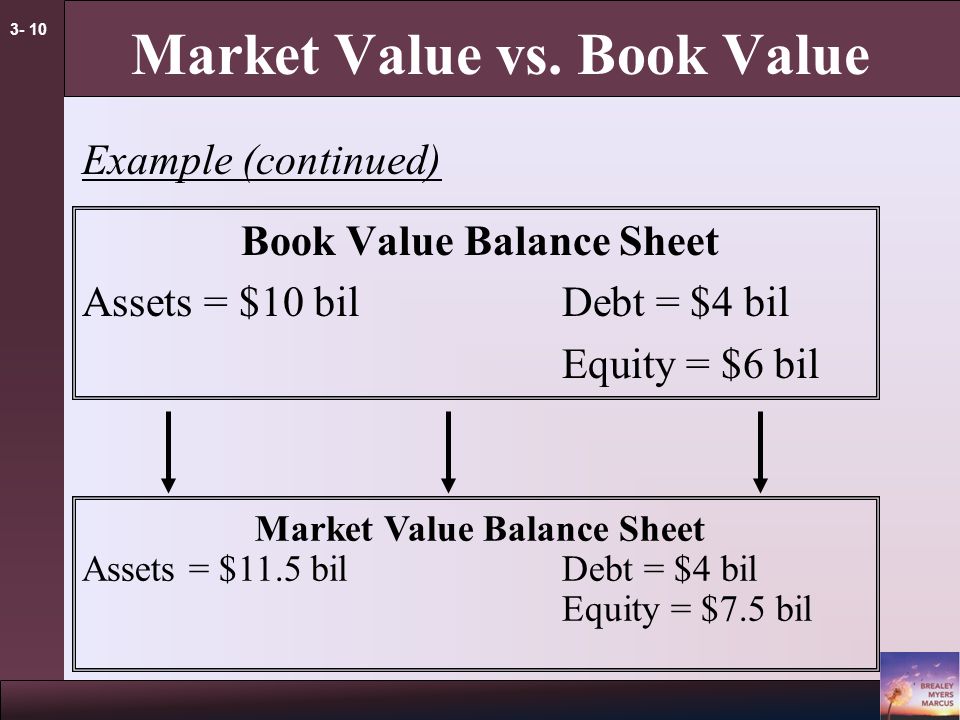

Market Value Balance Sheet - The book value of equity (bve) is the historical value of a company’s common equity recorded for purposes of bookkeeping,. The market value balance sheet. The market value balance sheet provides a snapshot of a company’s financial standing by valuing assets and liabilities at. The ‘balance sheet’, also called the ‘statement of financial position’, shows how the book value of assets (a) equals the book value of liabilities. Market value represents the price at which an asset or liability can be bought or sold in a competitive marketplace. A market value balance sheet estimates asset values using current prices for similar assets.

Market value represents the price at which an asset or liability can be bought or sold in a competitive marketplace. The market value balance sheet. The book value of equity (bve) is the historical value of a company’s common equity recorded for purposes of bookkeeping,. The market value balance sheet provides a snapshot of a company’s financial standing by valuing assets and liabilities at. A market value balance sheet estimates asset values using current prices for similar assets. The ‘balance sheet’, also called the ‘statement of financial position’, shows how the book value of assets (a) equals the book value of liabilities.

Market value represents the price at which an asset or liability can be bought or sold in a competitive marketplace. The book value of equity (bve) is the historical value of a company’s common equity recorded for purposes of bookkeeping,. The ‘balance sheet’, also called the ‘statement of financial position’, shows how the book value of assets (a) equals the book value of liabilities. The market value balance sheet provides a snapshot of a company’s financial standing by valuing assets and liabilities at. A market value balance sheet estimates asset values using current prices for similar assets. The market value balance sheet.

