King County Property Tax Exempt Form - State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property. Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Click here to apply online, or apply. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%.

Click here to apply online, or apply. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. They include property tax exemptions and property. Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. State law provides 2 tax benefit programs for senior citizens and persons with disabilities.

State law provides 2 tax benefit programs for senior citizens and persons with disabilities. Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. Click here to apply online, or apply. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. They include property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing.

King County Audit Property Tax Exemptions YouTube

Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. Click here to apply online, or apply. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. This exemption can reduce your property tax by 30 to 90 percent, depending.

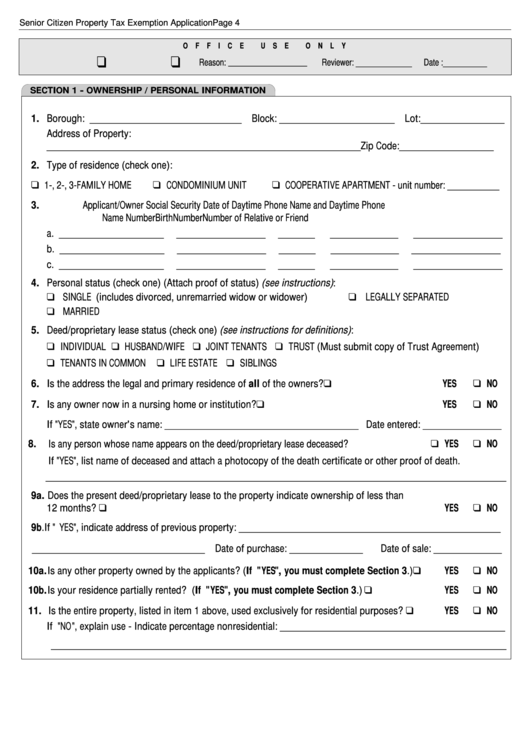

Fillable Online Real Property Tax Exemptions Fax Email Print pdfFiller

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. Click here to apply online, or apply. This exemption can reduce your property tax by 30 to 90 percent,.

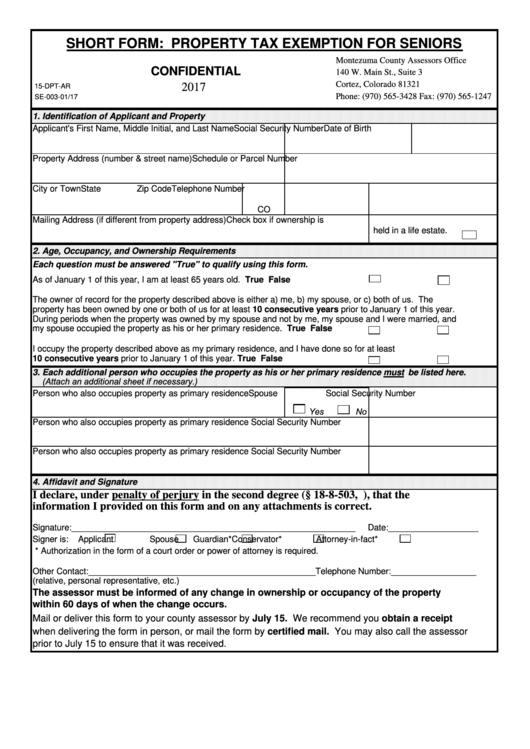

Property Tax Exemption for Seniors Form Larimer County

Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help.

Fillable Online short form property tax exemption for seniors

They include property tax exemptions and property. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is.

King County Senior Property Tax Exemption 2025 Lark Aurelia

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. Click here to apply online, or apply. State law provides 2 tax benefit programs for senior citizens and persons.

