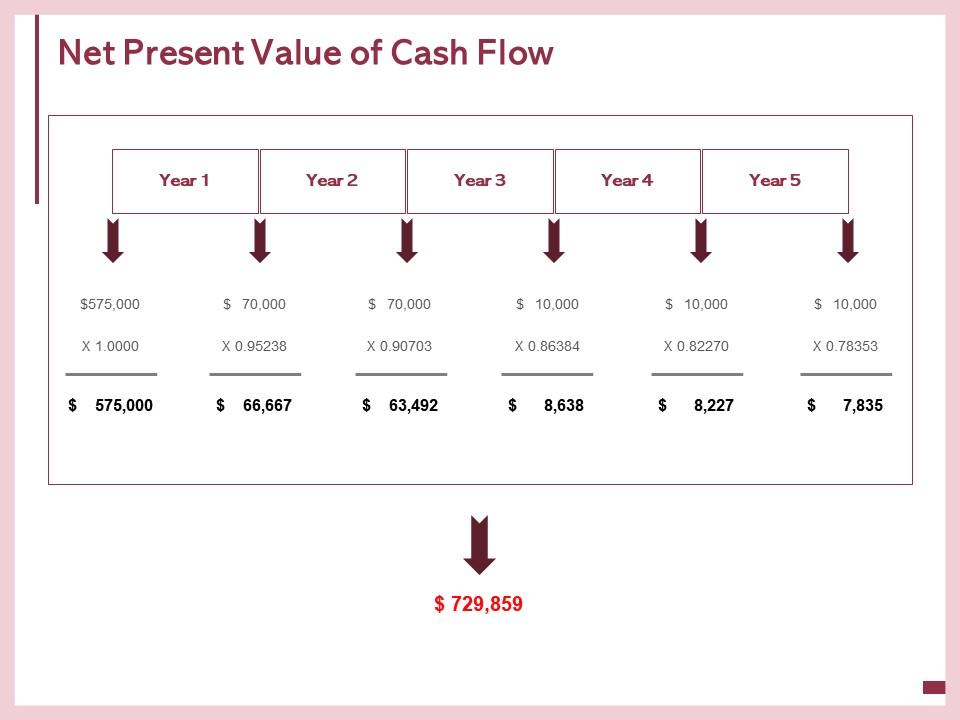

Npv Of Cash Flows - Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. What is net present value (npv)? Net present value is a financial metric used to determine the value of an investment by calculating the difference. Use the online npv calculator to enter the. Learn how to calculate net present value (npv) of a project with future cash flows and a discount rate.

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Use the online npv calculator to enter the. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. Learn how to calculate net present value (npv) of a project with future cash flows and a discount rate. What is net present value (npv)?

What is net present value (npv)? Learn how to calculate net present value (npv) of a project with future cash flows and a discount rate. Use the online npv calculator to enter the. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. Net present value is a financial metric used to determine the value of an investment by calculating the difference.