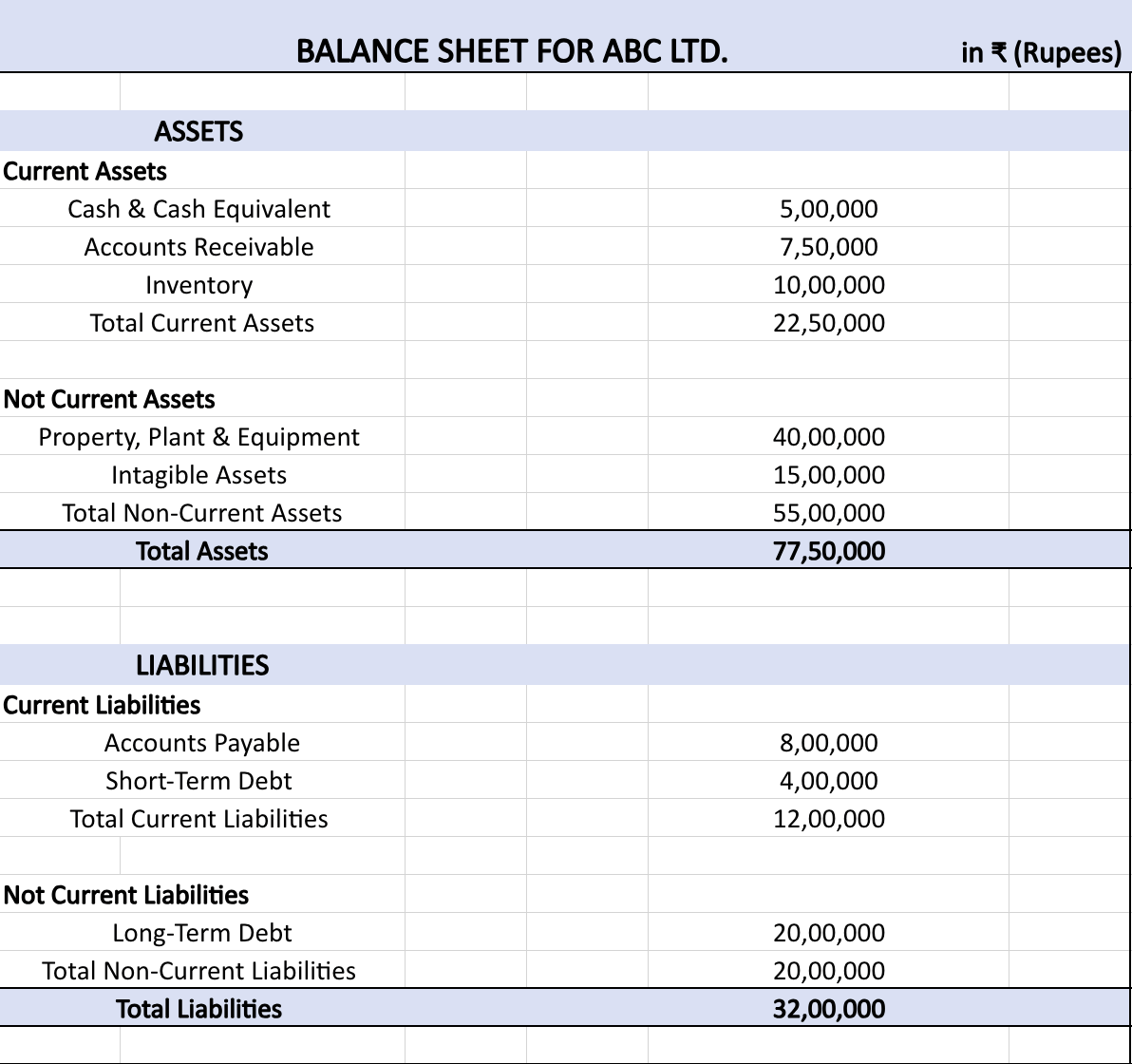

Book Value of Shares Meaning, Calculation & Importance

The ‘balance sheet’, also called the ‘statement of financial position’, shows how the book value of assets (a) equals the book value of liabilities. The book value of equity (bve) is the historical value of a company’s common equity recorded for purposes of bookkeeping,. A market value balance sheet estimates asset values using current prices for similar assets. The market.

