Federal Tax Form Schedule C 2023 Printable - This essential form also helps. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Click here to go to the home page.

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Click here to go to the home page. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. This essential form also helps.

This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Click here to go to the home page.

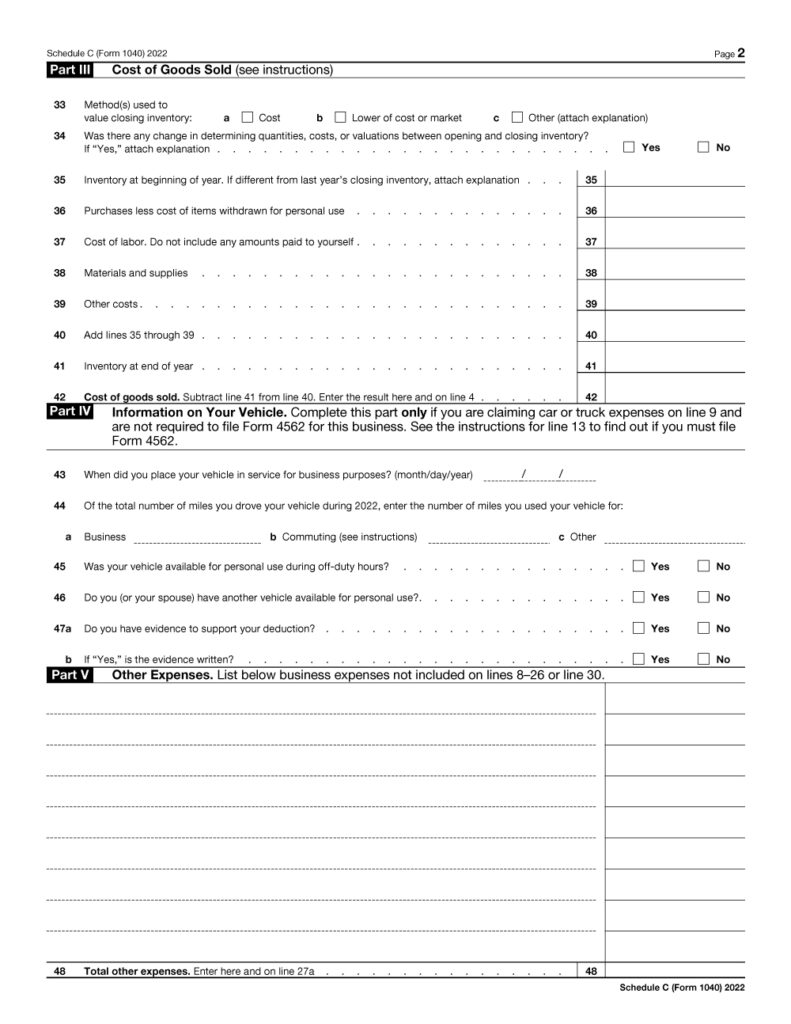

Tax Return 2023 Chart Printable Forms Free Online

Click here to go to the home page. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Maximize your business deductions and accurately calculate your.

