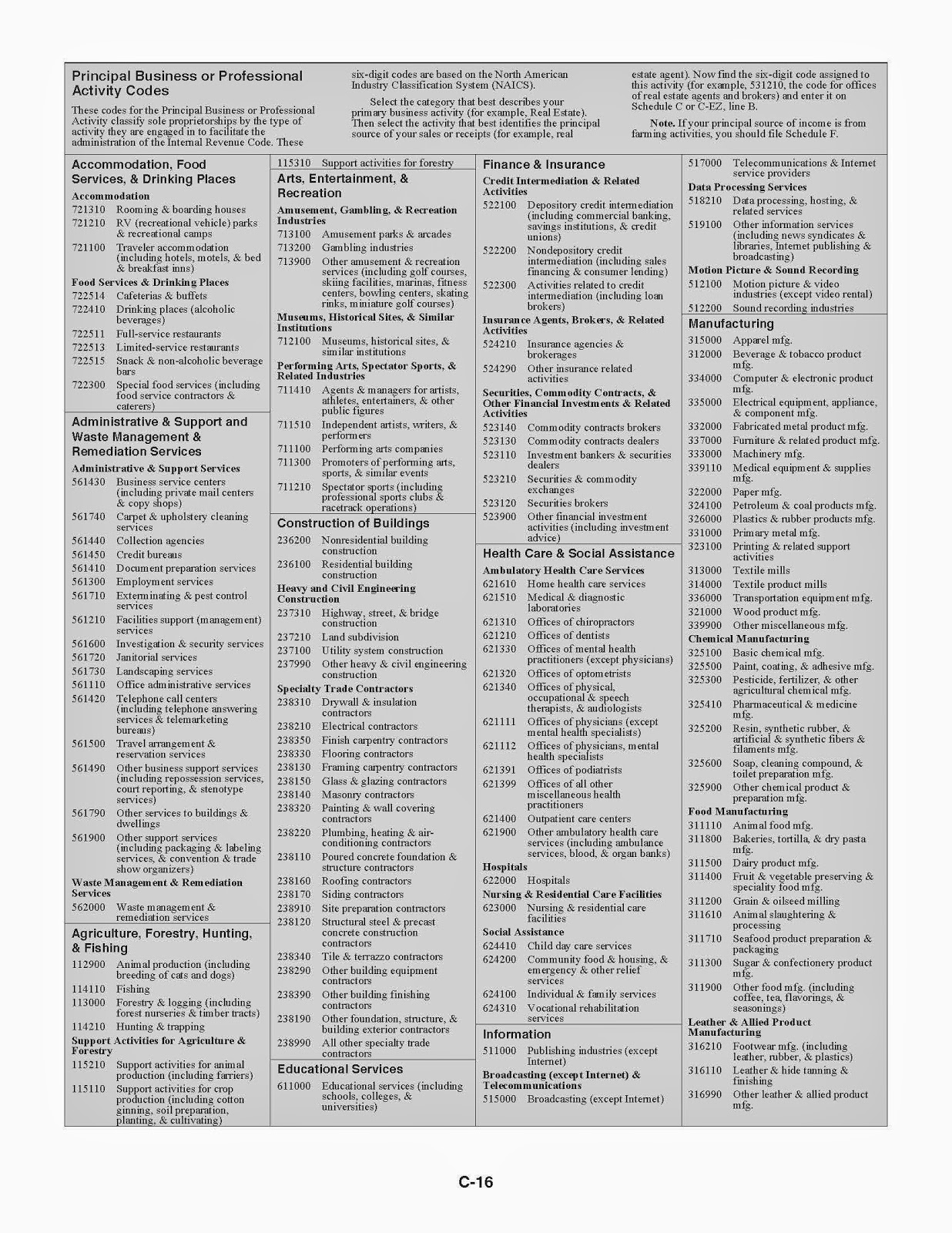

Schedule C Codes 2023 - (b) income and deductions of certain qualified joint. Irs business activity codes are for your principal business or professional activity. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. When completing schedule c (profit or loss from business), you must choose a principal business code that best describes the type of business. For a list of business activity codes, see instructions for. Discover the updated 2023 schedule c irs business activity code and access a printable business codes list. For real estate transactions, be sure to. Haga clic para español accommodation, food services, & drinking places administrative & support and waste management & remediation.

Haga clic para español accommodation, food services, & drinking places administrative & support and waste management & remediation. Discover the updated 2023 schedule c irs business activity code and access a printable business codes list. For a list of business activity codes, see instructions for. (b) income and deductions of certain qualified joint. For real estate transactions, be sure to. Irs business activity codes are for your principal business or professional activity. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. When completing schedule c (profit or loss from business), you must choose a principal business code that best describes the type of business.