Book Value vs Market Value Balance Sheet Simple Example Using Excel

A market value balance sheet estimates asset values using current prices for similar assets. The book value of equity (bve) is the historical value of a company’s common equity recorded for purposes of bookkeeping,. Market value represents the price at which an asset or liability can be bought or sold in a competitive marketplace. The ‘balance sheet’, also called the.

(Solved) 1. Prepare An Economic (Market Value) Balance Sheet For The

Market value represents the price at which an asset or liability can be bought or sold in a competitive marketplace. The book value of equity (bve) is the historical value of a company’s common equity recorded for purposes of bookkeeping,. The market value balance sheet. The market value balance sheet provides a snapshot of a company’s financial standing by valuing.

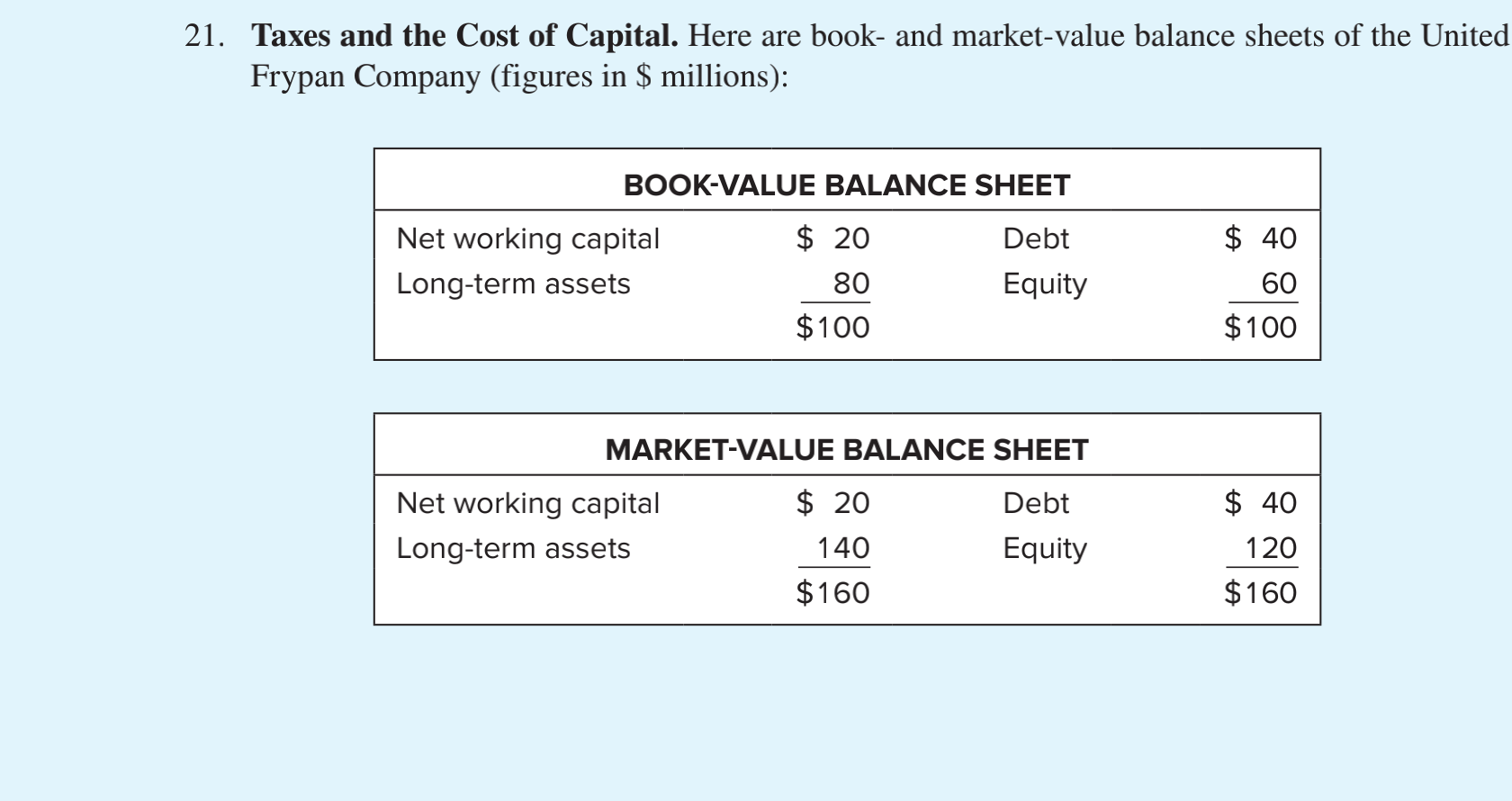

Solved 21. Taxes and the Cost of Capital. Here are book and

A market value balance sheet estimates asset values using current prices for similar assets. The ‘balance sheet’, also called the ‘statement of financial position’, shows how the book value of assets (a) equals the book value of liabilities. The market value balance sheet. Market value represents the price at which an asset or liability can be bought or sold in.

Musings on Markets June 2013

A market value balance sheet estimates asset values using current prices for similar assets. The book value of equity (bve) is the historical value of a company’s common equity recorded for purposes of bookkeeping,. The ‘balance sheet’, also called the ‘statement of financial position’, shows how the book value of assets (a) equals the book value of liabilities. The market.

