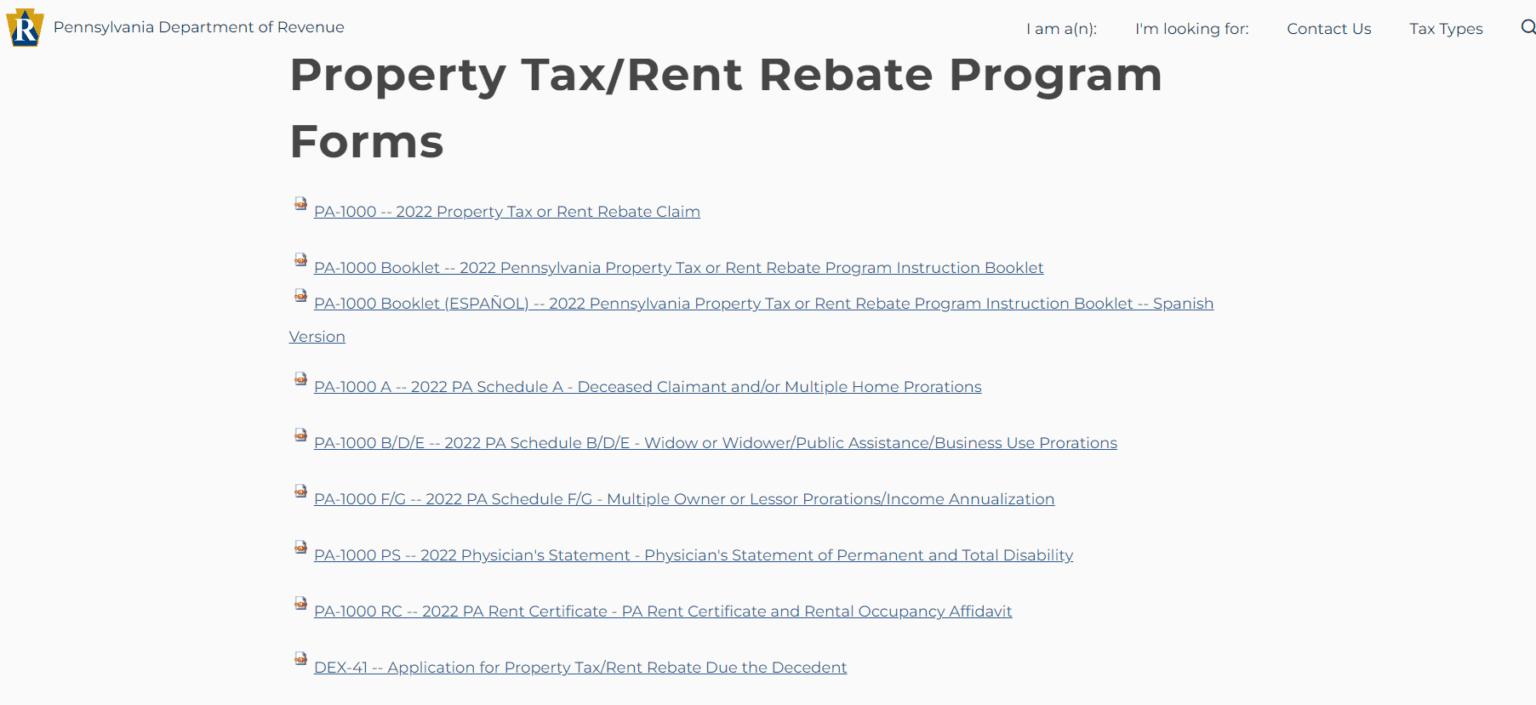

Pa Property Tax Rebate Forms - The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. Claimants have the option to electronically apply for a property tax/rent. The property tax/rent rebate program supports homeowners and renters across pennsylvania. The maximum standard rebate is $650, but supplemental rebates for qualifying. Use this form to apply for the property tax/rent rebate program by mail. Renters must make certain their landlords were required to pay property taxes or. Submit all necessary documents, including tax receipts for property.