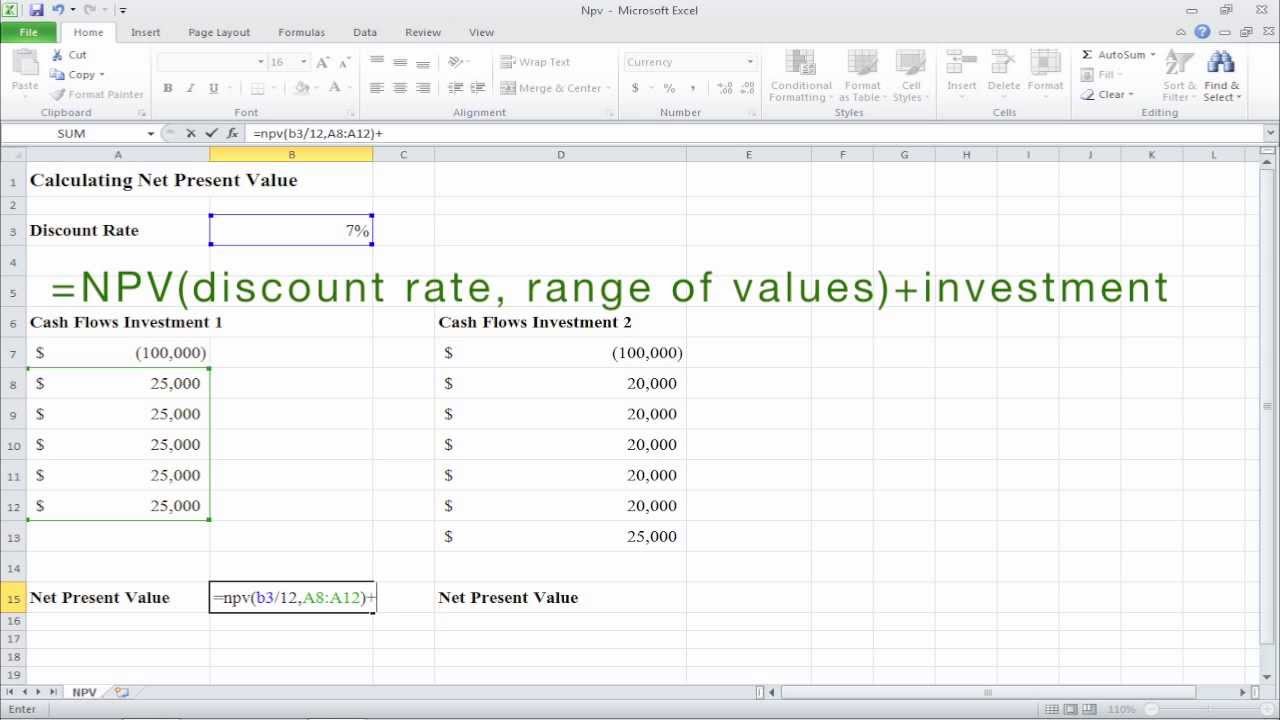

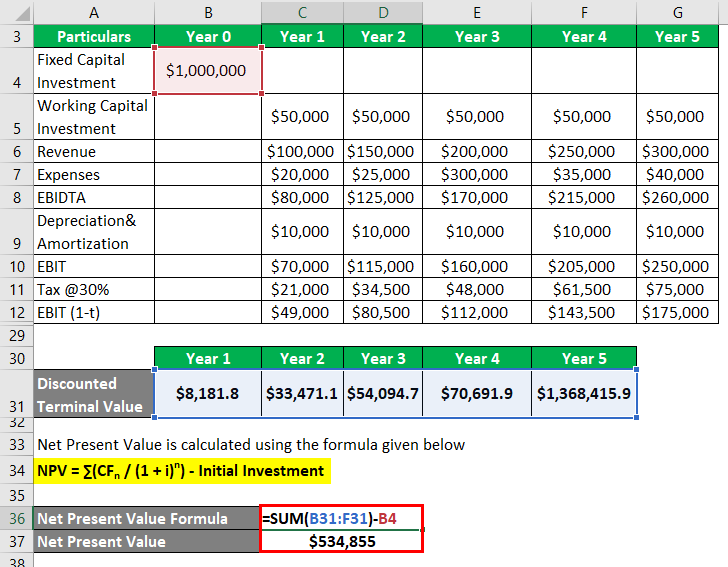

Best Present Value Of Future Cash Flows Excel Template Spending Tracker

Use the online npv calculator to enter the. What is net present value (npv)? Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. Learn how to calculate net present.

