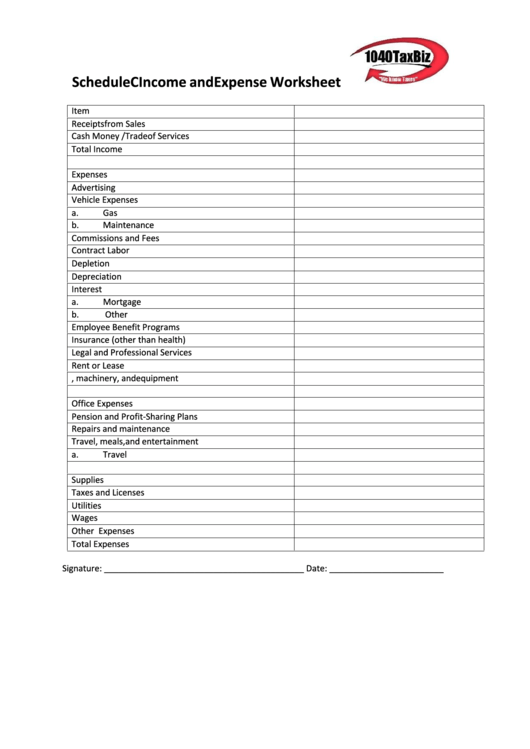

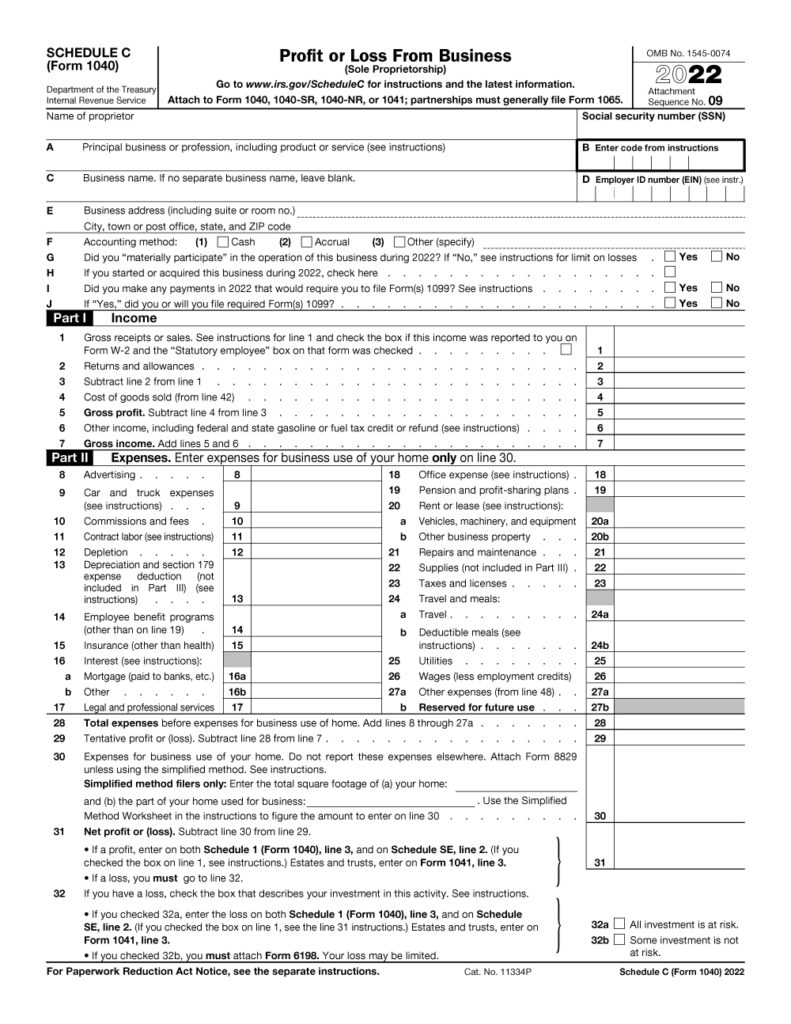

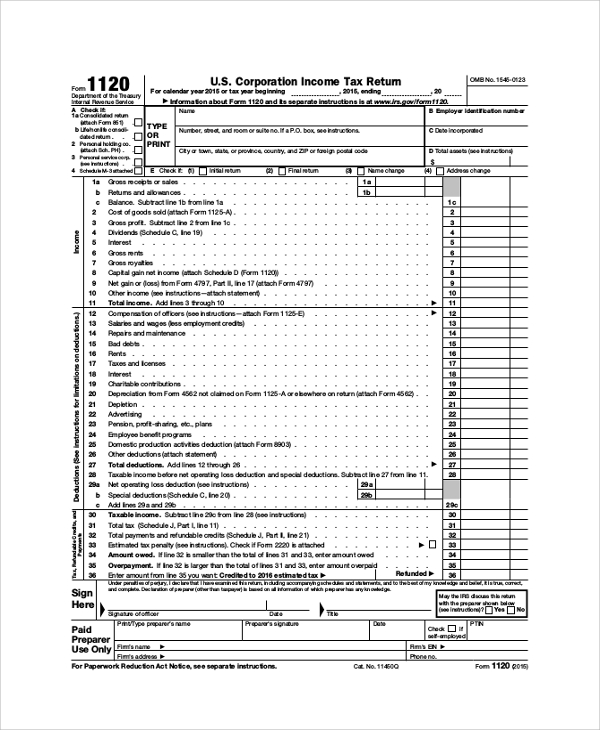

Free Printable Schedule C Worksheet 2023 - 2023 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. • if you checked 32a, enter the loss on both. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. If you have a loss, check the box that describes your investment in this activity. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562.

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. 2023 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. • if you checked 32a, enter the loss on both. If you have a loss, check the box that describes your investment in this activity.

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. • if you checked 32a, enter the loss on both. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. 2023 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. If you have a loss, check the box that describes your investment in this activity.

