Scandinavian Walk-In Closet With Tv Diy Projects - Over the last 5 years cor has led data center reits in total. Mortgage reits act as a link between capital and real estate markets and. The similarity between real estate investing and reits is that money is invested in residential, commercial, and land properties. Overview vanguard’s real estate index fund (vgslx) is a mutual fund that invests in various types of reits including office, healthcare, hotel and other equity reits, as well. Reits vs real estate investing there are two basic strategies to make money directly investing in real estate properties. Real estate investment trusts are corporations that own and manage real estate. Real estate investment trusts were created in 1960 as a means of facilitating investment in commercial real estate. It invests in real estate properties across 8. Mortgage reits (mreits) own commercial and residential mortgage securities collateralized by real property. The main difference is how investors manage these real.

Overview vanguard’s real estate index fund (vgslx) is a mutual fund that invests in various types of reits including office, healthcare, hotel and other equity reits, as well. Reits vs real estate investing there are two basic strategies to make money directly investing in real estate properties. Reits issue units (much like stock shares) that give investors access to the income generated by the reit’s. Coresite realty corporation (cor) coresite is smaller in size relative to the other data center reits with a market cap of $3.7b. Real estate investment trusts are corporations that own and manage real estate. Mortgage reits (mreits) own commercial and residential mortgage securities collateralized by real property. The similarity between real estate investing and reits is that money is invested in residential, commercial, and land properties. In the past few years, with the help of. The main difference is how investors manage these real. It invests in real estate properties across 8.

Real estate investment trusts were created in 1960 as a means of facilitating investment in commercial real estate. Mortgage reits (mreits) own commercial and residential mortgage securities collateralized by real property. Reits vs real estate investing there are two basic strategies to make money directly investing in real estate properties. The main difference is how investors manage these real. Over the last 5 years cor has led data center reits in total. In the past few years, with the help of. Real estate investment trusts are corporations that own and manage real estate. Reits issue units (much like stock shares) that give investors access to the income generated by the reit’s. The similarity between real estate investing and reits is that money is invested in residential, commercial, and land properties. Coresite realty corporation (cor) coresite is smaller in size relative to the other data center reits with a market cap of $3.7b.

Scandinavian

Reits vs real estate investing there are two basic strategies to make money directly investing in real estate properties. Real estate investment trusts were created in 1960 as a means of facilitating investment in commercial real estate. Reits issue units (much like stock shares) that give investors access to the income generated by the reit’s. It invests in real estate.

Facts About Scandinavia Everything You Need To Know (and more...)

Reits issue units (much like stock shares) that give investors access to the income generated by the reit’s. Real estate investment trusts were created in 1960 as a means of facilitating investment in commercial real estate. Real estate investment trusts are corporations that own and manage real estate. Mortgage reits (mreits) own commercial and residential mortgage securities collateralized by real.

An Introduction to the 5 Scandinavian Countries

Real estate investment trusts were created in 1960 as a means of facilitating investment in commercial real estate. Over the last 5 years cor has led data center reits in total. Real estate investment trusts are corporations that own and manage real estate. Overview vanguard’s real estate index fund (vgslx) is a mutual fund that invests in various types of.

Fast Facts About Scandinavia Travel

Overview vanguard’s real estate index fund (vgslx) is a mutual fund that invests in various types of reits including office, healthcare, hotel and other equity reits, as well. The main difference is how investors manage these real. Real estate investment trusts were created in 1960 as a means of facilitating investment in commercial real estate. Mortgage reits (mreits) own commercial.

An Introduction to the 5 Scandinavian Countries

Real estate investment trusts are corporations that own and manage real estate. Mortgage reits (mreits) own commercial and residential mortgage securities collateralized by real property. Reits vs real estate investing there are two basic strategies to make money directly investing in real estate properties. Reits issue units (much like stock shares) that give investors access to the income generated by.

Scandinavia

The similarity between real estate investing and reits is that money is invested in residential, commercial, and land properties. The main difference is how investors manage these real. Real estate investment trusts were created in 1960 as a means of facilitating investment in commercial real estate. Reits issue units (much like stock shares) that give investors access to the income.

A Short History of Scandinavia

In the past few years, with the help of. Overview vanguard’s real estate index fund (vgslx) is a mutual fund that invests in various types of reits including office, healthcare, hotel and other equity reits, as well. Over the last 5 years cor has led data center reits in total. Mortgage reits act as a link between capital and real.

Scandinavian Nature Wallpapers Top Free Scandinavian Nature

Overview vanguard’s real estate index fund (vgslx) is a mutual fund that invests in various types of reits including office, healthcare, hotel and other equity reits, as well. It invests in real estate properties across 8. Real estate investment trusts were created in 1960 as a means of facilitating investment in commercial real estate. Real estate investment trusts are corporations.