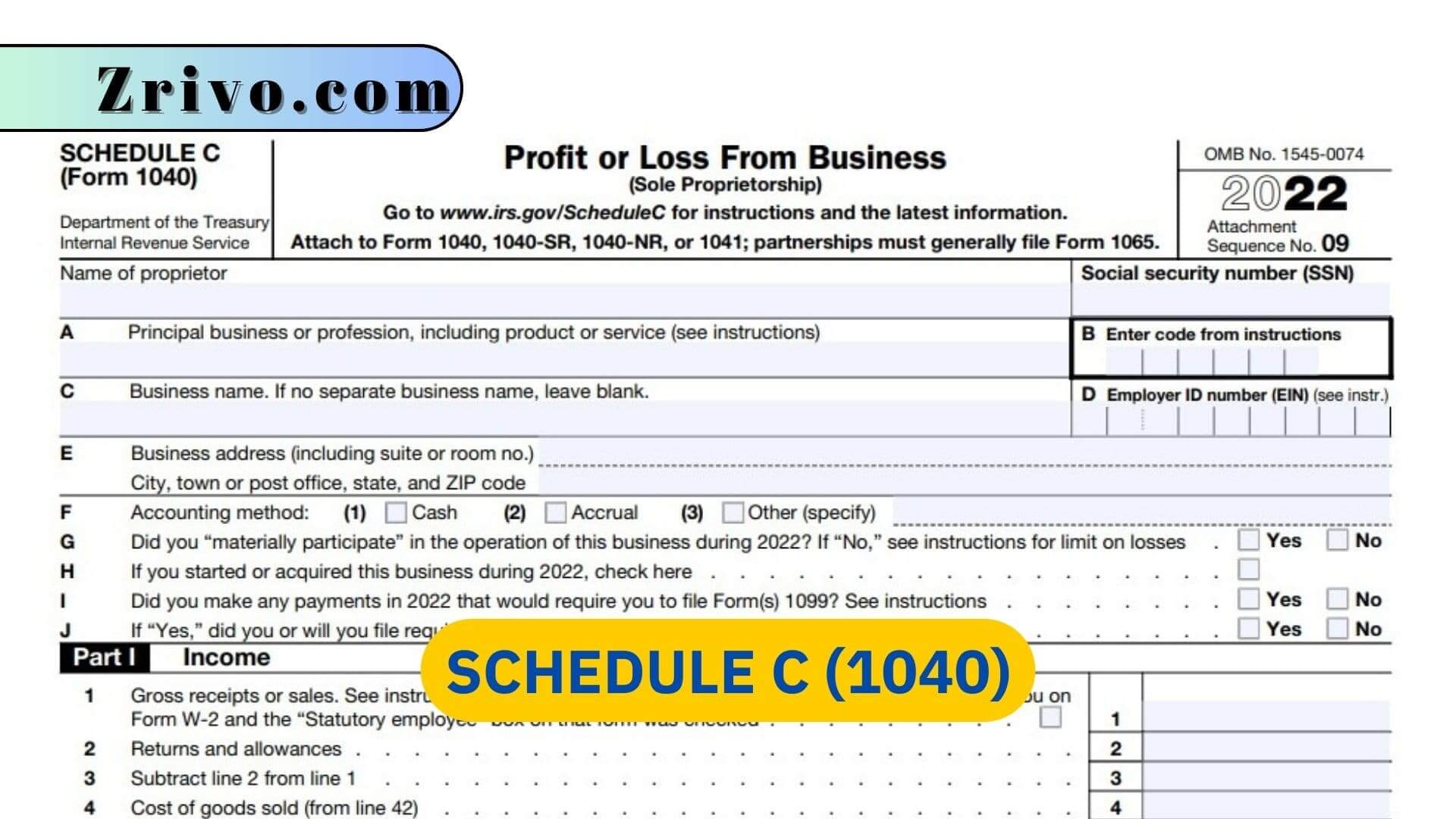

Schedule C 2023 Form Printable Forms Free Online

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Maximize your business deductions and accurately calculate your profit or loss with.

Printable Schedule C

Click here to go to the home page. This essential form also helps. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Schedule c (form 1040) is used to report income or.

Schedule C (Form 1040) 2023 Instructions

This essential form also helps. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Use schedule c to report income or loss from a business or profession in which you were the sole.

Download Fillable Schedule C Form

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Click here to go.

2023 Schedule C Form Printable Forms Free Online

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c..

Schedule C (1040) 2023 2024

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. This essential form also helps. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Click here to go to the home page. Information about schedule c (form 1040), profit or.

