King County Property Tax For Senior Citizens - State law provides 2 tax benefit programs for senior citizens and persons with disabilities. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. They include property tax exemptions and property. Property tax exemptions and property. King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing.

They include property tax exemptions and property. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. Property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing.

Property tax exemptions and property. They include property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing.

King County Senior Property Tax Exemption 2025 Karen K. Ater

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. They include property tax exemptions and property. State law provides 2 tax benefit programs for senior citizens.

Property Tax King 2025

This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. They include property tax exemptions and property. Property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. State law provides 2 tax.

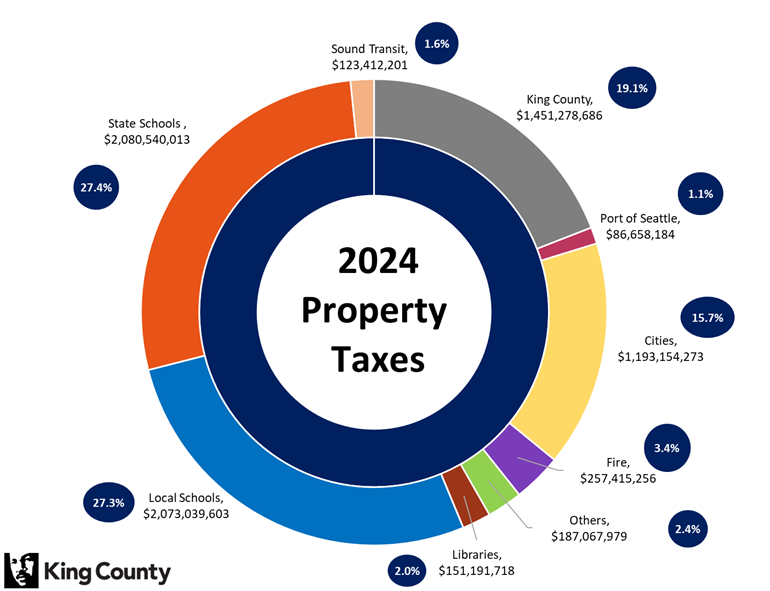

2024 Property Taxes King County, Washington

King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. They include property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. State law provides 2 tax benefit programs for senior citizens and persons with disabilities..

Senior Discount Property Tax King County at Ida Barrera blog

State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. Property tax exemptions and property. King county's tax.

King County Senior Property Tax Exemption 2025 Britt L. Yokley

Property tax exemptions and property. They include property tax exemptions and property. King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: State law provides 2 tax benefit programs for senior citizens and persons with disabilities.

Senior Discount Property Tax King County at Ida Barrera blog

King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. State law provides 2 tax.

Senior Tax Relief How to Reduce Property Tax Greatsenioryears

King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. They include property tax exemptions and property. This exemption can reduce your property tax by 30 to 90 percent, depending on.

King County Senior Property Tax Exemption 2025 Lark Aurelia

Property tax exemptions and property. They include property tax exemptions and property. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. King county's tax relief program expands eligibility and becomes more accessible to seniors.

King County Senior Property Tax Exemption 2024 Vina Aloisia

State law provides 2 tax benefit programs for senior citizens and persons with disabilities. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. Property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is.

King County Senior Property Tax Exemption 2025 Karen K. Ater

They include property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. King county's tax relief program expands eligibility and becomes more.

Property Tax Exemptions And Property.

They include property tax exemptions and property. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans:

King County's Tax Relief Program Expands Eligibility And Becomes More Accessible To Seniors And Disabled Individuals, Allowing.

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or.