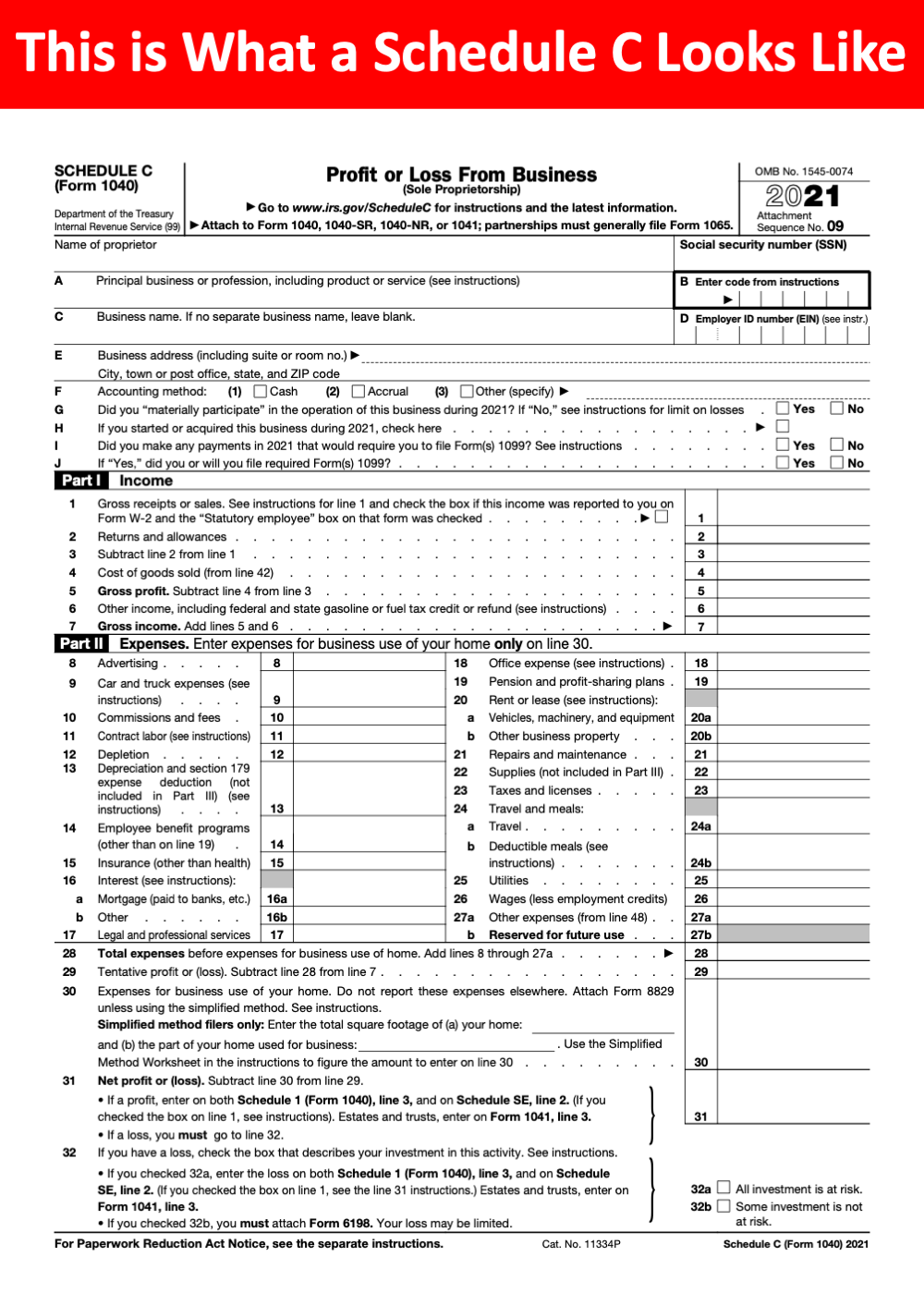

Printable Schedule C 2023

If you have a loss, check the box that describes your investment in this activity. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. 2023 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both.

Schedule C Worksheet 2021

If you have a loss, check the box that describes your investment in this activity. 2023 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If claimed, business.

2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. 2023 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. If you have a loss, check the box that describes your investment in this.

Printable Schedule C 2023