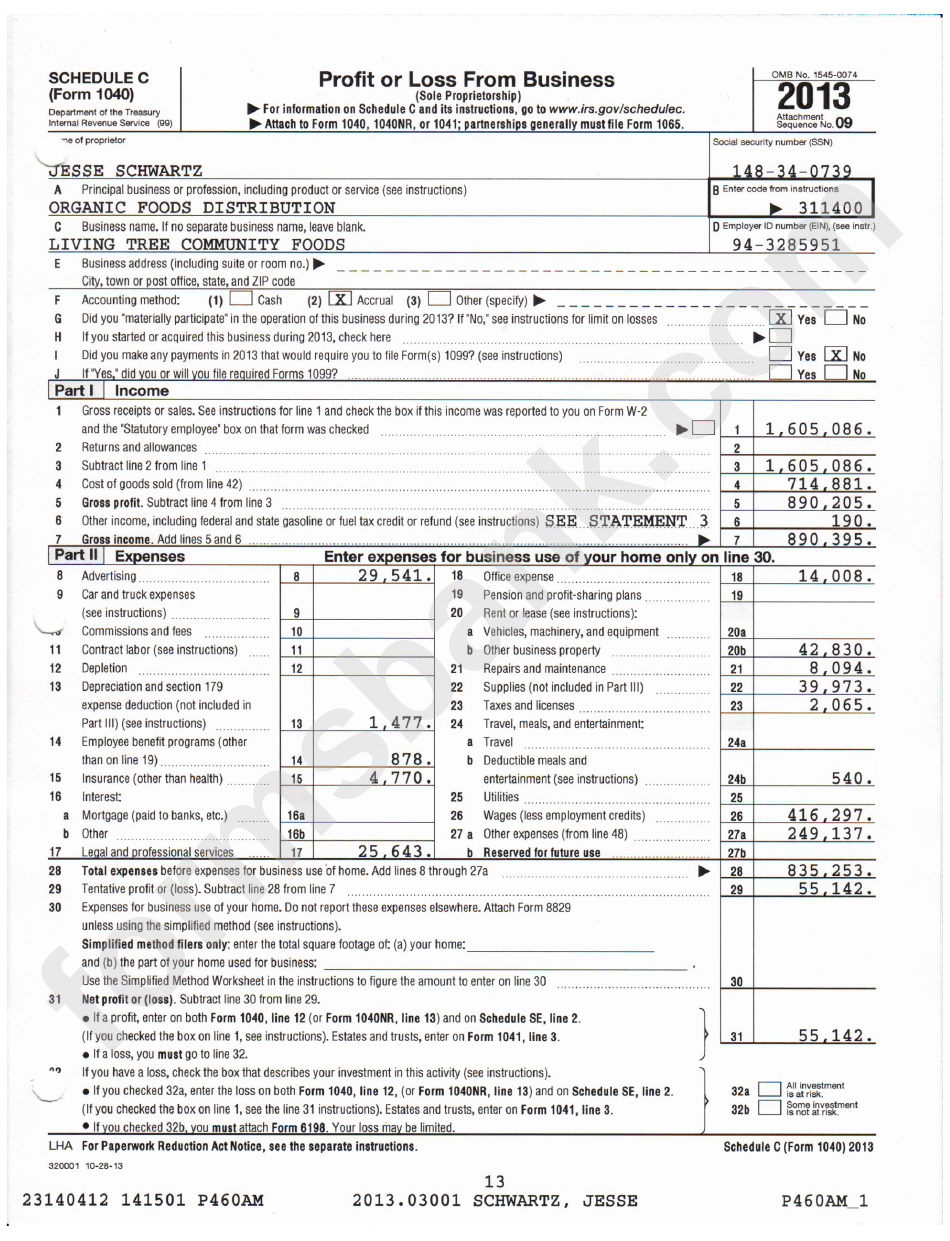

Form 1040 Schedule C Sample Profit Or Loss From Busin vrogue.co

Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. This essential form also helps. Click here to go to the home page. Information about schedule c (form 1040), profit or loss from business,.

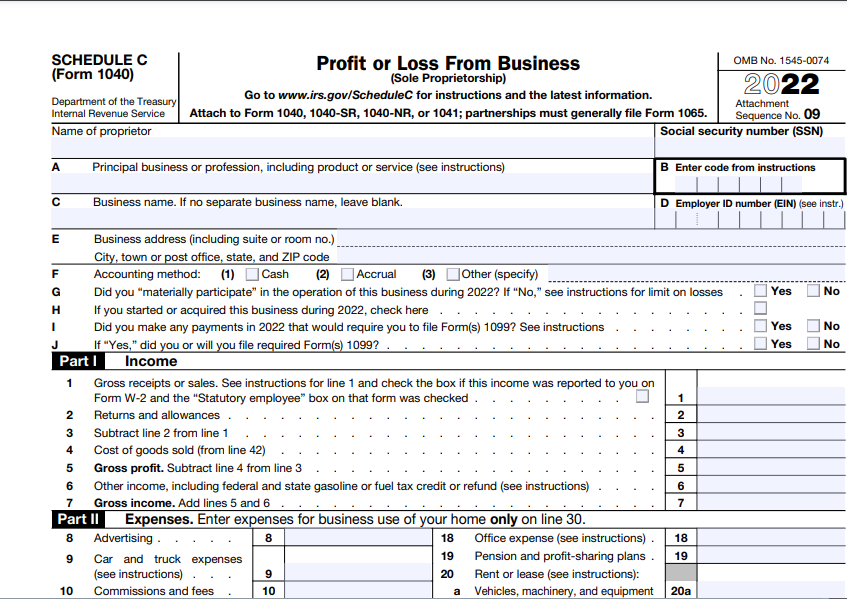

2025 Form 1040 Schedule C Patricia D Sampson

Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. This essential form also helps. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Use schedule c to report income or loss from a business or profession in which you were the sole.

IRS Form 1040 Schedule C. Profit or Loss From Business Forms Docs

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Click here to go to the home page. Maximize your business deductions and accurately calculate your.

Schedule C (Form 1040) Is Used To Report Income Or Loss From A Business Operated As A Sole Proprietorship.

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Click here to go to the home page.