Professional Tax In Salary Slip - If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Professional tax is a tax that is imposed by the state on salaried employees and businesses. It is also applicable to. Discover tax slab rates, deductions, & tips to maximize. Easily track pto & morediy payroll Learn what is professional tax, its applicability, and tax slab. For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. Professional tax is deducted from your gross salary with tds and epf. Learn how to calculate professional tax on salary effortlessly!

Professional tax is deducted from your gross salary with tds and epf. Professional tax is a tax that is imposed by the state on salaried employees and businesses. It is also applicable to. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. Easily track pto & morediy payroll Learn how to calculate professional tax on salary effortlessly! Discover tax slab rates, deductions, & tips to maximize. For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. Learn what is professional tax, its applicability, and tax slab.

For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. Learn what is professional tax, its applicability, and tax slab. Professional tax is a tax that is imposed by the state on salaried employees and businesses. Easily track pto & morediy payroll Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. It is also applicable to. Professional tax is deducted from your gross salary with tds and epf. Learn how to calculate professional tax on salary effortlessly! Discover tax slab rates, deductions, & tips to maximize.

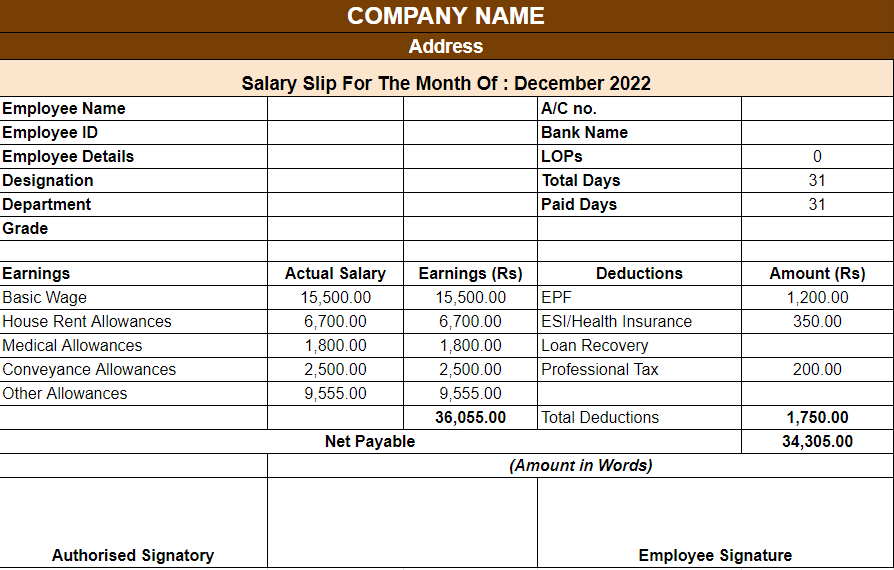

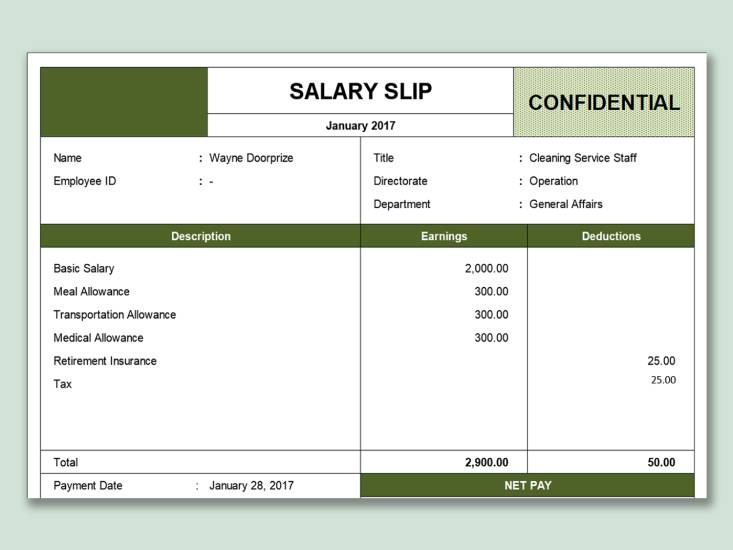

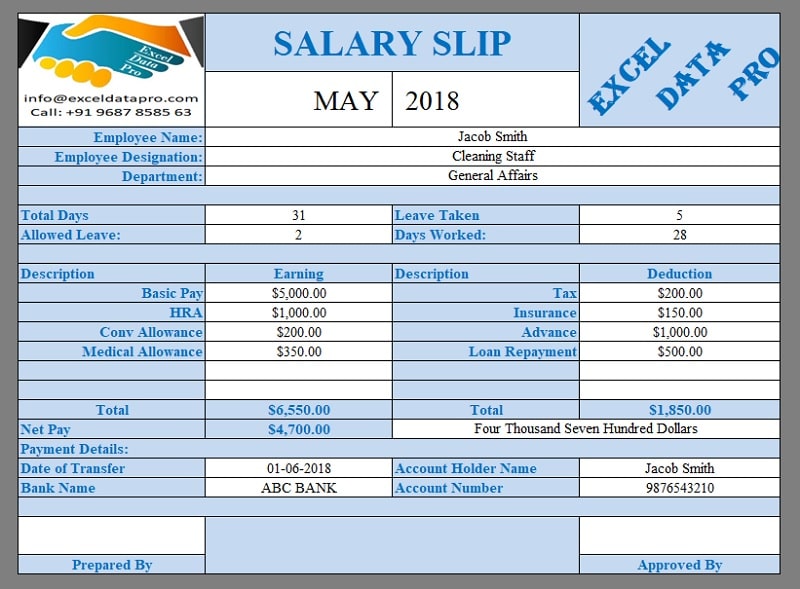

Simple Salary Slip Format in Word, Excel, PDF Pay Slip Free Download

It is also applicable to. Learn what is professional tax, its applicability, and tax slab. If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Easily track.

Creating a Professional Salary Slip Format in MS Excel

Learn what is professional tax, its applicability, and tax slab. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. It is also applicable to. If you.

Simple Salary Slip Formats in Excel Word PDF Download

Learn what is professional tax, its applicability, and tax slab. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Professional tax is a tax that is imposed by the state on salaried employees and businesses. Discover tax slab rates, deductions, & tips to maximize. Professional tax.

