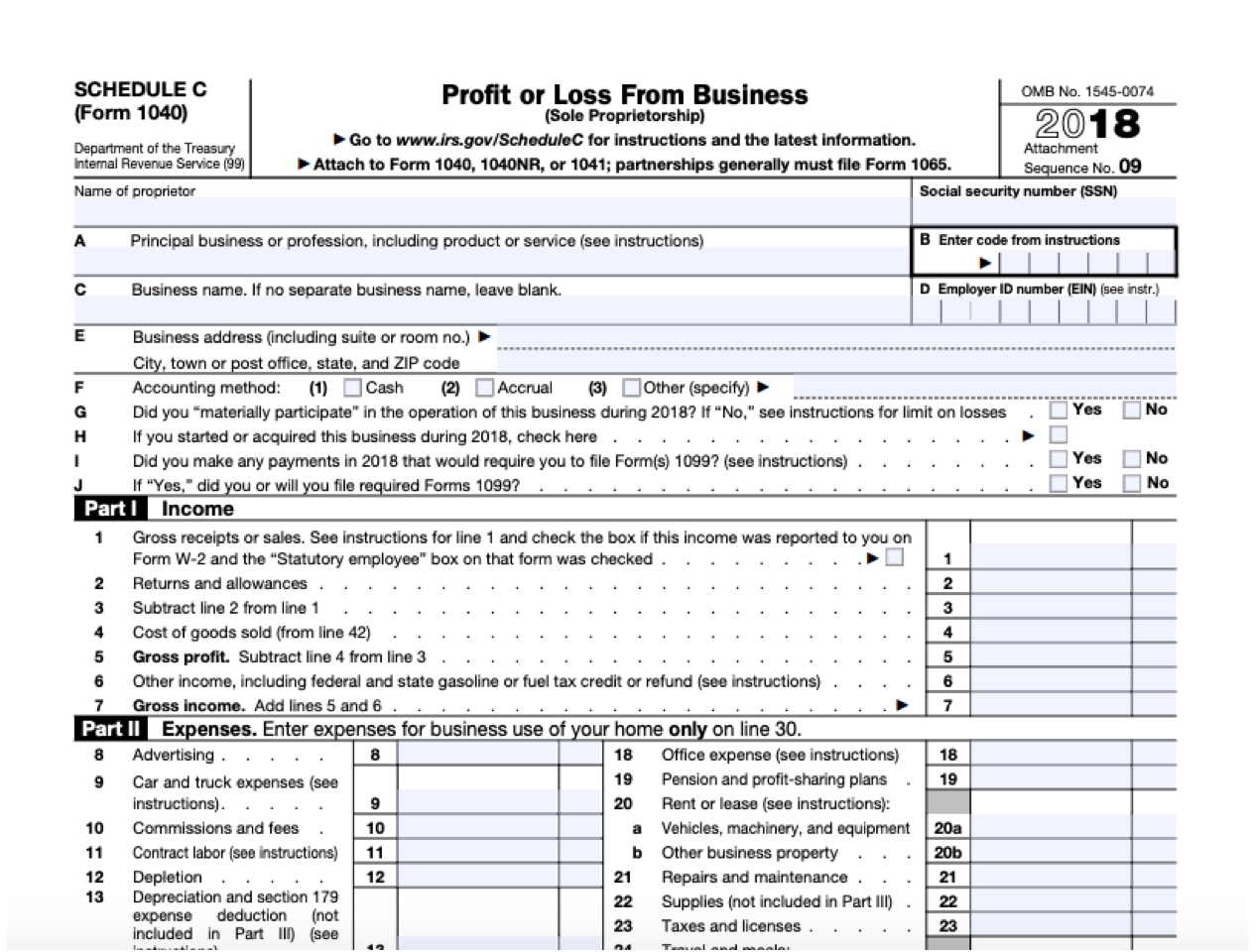

Schedule C 2024 Instructions - Gross income from a business means, for example,. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Gross income includes gains, but not losses, reported on form 8949 or schedule d. Learn how to report income or loss from a business you operated or a profession you practiced as a sole proprietor on schedule c. Find the latest updates, forms, and instructions for reporting income or loss from a sole proprietorship on schedule c (form 1040). It includes instructions, lines, and. Use your 2023 tax return as a guide in figuring your 2024 tax, but be sure to consider the following.