For real estate transactions, be sure to. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. For a list of business activity codes, see instructions for. Haga clic para español accommodation, food services, & drinking places administrative & support and waste management & remediation. Discover the updated 2023 schedule c irs business activity code and access a printable business codes list. When completing schedule c (profit or loss from business), you must choose a principal business code that best describes the type of business. Irs business activity codes are for your principal business or professional activity. (b) income and deductions of certain qualified joint.

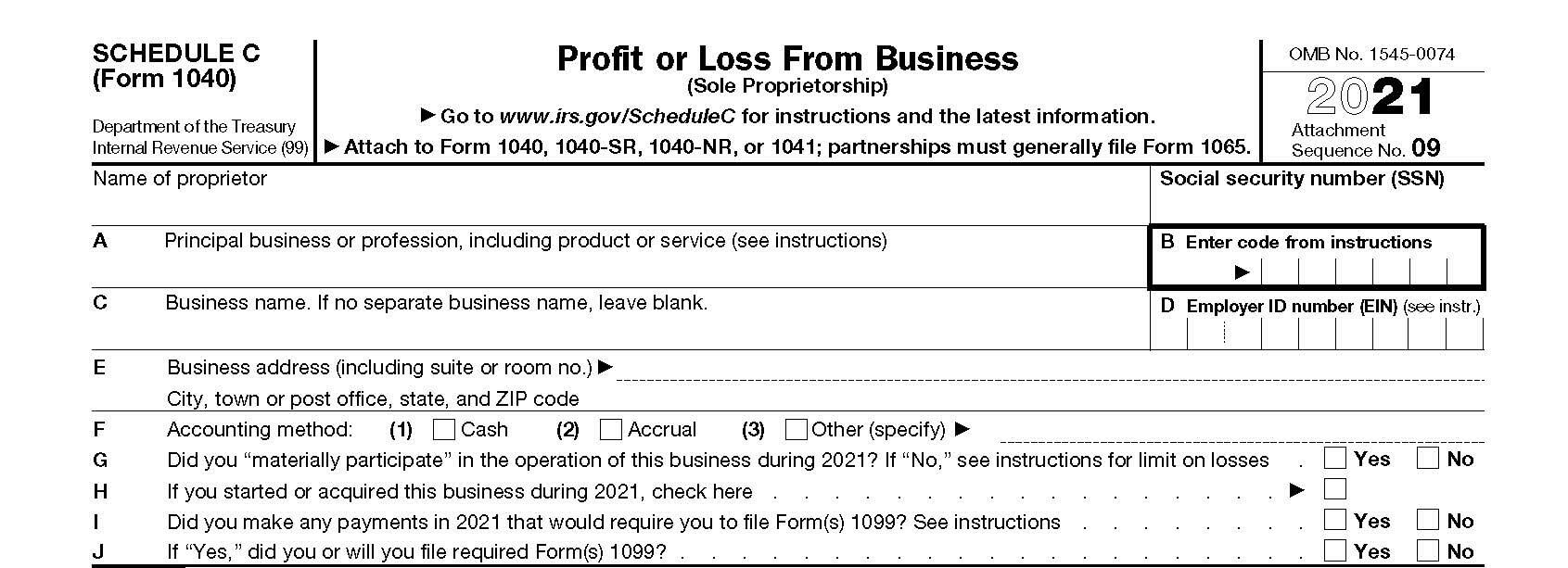

How to Fill Out Your Schedule C Perfectly (With Examples!)

When completing schedule c (profit or loss from business), you must choose a principal business code that best describes the type of business. (b) income and deductions of certain qualified joint. Discover the updated 2023 schedule c irs business activity code and access a printable business codes list. For a list of business activity codes, see instructions for. Haga clic.

