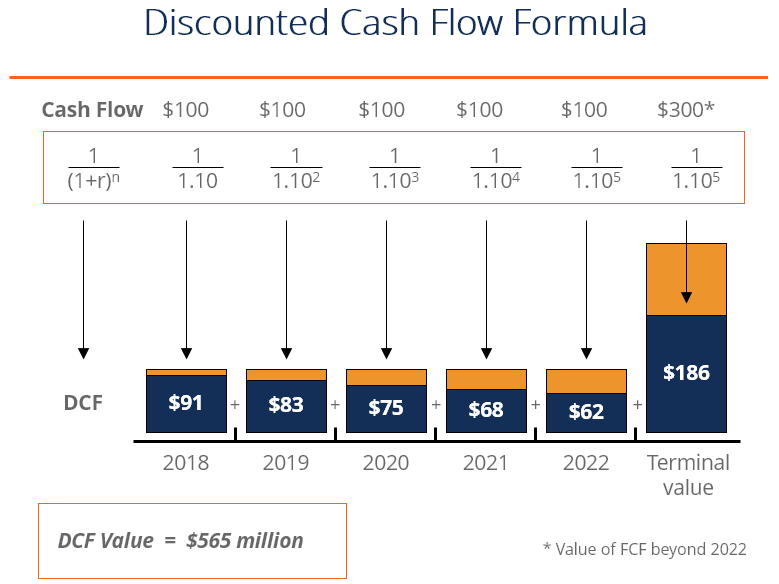

Reverse Discounted Cash Flow Calculator - Instead of projecting future cash flows to. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Calculate the implied growth rate needed to. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value.

The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation. Instead of projecting future cash flows to. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Calculate the implied growth rate needed to.

Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation. Instead of projecting future cash flows to. Calculate the implied growth rate needed to. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value.

Free Reverse DCF Calculator Reverse Discounted Cash Flow Valuation

Calculate the implied growth rate needed to. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Free reverse dcf calculator (reverse discounted cash flow.

How to Apply the Reverse Discounted Cash Flow Valuation Model StableBread

Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Instead of projecting future cash flows to. Free discounted cash flow (dcf), reverse dcf calculator.

What Is Reverse Discounted Cash Flow (DCF) and how to calculate it?

Instead of projecting future cash flows to. Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation. Calculate the implied growth rate needed to. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise.