Gross income includes gains, but not losses, reported on form 8949 or schedule d. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Find the latest updates, forms, and instructions for reporting income or loss from a sole proprietorship on schedule c (form 1040). Use your 2023 tax return as a guide in figuring your 2024 tax, but be sure to consider the following. Learn how to report income or loss from a business you operated or a profession you practiced as a sole proprietor on schedule c. Gross income from a business means, for example,. It includes instructions, lines, and.

Use your 2023 tax return as a guide in figuring your 2024 tax, but be sure to consider the following. It includes instructions, lines, and. Find the latest updates, forms, and instructions for reporting income or loss from a sole proprietorship on schedule c (form 1040). Gross income from a business means, for example,. Gross income includes gains, but not losses, reported on form 8949 or schedule d. Learn how to report income or loss from a business you operated or a profession you practiced as a sole proprietor on schedule c. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024.

Schedule C Instructions 2024 Instructions Ivett Letisha

Gross income includes gains, but not losses, reported on form 8949 or schedule d. Use your 2023 tax return as a guide in figuring your 2024 tax, but be sure to consider the following. It includes instructions, lines, and. Find the latest updates, forms, and instructions for reporting income or loss from a sole proprietorship on schedule c (form 1040)..

2024 Instructions For Forms 2024C And 2024C Fayth Cristionna

Learn how to report income or loss from a business you operated or a profession you practiced as a sole proprietor on schedule c. Gross income includes gains, but not losses, reported on form 8949 or schedule d. Gross income from a business means, for example,. Find the latest updates, forms, and instructions for reporting income or loss from a.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Use your 2023 tax return as a guide in figuring your 2024 tax, but be sure to consider the following. This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Gross income includes gains, but not losses, reported on form 8949 or schedule d. Find the latest updates, forms, and instructions.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Use your 2023 tax return as a guide in figuring your 2024 tax, but be sure to consider the following. Learn how to report income or loss from a business you operated or a profession you practiced as a sole proprietor on schedule c. Gross income from a business means, for example,. It includes instructions, lines, and. This is the.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Learn how to report income or loss from a business you operated or a profession you practiced as a sole proprietor on schedule c. It includes instructions, lines, and. Gross income from a business means, for example,. Use your 2023 tax return as a guide in figuring your 2024 tax, but be sure to consider the following. This is the.

Instructions For Schedule C 2024 Emmy Sissie

Gross income from a business means, for example,. Learn how to report income or loss from a business you operated or a profession you practiced as a sole proprietor on schedule c. Gross income includes gains, but not losses, reported on form 8949 or schedule d. Find the latest updates, forms, and instructions for reporting income or loss from a.

Schedule C Instructions 2024 Pdf Download Roxy Catarina

This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. Find the latest updates, forms, and instructions for reporting income or loss from a sole proprietorship on schedule c (form 1040). Use your 2023 tax return as a guide in figuring your 2024 tax, but be sure to consider the following..

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Gross income includes gains, but not losses, reported on form 8949 or schedule d. Gross income from a business means, for example,. Learn how to report income or loss from a business you operated or a profession you practiced as a sole proprietor on schedule c. Find the latest updates, forms, and instructions for reporting income or loss from a.

2024 Schedule C Form 1040 Forms Lissa Phillis

This is the official pdf form for reporting profit or loss from business (sole proprietorship) for tax year 2024. It includes instructions, lines, and. Gross income includes gains, but not losses, reported on form 8949 or schedule d. Use your 2023 tax return as a guide in figuring your 2024 tax, but be sure to consider the following. Learn how.

Instructions For Schedule C 2024 Emmy Sissie

Use your 2023 tax return as a guide in figuring your 2024 tax, but be sure to consider the following. Gross income from a business means, for example,. Learn how to report income or loss from a business you operated or a profession you practiced as a sole proprietor on schedule c. It includes instructions, lines, and. This is the.

Use Your 2023 Tax Return As A Guide In Figuring Your 2024 Tax, But Be Sure To Consider The Following.

Gross income from a business means, for example,. Gross income includes gains, but not losses, reported on form 8949 or schedule d. It includes instructions, lines, and. Learn how to report income or loss from a business you operated or a profession you practiced as a sole proprietor on schedule c.

This Is The Official Pdf Form For Reporting Profit Or Loss From Business (Sole Proprietorship) For Tax Year 2024.

Find the latest updates, forms, and instructions for reporting income or loss from a sole proprietorship on schedule c (form 1040).

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)