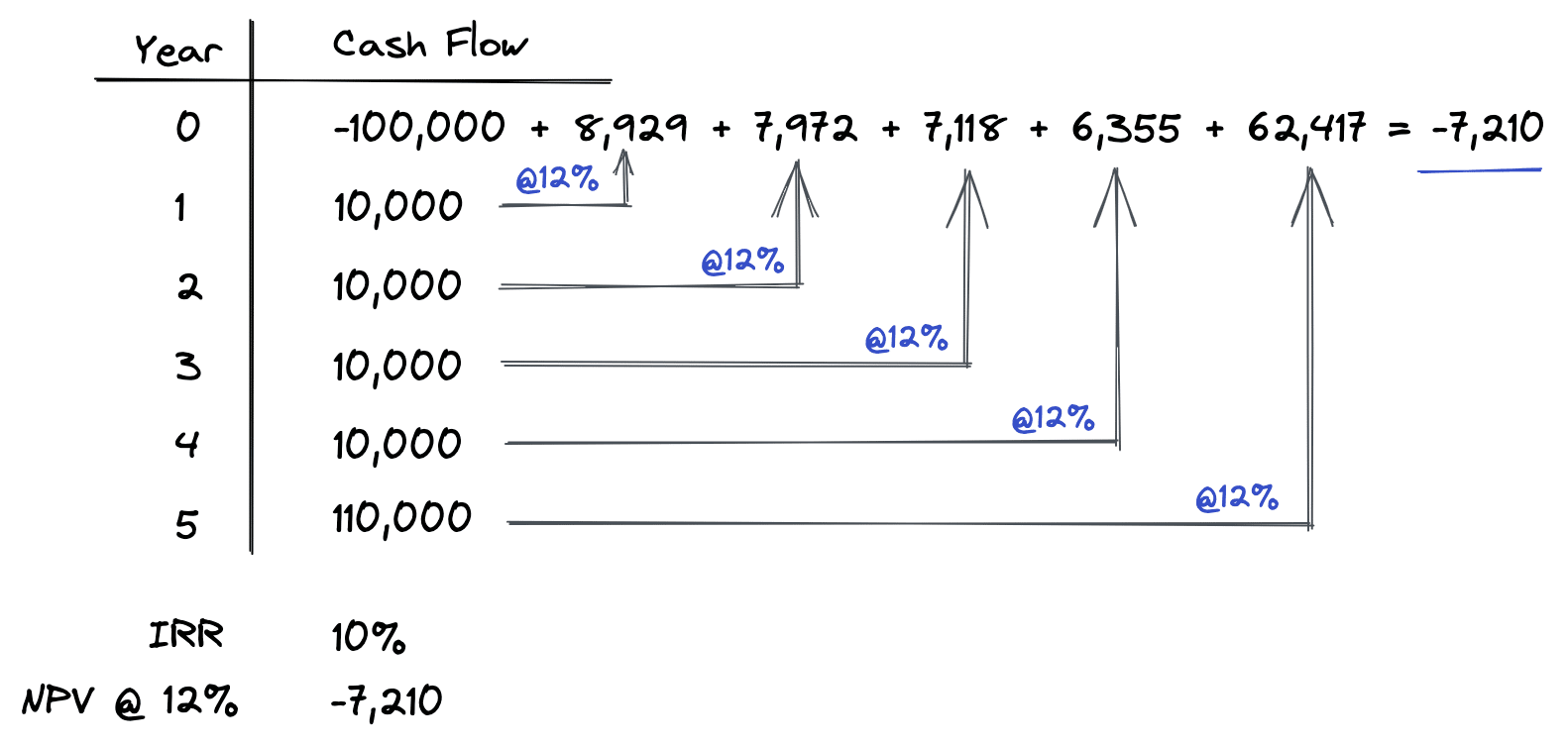

4 Ways To Calculate NPV Wikihow Innovator

Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. Use the online npv calculator to enter the. What is net present value (npv)? Net present value is a financial metric used to determine the value of an investment by calculating the difference. Learn how to calculate net present.