If you have a loss, check the box that describes your investment in this activity. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. Schedule.

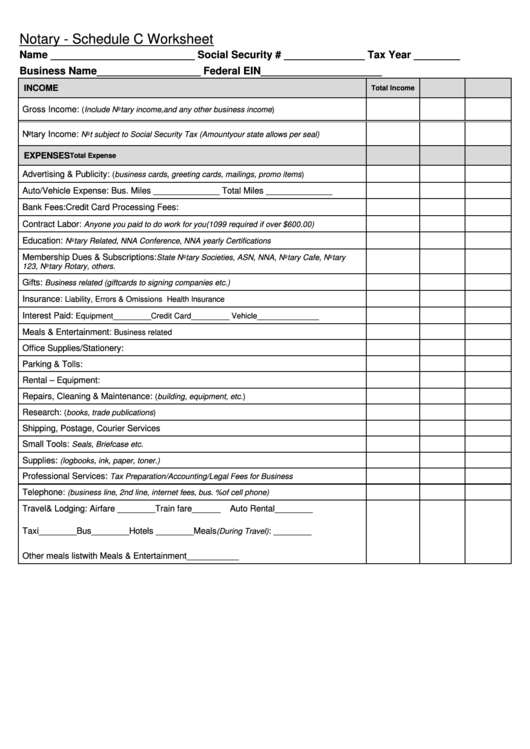

Fillable Online Schedule C Worksheet.docx Fax Email Print pdfFiller

If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562. • if you checked 32a, enter the loss on both. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. If you have a loss, check.

Schedule C 2023 Form Printable Forms Free Online

If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. If claimed, business miles can be found on either line 44a of the schedule c, or on line.

Schedule C Simplified Method Worksheet

2023 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have.