The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. The property tax/rent rebate program supports homeowners and renters across pennsylvania. Use this form to apply for the property tax/rent rebate program by mail. Submit all necessary documents, including tax receipts for property. The maximum standard rebate is $650, but supplemental rebates for qualifying. Claimants have the option to electronically apply for a property tax/rent. Renters must make certain their landlords were required to pay property taxes or.

Use this form to apply for the property tax/rent rebate program by mail. The property tax/rent rebate program supports homeowners and renters across pennsylvania. Claimants have the option to electronically apply for a property tax/rent. Submit all necessary documents, including tax receipts for property. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. Renters must make certain their landlords were required to pay property taxes or. The maximum standard rebate is $650, but supplemental rebates for qualifying.

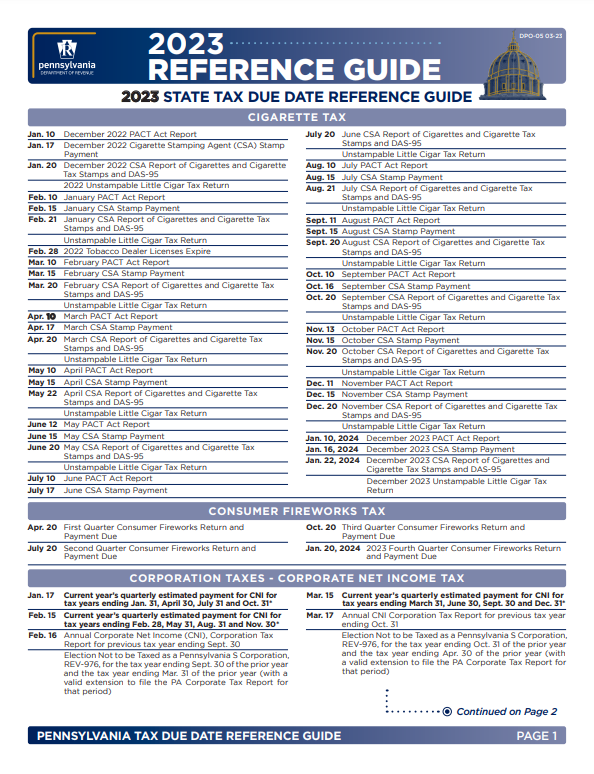

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

The property tax/rent rebate program supports homeowners and renters across pennsylvania. Submit all necessary documents, including tax receipts for property. The maximum standard rebate is $650, but supplemental rebates for qualifying. Renters must make certain their landlords were required to pay property taxes or. Use this form to apply for the property tax/rent rebate program by mail.

Pa Property Tax Rebate Forms For 2024 Amelie Steffi

The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. Use this form to apply for the property tax/rent rebate program by mail. Renters must make certain their landlords were required to pay property taxes or. Claimants have the option to electronically apply for a property tax/rent. The property tax/rent rebate program supports homeowners and renters across pennsylvania.

2022 Pa Property Tax Rebate Forms

Claimants have the option to electronically apply for a property tax/rent. Use this form to apply for the property tax/rent rebate program by mail. Submit all necessary documents, including tax receipts for property. The maximum standard rebate is $650, but supplemental rebates for qualifying. Renters must make certain their landlords were required to pay property taxes or.

Pa Rent Rebate 2021 Printable Rebate Form

The maximum standard rebate is $650, but supplemental rebates for qualifying. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. Use this form to apply for the property tax/rent rebate program by mail. Submit all necessary documents, including tax receipts for property. Claimants have the option to electronically apply for a property tax/rent.

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form

Claimants have the option to electronically apply for a property tax/rent. Use this form to apply for the property tax/rent rebate program by mail. Renters must make certain their landlords were required to pay property taxes or. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. The maximum standard rebate is $650, but supplemental rebates for qualifying.

Pa Property Tax Rebate 2024 Application Format Verna Zorine

The maximum standard rebate is $650, but supplemental rebates for qualifying. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. The property tax/rent rebate program supports homeowners and renters across pennsylvania. Submit all necessary documents, including tax receipts for property. Claimants have the option to electronically apply for a property tax/rent.

Pennsylvania's Property Tax/Rent Rebate Program may help

Renters must make certain their landlords were required to pay property taxes or. The property tax/rent rebate program supports homeowners and renters across pennsylvania. Use this form to apply for the property tax/rent rebate program by mail. Submit all necessary documents, including tax receipts for property. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;.

