Easiest Way To Track Small Business Expenses - In this article, we're going to chat about the best expense tracking tools for small businesses in 2024. Free payroll servicetime and attendance Free payroll servicetime and attendance Follow the steps below to properly track your business expenses. We'll explore what makes each one tick. The first step to keep track of business expenses is to create a.

In this article, we're going to chat about the best expense tracking tools for small businesses in 2024. Free payroll servicetime and attendance Free payroll servicetime and attendance The first step to keep track of business expenses is to create a. Follow the steps below to properly track your business expenses. We'll explore what makes each one tick.

The first step to keep track of business expenses is to create a. Free payroll servicetime and attendance We'll explore what makes each one tick. In this article, we're going to chat about the best expense tracking tools for small businesses in 2024. Free payroll servicetime and attendance Follow the steps below to properly track your business expenses.

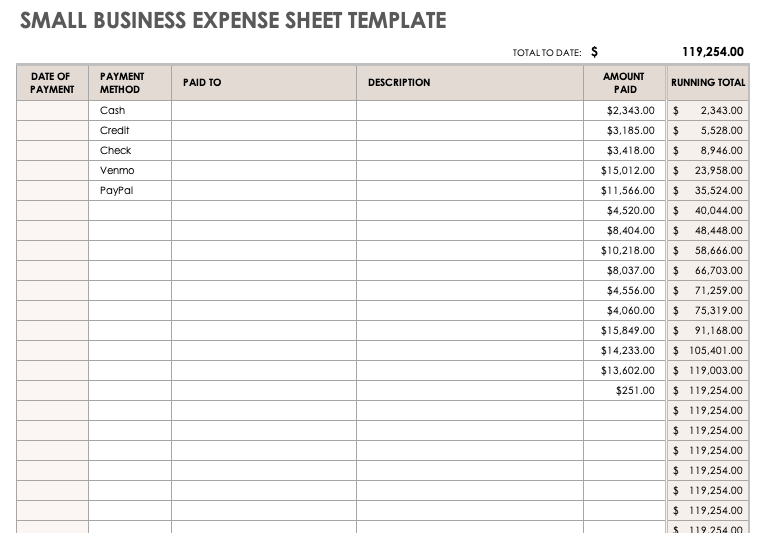

Free Small Business Expense Report Templates Smartsheet

We'll explore what makes each one tick. Free payroll servicetime and attendance Free payroll servicetime and attendance The first step to keep track of business expenses is to create a. Follow the steps below to properly track your business expenses.

Best ways to keep track of business expenses easily

Free payroll servicetime and attendance In this article, we're going to chat about the best expense tracking tools for small businesses in 2024. We'll explore what makes each one tick. The first step to keep track of business expenses is to create a. Free payroll servicetime and attendance

Free Small Business Expense Report Templates Smartsheet

In this article, we're going to chat about the best expense tracking tools for small businesses in 2024. Follow the steps below to properly track your business expenses. The first step to keep track of business expenses is to create a. Free payroll servicetime and attendance Free payroll servicetime and attendance