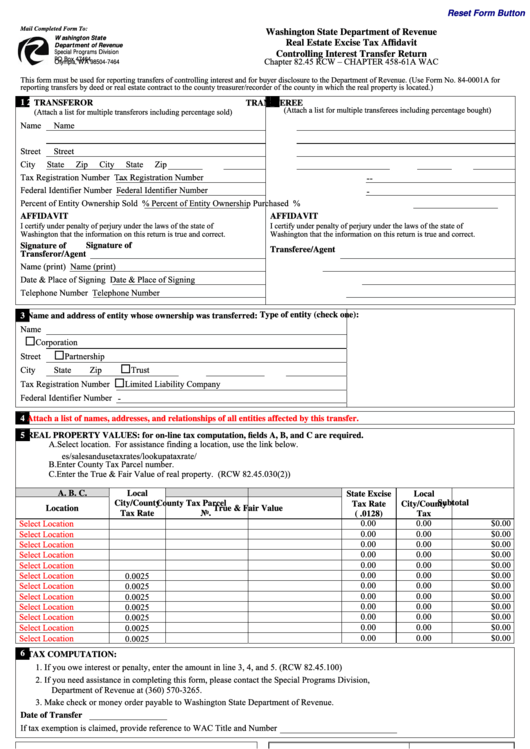

King County Real Estate Excise Tax Affidavit Form 2024

Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington.

King County Senior Property Tax Exemption 2025 Karen K. Ater

Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. Click here to apply online, or apply. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. They include property tax exemptions and property. This exemption can reduce your property.

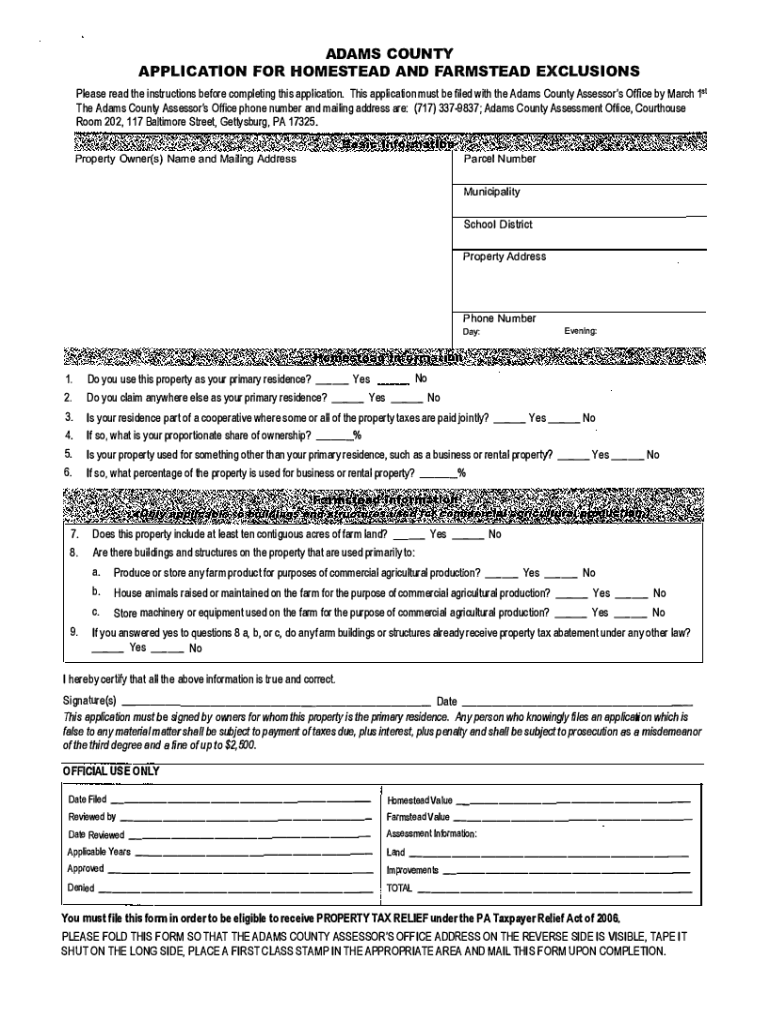

Pa Tax Exemption Form 2025 A Alice Fairfax

To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus.

Property Tax King 2025

This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. Launching in may, monthly workshops will take place where eligible king county residents will meet with counselors who will help them. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified.

King County Property Tax Exemption 2025 Stephen E. Stanley

State law provides 2 tax benefit programs for senior citizens and persons with disabilities. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. They include property tax exemptions and property. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus.

State Law Provides 2 Tax Benefit Programs For Senior Citizens And Persons With Disabilities.

To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Exempt from regular property taxes on $60,000 or 60% of the valuation, whichever is greater, plus exemption from 100%. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Click here to apply online, or apply.

Launching In May, Monthly Workshops Will Take Place Where Eligible King County Residents Will Meet With Counselors Who Will Help Them.

They include property tax exemptions and property. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing.