Employee Salary Pay Slip - Easily customize and generate professional. Easily track pto & morediy payroll Download a free employee salary slip template in excel, word, and pdf formats. A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions. Download a free and fully customizable payslip templates in word, excel and pdf for your employees.

Download a free employee salary slip template in excel, word, and pdf formats. Easily track pto & morediy payroll Download a free and fully customizable payslip templates in word, excel and pdf for your employees. Easily customize and generate professional. A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions.

A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions. Easily customize and generate professional. Easily track pto & morediy payroll Download a free employee salary slip template in excel, word, and pdf formats. Download a free and fully customizable payslip templates in word, excel and pdf for your employees.

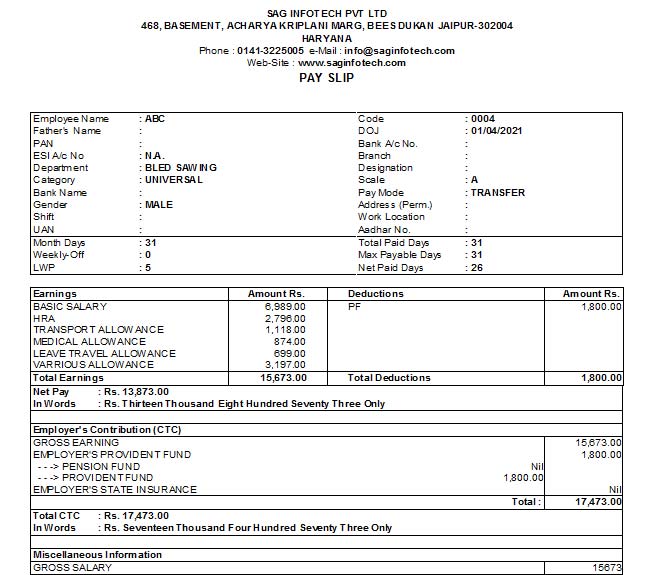

Understanding the Salary Slip Pay Slip Format, Download, Components

Download a free employee salary slip template in excel, word, and pdf formats. A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions. Easily customize and generate professional. Download a free and fully customizable payslip templates in word, excel and pdf for your employees. Easily track pto & morediy payroll

Salary Slip Template In Excel

A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions. Download a free and fully customizable payslip templates in word, excel and pdf for your employees. Download a free employee salary slip template in excel, word, and pdf formats. Easily customize and generate professional. Easily track pto & morediy payroll

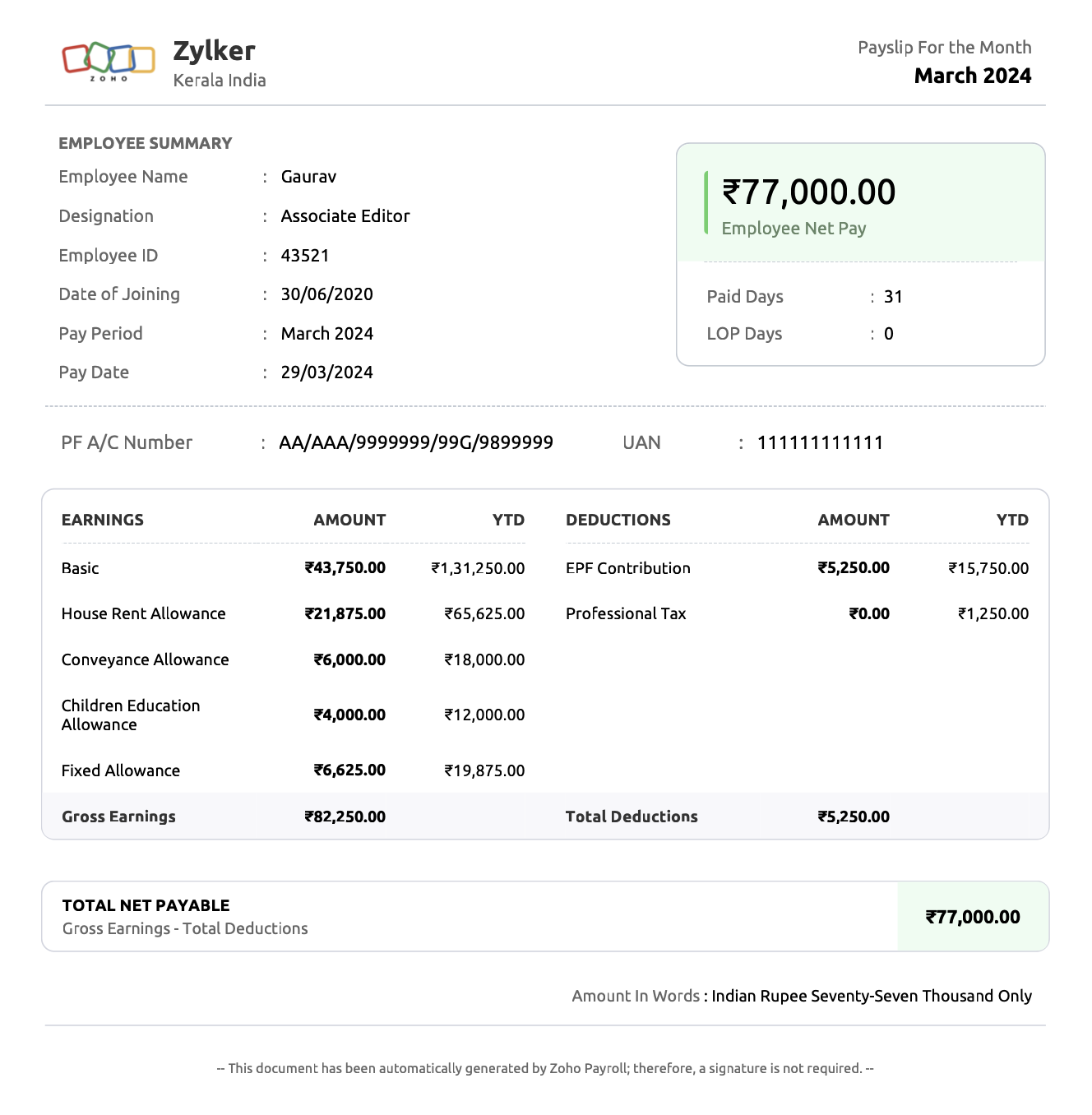

What is salary slip or payslip? Format & components Zoho Payroll

Easily customize and generate professional. Download a free and fully customizable payslip templates in word, excel and pdf for your employees. Download a free employee salary slip template in excel, word, and pdf formats. Easily track pto & morediy payroll A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions.

Salary Slip Format In Excel, Word, And PDF Download

Easily customize and generate professional. Easily track pto & morediy payroll Download a free and fully customizable payslip templates in word, excel and pdf for your employees. A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions. Download a free employee salary slip template in excel, word, and pdf formats.

Earning Statement Generator Salary Pay Slip Template for Salaried

Download a free employee salary slip template in excel, word, and pdf formats. Easily track pto & morediy payroll Download a free and fully customizable payslip templates in word, excel and pdf for your employees. A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions. Easily customize and generate professional.

EXCEL of Simple Salary Slip.xlsx WPS Free Templates

A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions. Download a free employee salary slip template in excel, word, and pdf formats. Easily customize and generate professional. Easily track pto & morediy payroll Download a free and fully customizable payslip templates in word, excel and pdf for your employees.

All About Salary Slip with Format and Its Important Parts

Download a free employee salary slip template in excel, word, and pdf formats. A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions. Easily track pto & morediy payroll Easily customize and generate professional. Download a free and fully customizable payslip templates in word, excel and pdf for your employees.