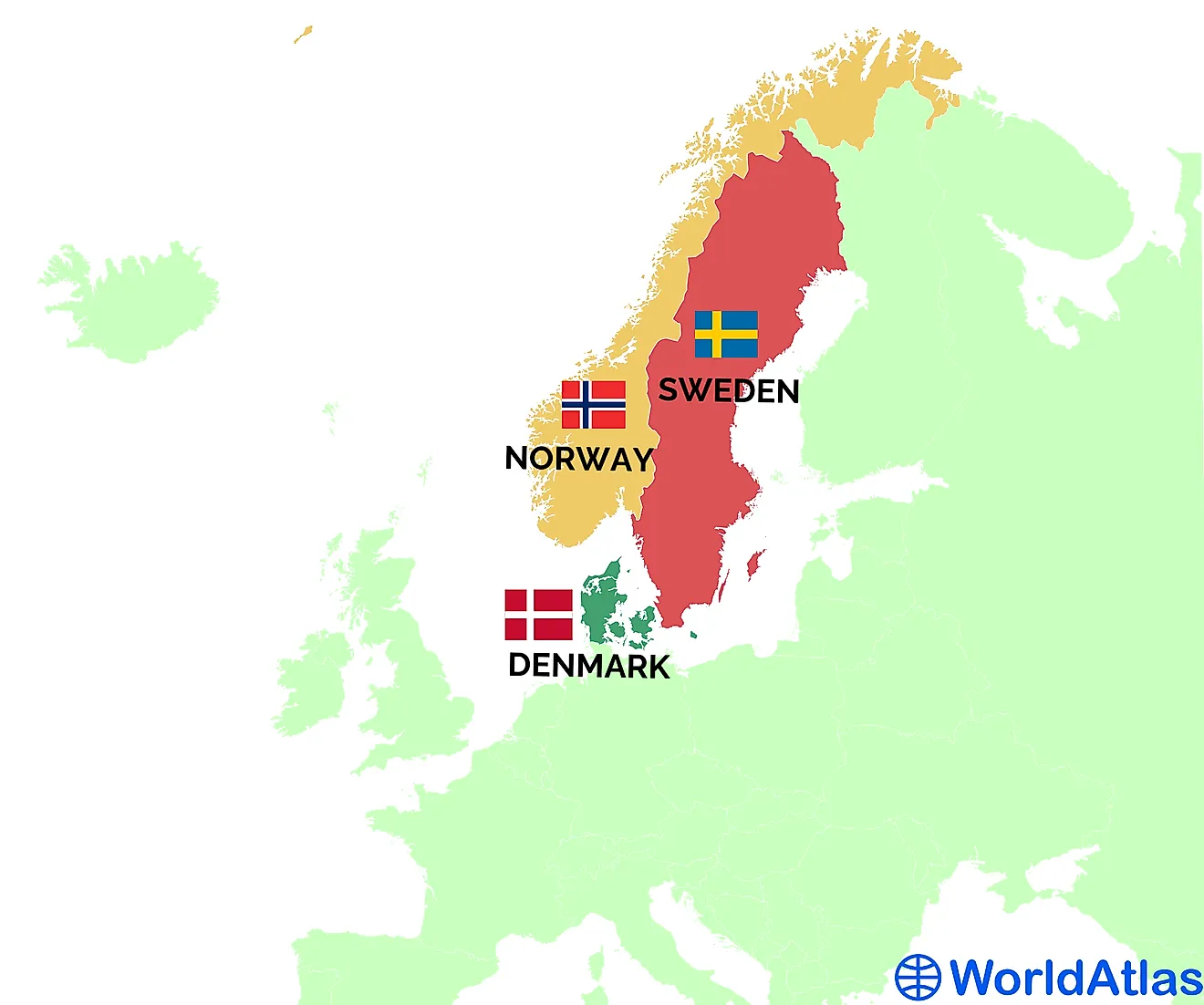

Scandinavian Countries WorldAtlas

Mortgage reits (mreits) own commercial and residential mortgage securities collateralized by real property. Real estate investment trusts were created in 1960 as a means of facilitating investment in commercial real estate. In the past few years, with the help of. Coresite realty corporation (cor) coresite is smaller in size relative to the other data center reits with a market cap.

Where is Scandinavia?

In the past few years, with the help of. The main difference is how investors manage these real. The similarity between real estate investing and reits is that money is invested in residential, commercial, and land properties. It invests in real estate properties across 8. Real estate investment trusts were created in 1960 as a means of facilitating investment in.

Real Estate Investment Trusts Were Created In 1960 As A Means Of Facilitating Investment In Commercial Real Estate.

Real estate investment trusts are corporations that own and manage real estate. Reits issue units (much like stock shares) that give investors access to the income generated by the reit’s. Over the last 5 years cor has led data center reits in total. It invests in real estate properties across 8.

The Main Difference Is How Investors Manage These Real.

The similarity between real estate investing and reits is that money is invested in residential, commercial, and land properties. Reits vs real estate investing there are two basic strategies to make money directly investing in real estate properties. Overview vanguard’s real estate index fund (vgslx) is a mutual fund that invests in various types of reits including office, healthcare, hotel and other equity reits, as well. Mortgage reits act as a link between capital and real estate markets and.

Coresite Realty Corporation (Cor) Coresite Is Smaller In Size Relative To The Other Data Center Reits With A Market Cap Of $3.7B.

In the past few years, with the help of. Mortgage reits (mreits) own commercial and residential mortgage securities collateralized by real property.

/henningsv-r-village-at-the-lofoten-949115006-9b1d6202650d4d8986c4781a9dc1f671.jpg)

:max_bytes(150000):strip_icc()/GettyImages-544331009-5936dc913df78c08abfc4936.jpg)

:max_bytes(150000):strip_icc()/dancing-over-hamnoy-532431267-5aa18ee91d640400376c1ab2.jpg)

/GettyImages-697601144-59827cb5aad52b001077e6f3.jpg)