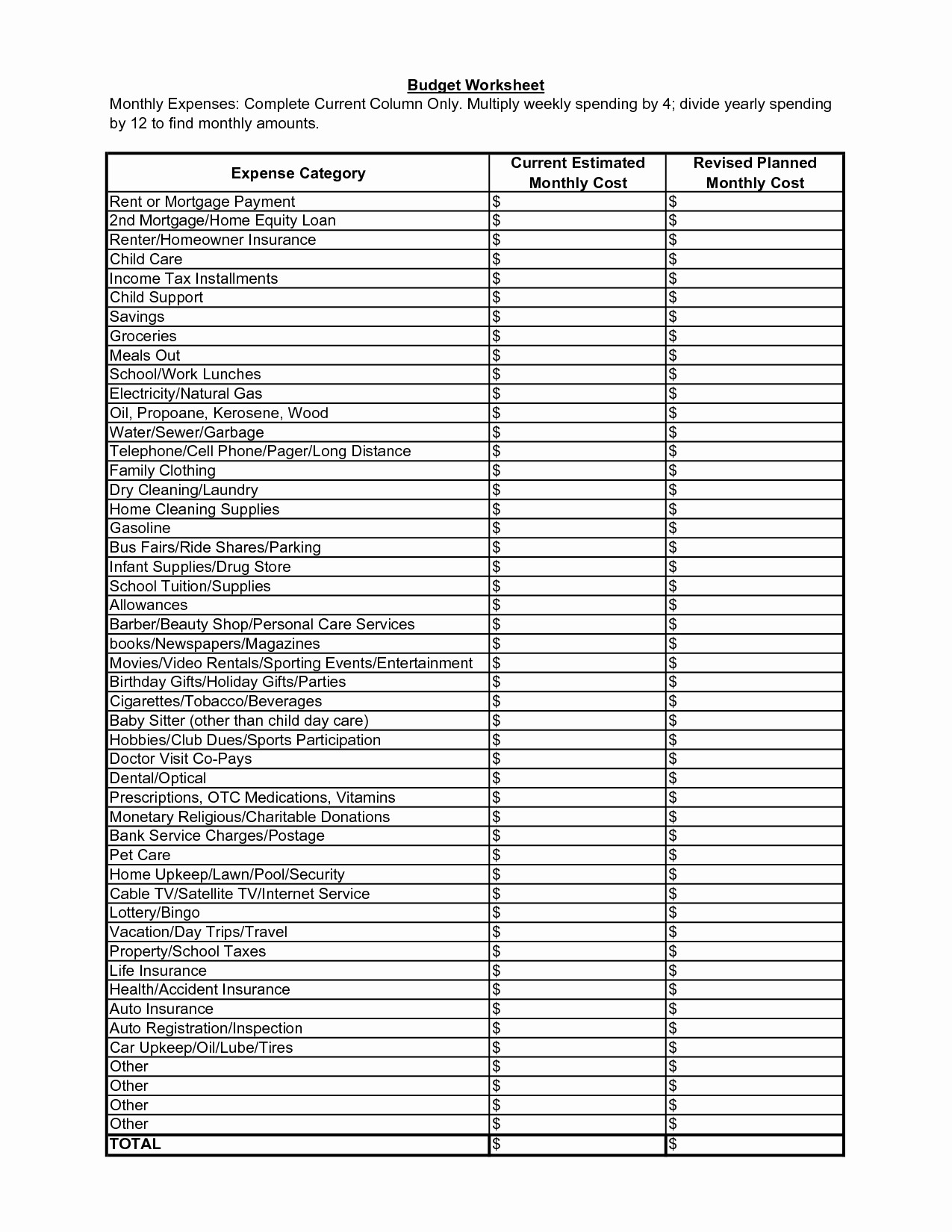

Schedule C Expenses Worksheet 2023

If you have a loss, check the box that describes your investment in this activity. 2023 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in.

Schedule C 1040 Form 2025 Pdf Kelley J. Fortune

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. 2023 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. • if you checked 32a, enter the loss on both. Schedule c worksheet for self employed businesses and/or.

Printable Schedule C

If you have a loss, check the box that describes your investment in this activity. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,. Schedule c worksheet for self.

Schedule C Worksheet For Self Employed Businesses And/Or Independent Contractors Irs Requires We Have On File To Support All Schedule.

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. • if you checked 32a, enter the loss on both. 2023 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. If claimed, business miles can be found on either line 44a of the schedule c, or on line 30 of form 4562.

If You Have A Loss, Check The Box That Describes Your Investment In This Activity.

If you purchased any business assets (furniture, equipment, vehicles, real estate, etc.) or converted any personal assets to business use in 2023,.