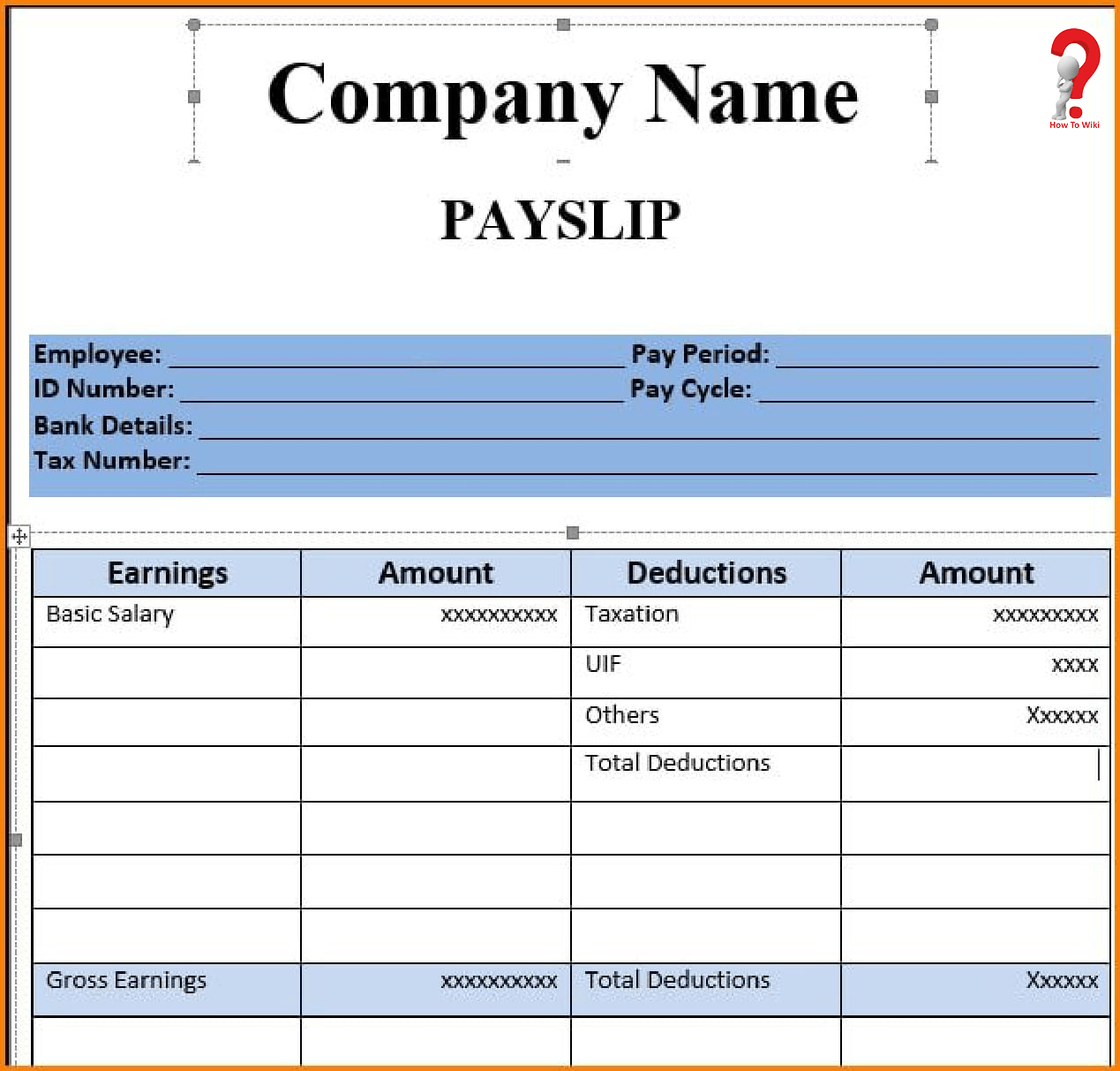

How To Make Salary Slip Format in PDF, Excel, Word

Download a free employee salary slip template in excel, word, and pdf formats. A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions. Download a free and fully customizable payslip templates in word, excel and pdf for your employees. Easily customize and generate professional. Easily track pto & morediy payroll