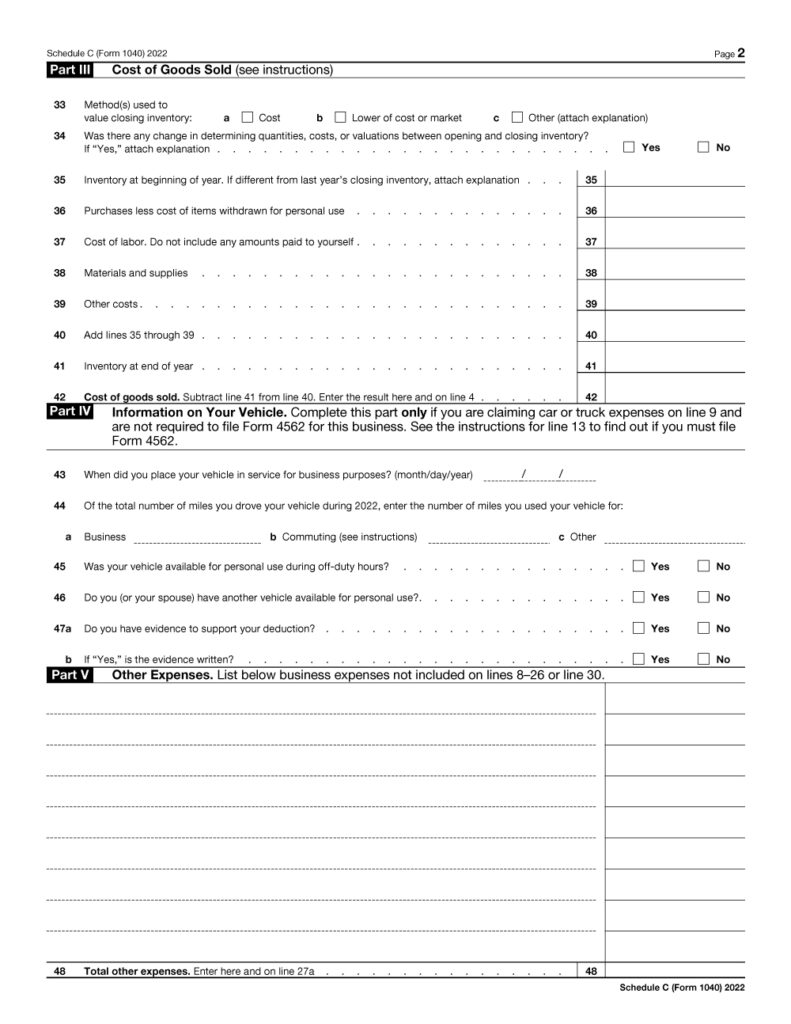

Schedule C (Form 1040) 2023 Instructions

For a list of business activity codes, see instructions for. Irs business activity codes are for your principal business or professional activity. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Discover the updated 2023 schedule c irs business activity code and access a printable business codes list. For real.

How to Complete IRS Schedule C

Haga clic para español accommodation, food services, & drinking places administrative & support and waste management & remediation. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Irs business activity codes are for your principal business or professional activity. Discover the updated 2023 schedule c irs business activity code and.

Schedule C Business Code All You Need To Know In 2023 4th Of July

Irs business activity codes are for your principal business or professional activity. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale. Haga clic para español accommodation, food services, & drinking places administrative & support and waste management & remediation. When completing schedule c (profit or loss from business), you must.

Unlock Hidden Tax Savings Discoveries in Schedule C Business Codes

When completing schedule c (profit or loss from business), you must choose a principal business code that best describes the type of business. Discover the updated 2023 schedule c irs business activity code and access a printable business codes list. Haga clic para español accommodation, food services, & drinking places administrative & support and waste management & remediation. For a.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

For real estate transactions, be sure to. For a list of business activity codes, see instructions for. (b) income and deductions of certain qualified joint. Discover the updated 2023 schedule c irs business activity code and access a printable business codes list. When completing schedule c (profit or loss from business), you must choose a principal business code that best.

Schedule C 2023 Form Printable Forms Free Online

Discover the updated 2023 schedule c irs business activity code and access a printable business codes list. When completing schedule c (profit or loss from business), you must choose a principal business code that best describes the type of business. For a list of business activity codes, see instructions for. Haga clic para español accommodation, food services, & drinking places.

Printable Schedule C 2023

Irs business activity codes are for your principal business or professional activity. For real estate transactions, be sure to. Discover the updated 2023 schedule c irs business activity code and access a printable business codes list. Haga clic para español accommodation, food services, & drinking places administrative & support and waste management & remediation. For a list of business activity.

Unlock Hidden Tax Savings Discoveries in Schedule C Business Codes

Irs business activity codes are for your principal business or professional activity. (b) income and deductions of certain qualified joint. For real estate transactions, be sure to. Discover the updated 2023 schedule c irs business activity code and access a printable business codes list. For a list of business activity codes, see instructions for.

Schedule C (Form 1040) 2023 Instructions

Discover the updated 2023 schedule c irs business activity code and access a printable business codes list. (b) income and deductions of certain qualified joint. Haga clic para español accommodation, food services, & drinking places administrative & support and waste management & remediation. For a list of business activity codes, see instructions for. When completing schedule c (profit or loss.

For A List Of Business Activity Codes, See Instructions For.

For real estate transactions, be sure to. When completing schedule c (profit or loss from business), you must choose a principal business code that best describes the type of business. Irs business activity codes are for your principal business or professional activity. (b) income and deductions of certain qualified joint.

Discover The Updated 2023 Schedule C Irs Business Activity Code And Access A Printable Business Codes List.

Haga clic para español accommodation, food services, & drinking places administrative & support and waste management & remediation. If you disposed of any business assets in 2023, please enter date sold, sales price, and expenses of sale.

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)