PA Property Tax Rebate Form Printable Rebate Form

Claimants have the option to electronically apply for a property tax/rent. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. Renters must make certain their landlords were required to pay property taxes or. The maximum standard rebate is $650, but supplemental rebates for qualifying. Use this form to apply for the property tax/rent rebate program by mail.

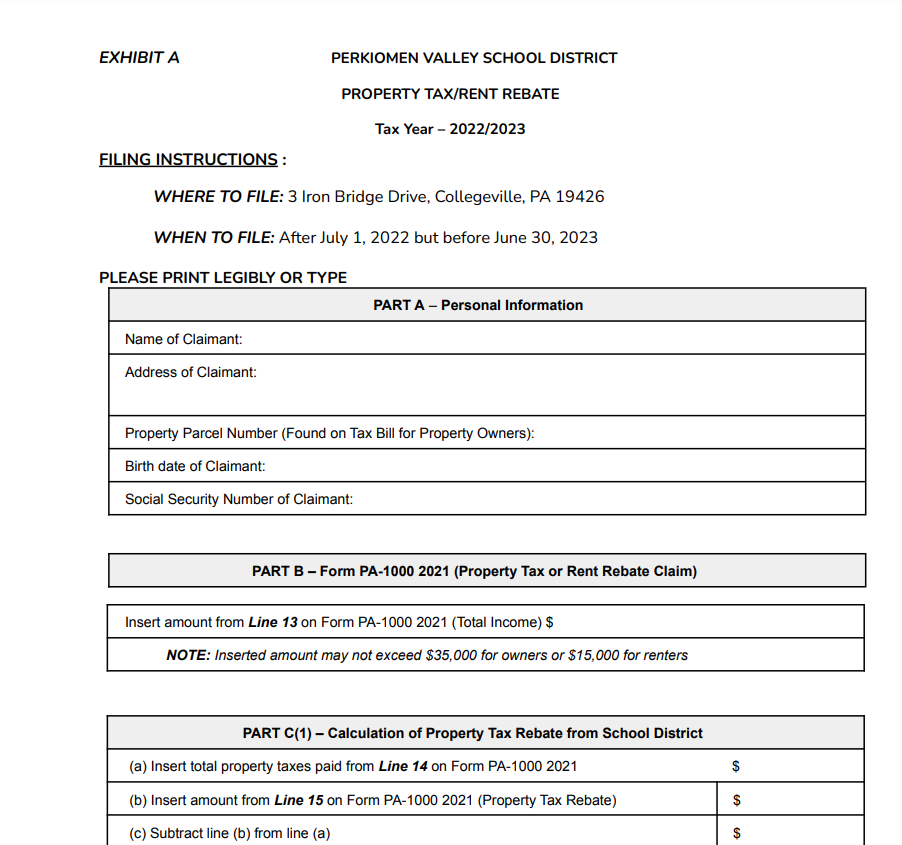

Property Tax Rebate Application printable pdf download

Claimants have the option to electronically apply for a property tax/rent. The property tax/rent rebate program supports homeowners and renters across pennsylvania. Use this form to apply for the property tax/rent rebate program by mail. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. The maximum standard rebate is $650, but supplemental rebates for qualifying.

Pa Property Tax Rebate 2024 Instructions Darby Ellissa

Submit all necessary documents, including tax receipts for property. Claimants have the option to electronically apply for a property tax/rent. The property tax/rent rebate program benefits eligible pennsylvanians age 65 and older;. The maximum standard rebate is $650, but supplemental rebates for qualifying. Use this form to apply for the property tax/rent rebate program by mail.

Renters Must Make Certain Their Landlords Were Required To Pay Property Taxes Or.

The property tax/rent rebate program supports homeowners and renters across pennsylvania. Submit all necessary documents, including tax receipts for property. Claimants have the option to electronically apply for a property tax/rent. The maximum standard rebate is $650, but supplemental rebates for qualifying.

The Property Tax/Rent Rebate Program Benefits Eligible Pennsylvanians Age 65 And Older;.

Use this form to apply for the property tax/rent rebate program by mail.