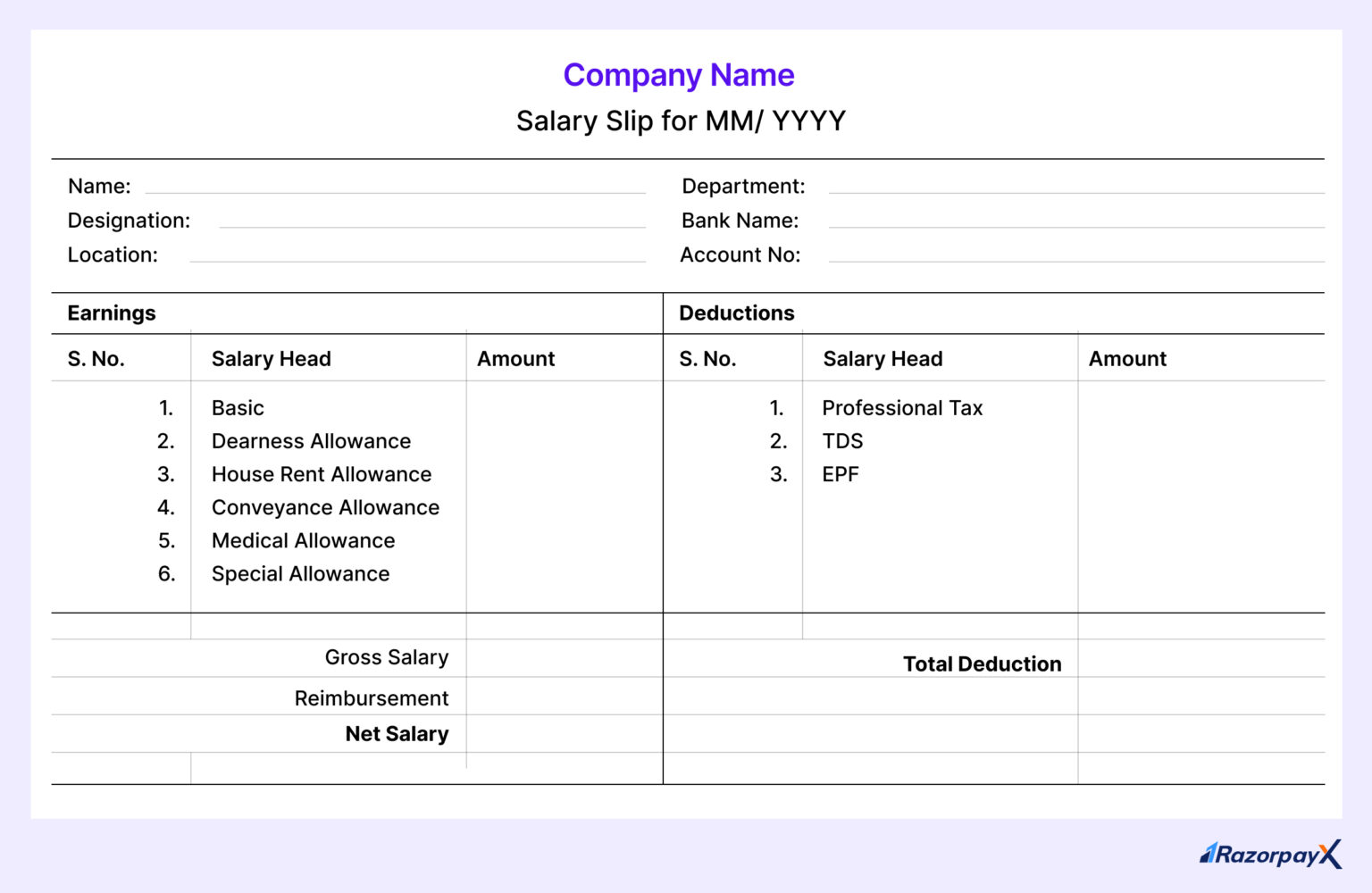

Salary Slip or Payslip Meaning, Format, Components RazorpayX

Download a free and fully customizable payslip templates in word, excel and pdf for your employees. Easily customize and generate professional. A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions. Download a free employee salary slip template in excel, word, and pdf formats. Easily track pto & morediy payroll

Sccl employee salary slip notesxaser

Easily track pto & morediy payroll Easily customize and generate professional. Download a free employee salary slip template in excel, word, and pdf formats. A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions. Download a free and fully customizable payslip templates in word, excel and pdf for your employees.

Easily Customize And Generate Professional.

Download a free and fully customizable payslip templates in word, excel and pdf for your employees. Easily track pto & morediy payroll Download a free employee salary slip template in excel, word, and pdf formats. A paystub is a simple document issued by an employer that reflects an employee's earnings and pay deductions.

.png)