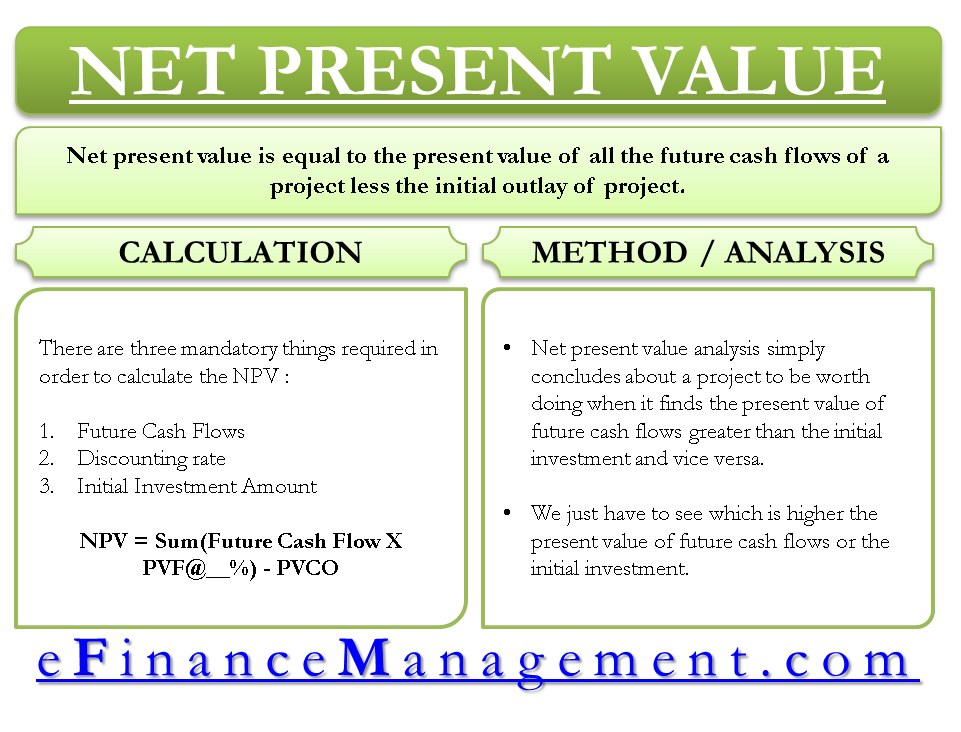

Net Present Value (NPV) What You Should Know PropertyMetrics

Learn how to calculate net present value (npv) of a project with future cash flows and a discount rate. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. What is net present value (npv)? Net present value is a financial metric used to determine the value of an.

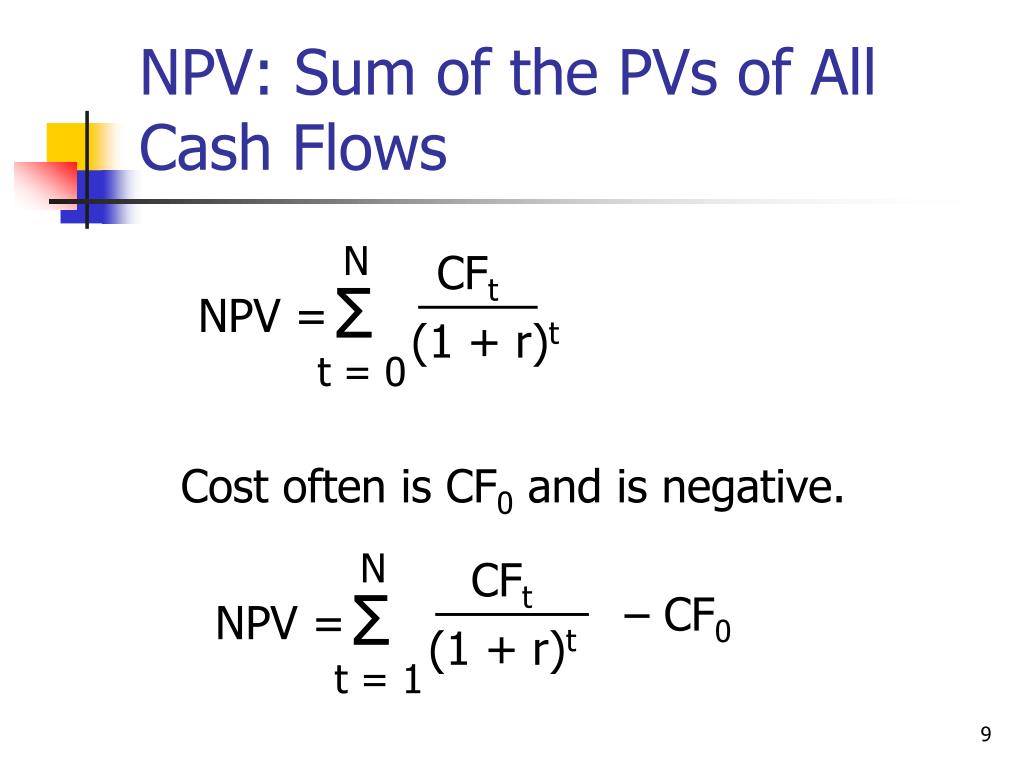

PPT Chapter 10 PowerPoint Presentation, free download ID6952313

Learn how to calculate net present value (npv) of a project with future cash flows and a discount rate. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. Use.