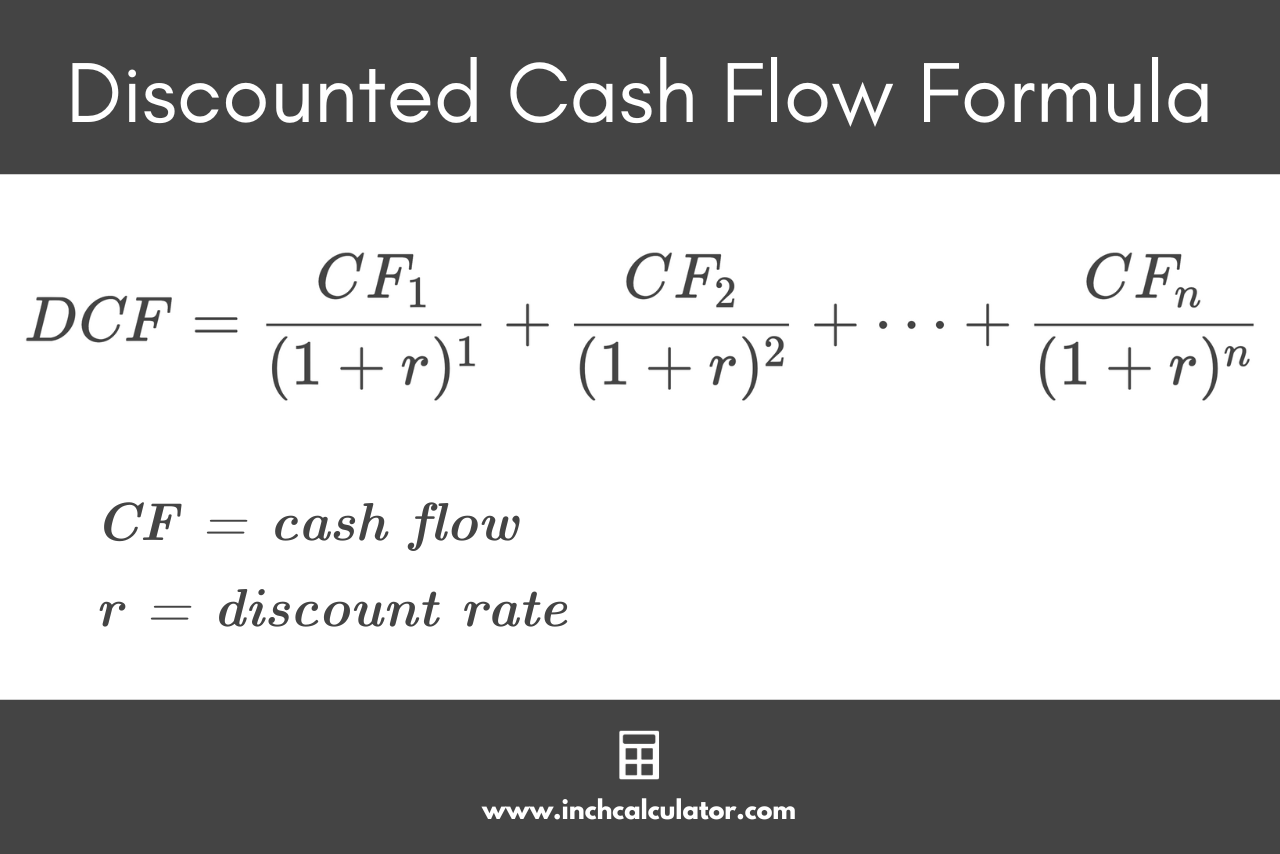

Discounted Cash Flow Calculator Inch Calculator

Calculate the implied growth rate needed to. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present.