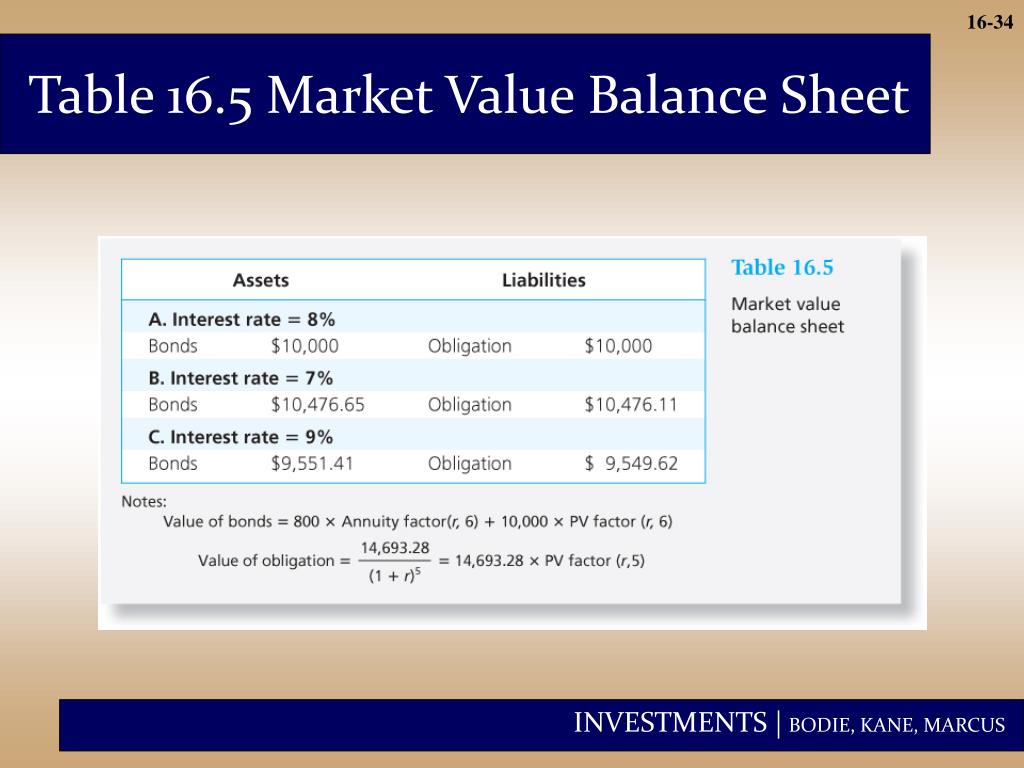

PPT CHAPTER 16 PowerPoint Presentation, free download ID928631

The book value of equity (bve) is the historical value of a company’s common equity recorded for purposes of bookkeeping,. The ‘balance sheet’, also called the ‘statement of financial position’, shows how the book value of assets (a) equals the book value of liabilities. The market value balance sheet provides a snapshot of a company’s financial standing by valuing assets.