Excel Payslip Template

Learn how to calculate professional tax on salary effortlessly! Professional tax is deducted from your gross salary with tds and epf. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. If you ever pay close attention to your pay slips, you’ll see a monthly deduction called.

Know What is Salary Slip and Why it is Important in Tax Savings

It is also applicable to. For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. Learn how to calculate professional tax on salary effortlessly! Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Discover tax slab.

Payslip Sample Template Paysliper, 55 OFF

Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Professional tax is deducted from your gross salary with tds and epf. Professional tax is a tax that is imposed by the state on salaried employees and businesses. Learn how to calculate professional tax on salary effortlessly!.

8 Essential Components Of Salary Slip That You Should vrogue.co

If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. Learn what is professional tax, its applicability, and tax slab. It is also applicable to. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Easily track.

Salary Slip Template In Excel The Ultimate Guide To Creating And Using

Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. Professional tax is deducted from your gross salary with tds and epf. Discover tax slab rates, deductions,.

Salary Slip Meaning, Format and Components

Learn how to calculate professional tax on salary effortlessly! If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Learn what is professional tax, its applicability, and.

Salary slip excel format vfecasa

Learn what is professional tax, its applicability, and tax slab. Learn how to calculate professional tax on salary effortlessly! Professional tax is deducted from your gross salary with tds and epf. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Professional tax is a tax that.

Learn How To Calculate Professional Tax On Salary Effortlessly!

Professional tax is deducted from your gross salary with tds and epf. Easily track pto & morediy payroll Professional tax is a tax that is imposed by the state on salaried employees and businesses. Discover tax slab rates, deductions, & tips to maximize.

Learn What Is Professional Tax, Its Applicability, And Tax Slab.

Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. It is also applicable to. If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’.