Present Value Excel Template

What is net present value (npv)? Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Use the online npv calculator to enter the. Learn how to calculate net present.

Net Present Value Formula On Excel at sasfloatblog Blog

What is net present value (npv)? Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. Use the online npv calculator to enter the. Learn how to calculate net present.

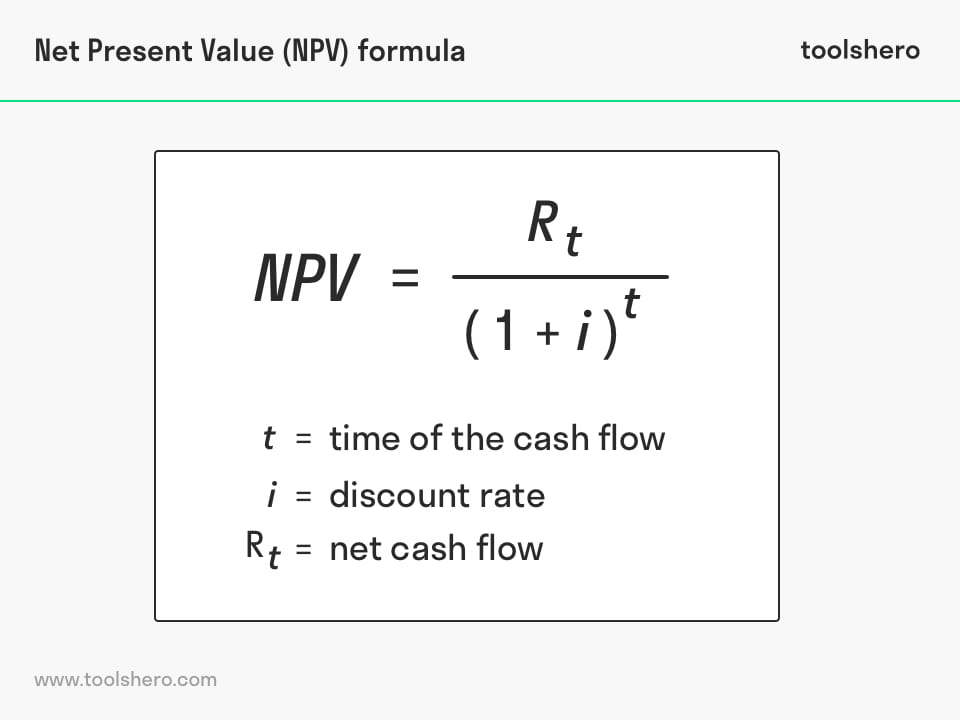

Net Present Value formula and example Toolshero

Learn how to calculate net present value (npv) of a project with future cash flows and a discount rate. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. What is net present value (npv)? Use the online npv calculator to enter the. Net present value is a financial.

Net Present Value (NPV) What It Means and Steps to Calculate It

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Learn how to calculate net present value (npv) of a project with future cash flows and a discount rate. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. Use.

Net Present Value (NPV) What It Means and Steps to Calculate It (2022)

Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. Learn how to calculate net present value (npv) of a project with future cash flows and a discount rate. Use the online npv calculator to enter the. Net present value is a financial metric used to determine the value.

Net Present Value Example

Learn how to calculate net present value (npv) of a project with future cash flows and a discount rate. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. Use the online npv calculator to enter the. Net present value is a financial metric used to determine the value.

Use The Online Npv Calculator To Enter The.

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Learn how to calculate net present value (npv) of a project with future cash flows and a discount rate. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an. What is net present value (npv)?

:max_bytes(150000):strip_icc()/ScreenShot2019-06-20at10.46.59AM-f30499c2303c44a5a883c6c1e676569b.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)