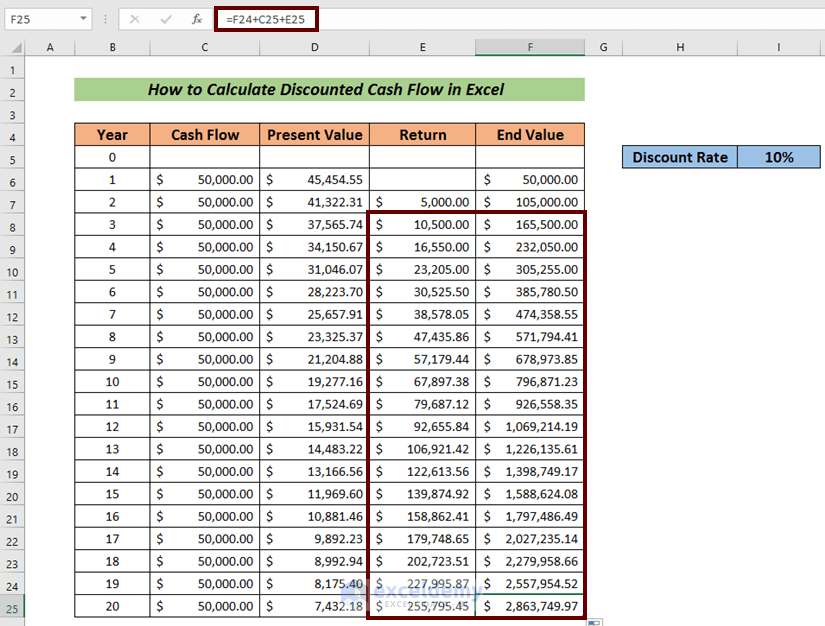

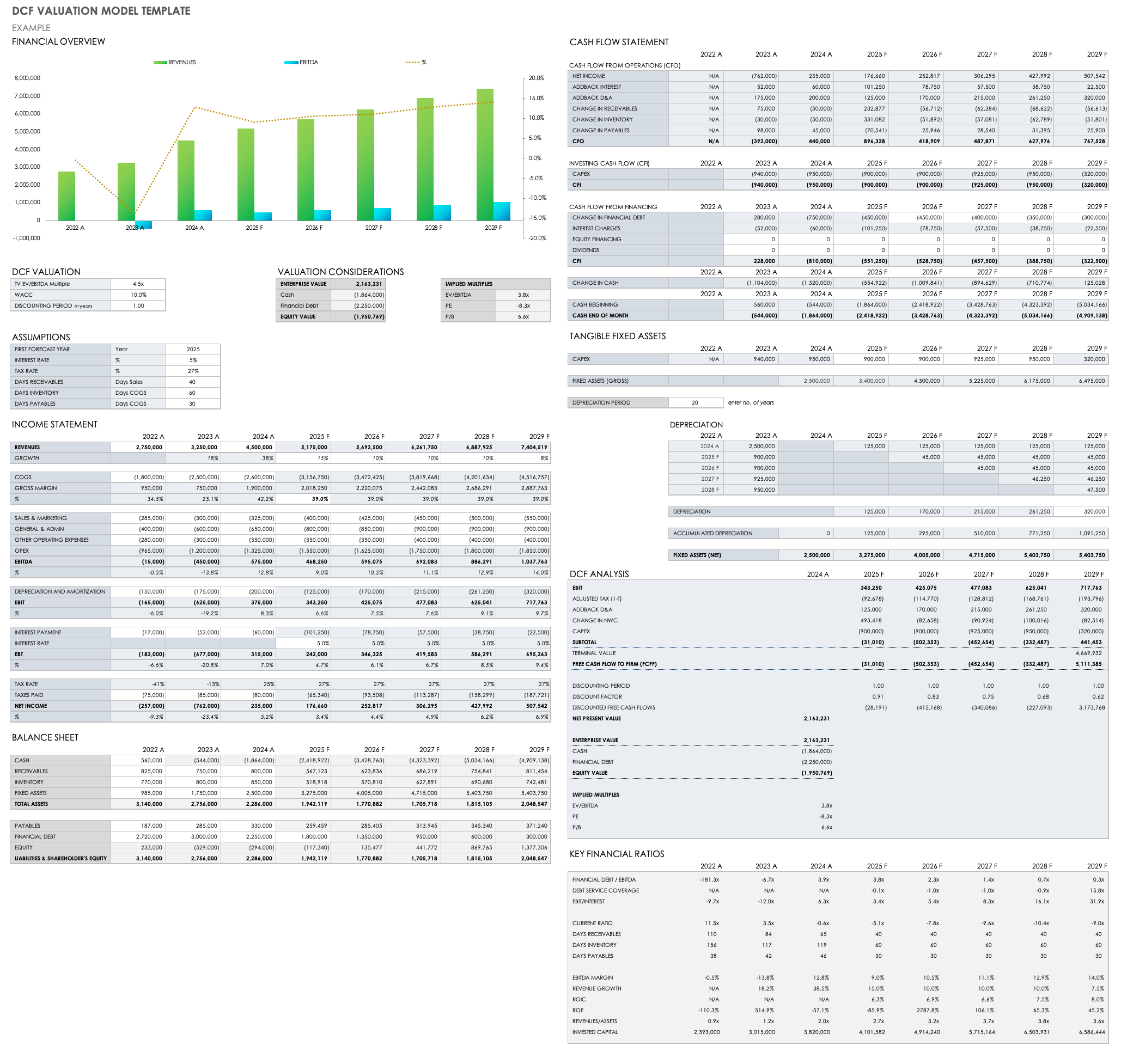

Navigate Your Success How to Calculate a DCF in Excel

Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Calculate the.

