How To File Vat Return In Uae - Learn how to file vat returns electronically through the fta portal and pay your vat liability. Find out the requirements, deadlines, and. Any business or individual registered for vat in the uae, with a valid trn (tax registration number), must file vat. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days.

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Learn how to file vat returns electronically through the fta portal and pay your vat liability. Any business or individual registered for vat in the uae, with a valid trn (tax registration number), must file vat. Find out the requirements, deadlines, and.

Find out the requirements, deadlines, and. Any business or individual registered for vat in the uae, with a valid trn (tax registration number), must file vat. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Learn how to file vat returns electronically through the fta portal and pay your vat liability.

PPT How to File VAT Returns in UAE PowerPoint Presentation, free

Any business or individual registered for vat in the uae, with a valid trn (tax registration number), must file vat. Find out the requirements, deadlines, and. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Learn how to file vat returns electronically through the.

How to File VAT Return in UAE New EMARA TAX PORTAL YouTube

Find out the requirements, deadlines, and. Any business or individual registered for vat in the uae, with a valid trn (tax registration number), must file vat. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Learn how to file vat returns electronically through the.

How to file VAT return in UAE On Emara Tax Portal Step wise guide VAT

Learn how to file vat returns electronically through the fta portal and pay your vat liability. Any business or individual registered for vat in the uae, with a valid trn (tax registration number), must file vat. Find out the requirements, deadlines, and. Once you have registered for vat in the uae, you are required to file your vat return and.

How to File VAT Return in UAE BSD Prime Services

Find out the requirements, deadlines, and. Learn how to file vat returns electronically through the fta portal and pay your vat liability. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Any business or individual registered for vat in the uae, with a valid.

How to File VAT Return in UAE Complete Video YouTube

Learn how to file vat returns electronically through the fta portal and pay your vat liability. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Find out the requirements, deadlines, and. Any business or individual registered for vat in the uae, with a valid.

How to File VAT Return in EMARATAX Platform How to file VAT Return in

Any business or individual registered for vat in the uae, with a valid trn (tax registration number), must file vat. Find out the requirements, deadlines, and. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Learn how to file vat returns electronically through the.

How to File a VAT Return in the UAE

Find out the requirements, deadlines, and. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Learn how to file vat returns electronically through the fta portal and pay your vat liability. Any business or individual registered for vat in the uae, with a valid.

PPT How to File VAT Returns in UAE PowerPoint Presentation, free

Any business or individual registered for vat in the uae, with a valid trn (tax registration number), must file vat. Learn how to file vat returns electronically through the fta portal and pay your vat liability. Find out the requirements, deadlines, and. Once you have registered for vat in the uae, you are required to file your vat return and.

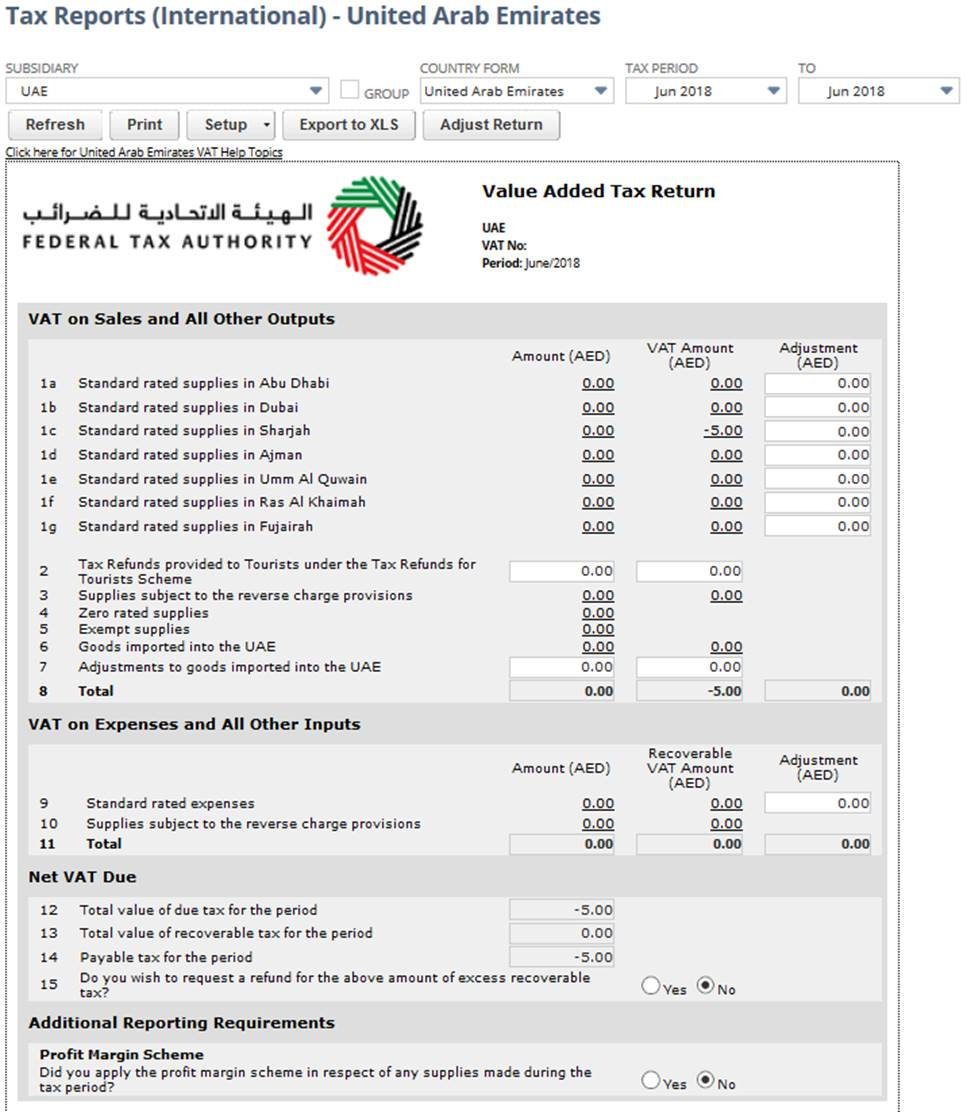

NetSuite Applications Suite United Arab Emirates VAT Report

Find out the requirements, deadlines, and. Learn how to file vat returns electronically through the fta portal and pay your vat liability. Any business or individual registered for vat in the uae, with a valid trn (tax registration number), must file vat. Once you have registered for vat in the uae, you are required to file your vat return and.

Filing Vat Return in UAE Vat Return UAE How to file VAT Return in

Learn how to file vat returns electronically through the fta portal and pay your vat liability. Find out the requirements, deadlines, and. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Any business or individual registered for vat in the uae, with a valid.

Any Business Or Individual Registered For Vat In The Uae, With A Valid Trn (Tax Registration Number), Must File Vat.

Learn how to file vat returns electronically through the fta portal and pay your vat liability. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Find out the requirements, deadlines, and.