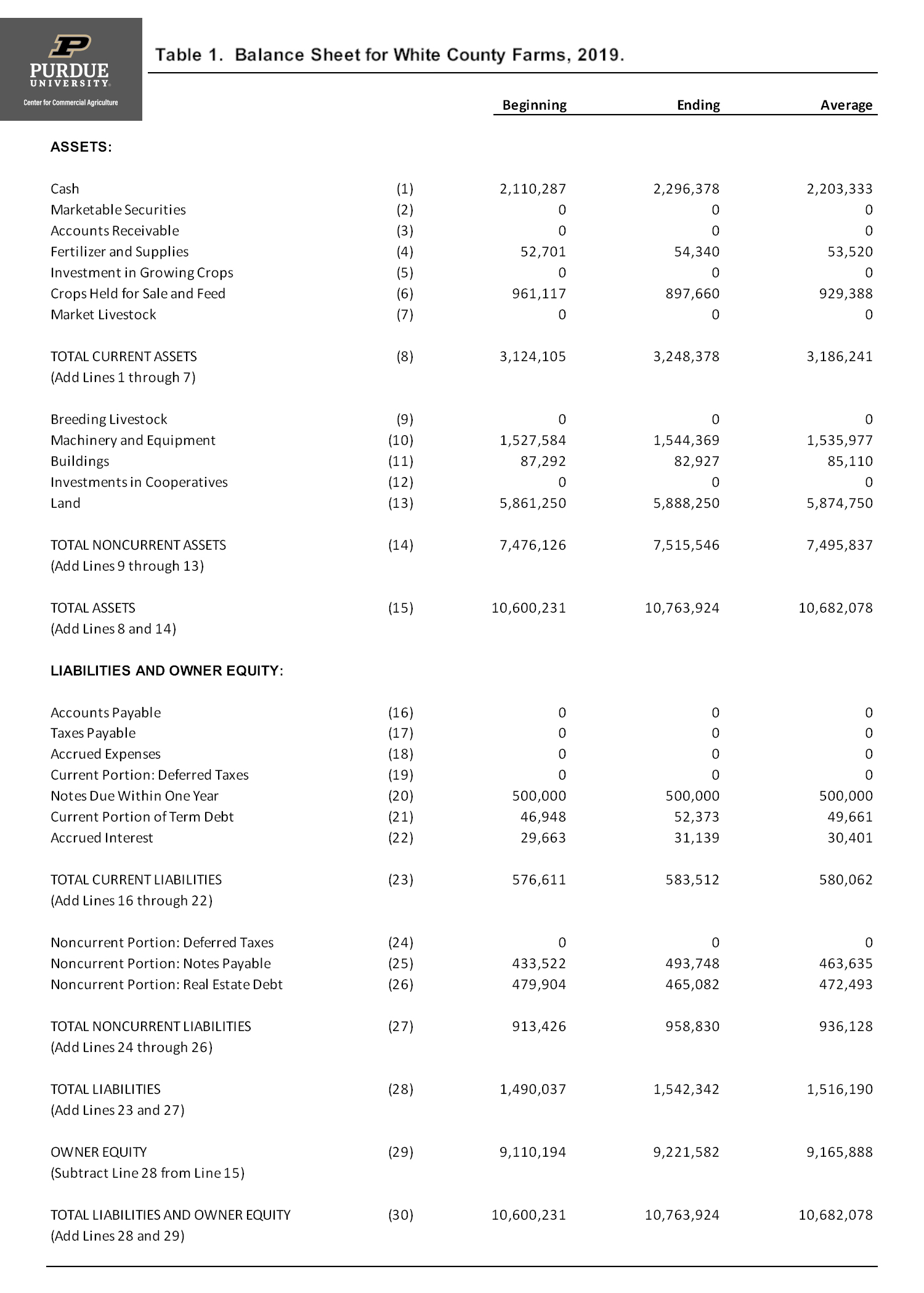

Market Value Balance Sheet and Analysis Center for Commercial Agriculture

The market value balance sheet provides a snapshot of a company’s financial standing by valuing assets and liabilities at. The book value of equity (bve) is the historical value of a company’s common equity recorded for purposes of bookkeeping,. The market value balance sheet. A market value balance sheet estimates asset values using current prices for similar assets. The ‘balance.

Book Value vs. Market Value What's the Difference?

The market value balance sheet provides a snapshot of a company’s financial standing by valuing assets and liabilities at. The ‘balance sheet’, also called the ‘statement of financial position’, shows how the book value of assets (a) equals the book value of liabilities. A market value balance sheet estimates asset values using current prices for similar assets. The book value.

Chapter 3 Accounting and Finance Fundamentals of Corporate Finance

The ‘balance sheet’, also called the ‘statement of financial position’, shows how the book value of assets (a) equals the book value of liabilities. The market value balance sheet provides a snapshot of a company’s financial standing by valuing assets and liabilities at. The book value of equity (bve) is the historical value of a company’s common equity recorded for.