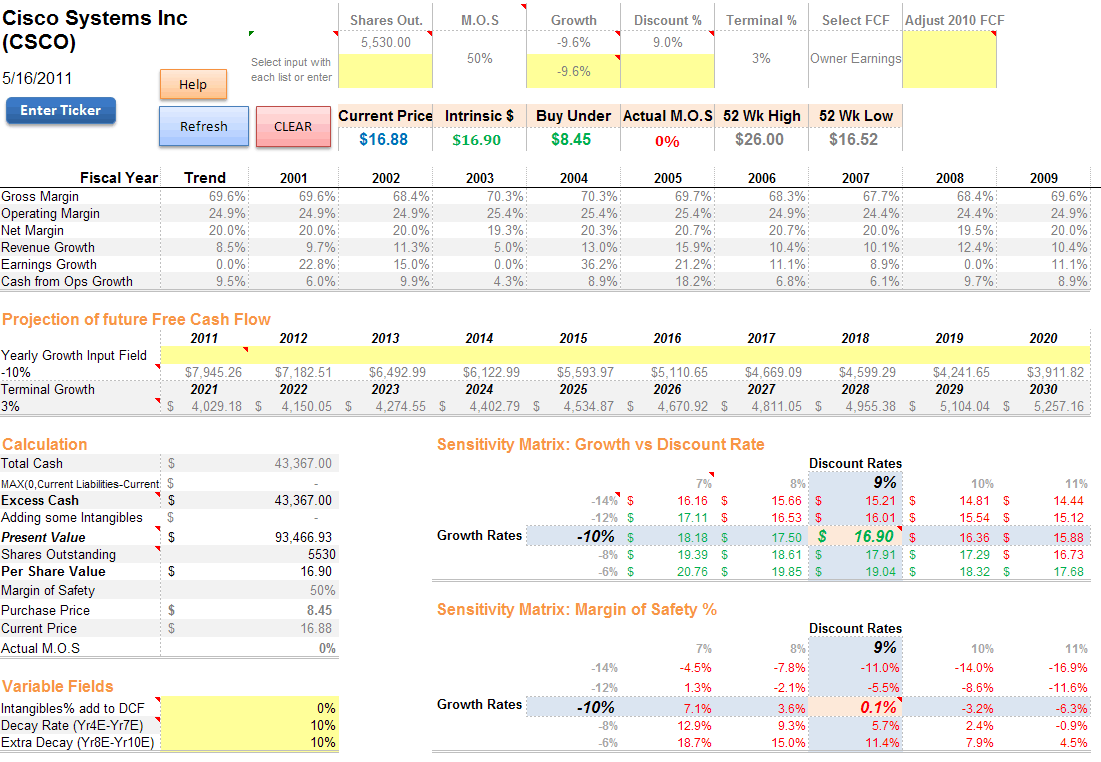

How to Value a Stock With Reverse Discounted Cash Flow Seeking Alpha

Calculate the implied growth rate needed to. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Free discounted cash flow (dcf), reverse dcf calculator.

Пример dcf модели в excel Word и Excel помощь в работе с программами

Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Calculate the implied growth rate needed to. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Instead of projecting future cash flows to. Free discounted cash flow (dcf), reverse dcf calculator calculates the value.

DCF Model Excel Free Template Macabacus

In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. The reverse dcf calculator inverts the traditional approach of estimating a stock’s value. Free reverse.

Dcf Model Template

Calculate the implied growth rate needed to. In order to calculate the fcff for years one to five, we’ll add d&a, subtract capital expenditures, and finally subtract the change in. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. The reverse dcf calculator inverts the traditional approach.

Mastering DCF Analysis for Investment Banking Interviews CFI

Instead of projecting future cash flows to. Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. The reverse dcf calculator inverts the traditional approach of.

In Order To Calculate The Fcff For Years One To Five, We’ll Add D&A, Subtract Capital Expenditures, And Finally Subtract The Change In.

Free reverse discounted cash flow (dcf) analysis tool for stock valuation based on fcf, terminal value, present value, wacc and enterprise value. Free discounted cash flow (dcf), reverse dcf calculator calculates the value of business using the discounted cash flow model based on eps. Calculate the implied growth rate needed to. Instead of projecting future cash flows to.

The Reverse Dcf Calculator Inverts The Traditional Approach Of Estimating A Stock’s Value.

Free reverse dcf calculator (reverse discounted cash flow calculator) for stock valuation.