Market Value Balance Sheet and Analysis Center for Commercial Agriculture

The market value balance sheet provides a snapshot of a company’s financial standing by valuing assets and liabilities at. A market value balance sheet estimates asset values using current prices for similar assets. The book value of equity (bve) is the historical value of a company’s common equity recorded for purposes of bookkeeping,. The market value balance sheet. Market value.

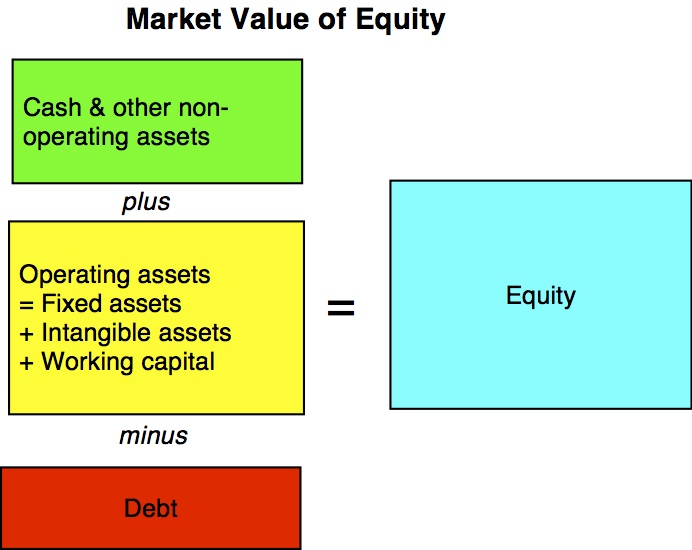

The Market Value Balance Sheet.

The market value balance sheet provides a snapshot of a company’s financial standing by valuing assets and liabilities at. The ‘balance sheet’, also called the ‘statement of financial position’, shows how the book value of assets (a) equals the book value of liabilities. Market value represents the price at which an asset or liability can be bought or sold in a competitive marketplace. The book value of equity (bve) is the historical value of a company’s common equity recorded for purposes of bookkeeping,.

:max_bytes(150000):strip_icc()/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)