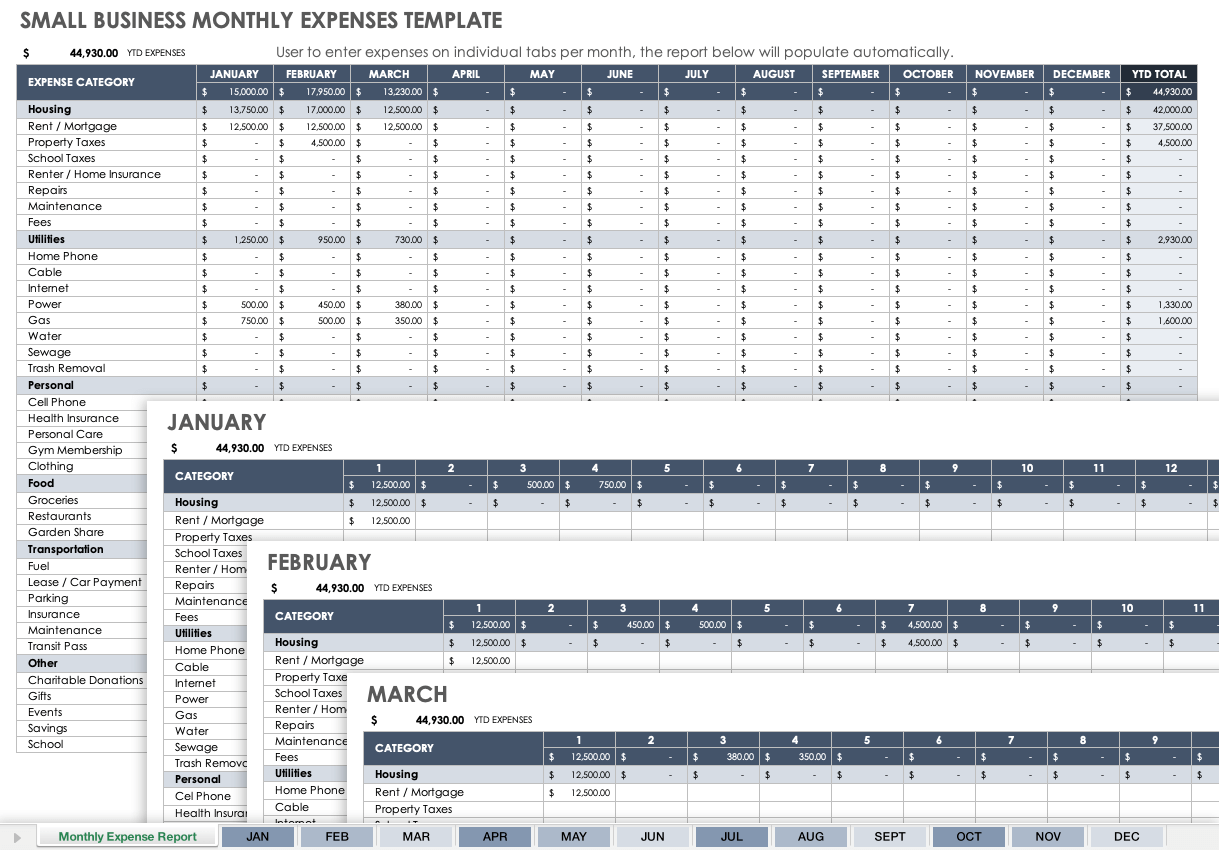

Easy Accounting Spreadsheet with Easy Ways To Track Small Business

Follow the steps below to properly track your business expenses. In this article, we're going to chat about the best expense tracking tools for small businesses in 2024. The first step to keep track of business expenses is to create a. We'll explore what makes each one tick. Free payroll servicetime and attendance

How To Track Small Business Expenses 4 Easy Steps

Free payroll servicetime and attendance The first step to keep track of business expenses is to create a. In this article, we're going to chat about the best expense tracking tools for small businesses in 2024. Free payroll servicetime and attendance We'll explore what makes each one tick.

How to Keep Track of Small Business Expenses in Excel (2 Ways)

In this article, we're going to chat about the best expense tracking tools for small businesses in 2024. We'll explore what makes each one tick. Follow the steps below to properly track your business expenses. Free payroll servicetime and attendance The first step to keep track of business expenses is to create a.

Free Small Business Expense Report Templates Smartsheet

Follow the steps below to properly track your business expenses. Free payroll servicetime and attendance In this article, we're going to chat about the best expense tracking tools for small businesses in 2024. Free payroll servicetime and attendance We'll explore what makes each one tick.

How To Track Your Small Business Expenses (7 Easy Tips)

In this article, we're going to chat about the best expense tracking tools for small businesses in 2024. The first step to keep track of business expenses is to create a. We'll explore what makes each one tick. Free payroll servicetime and attendance Follow the steps below to properly track your business expenses.

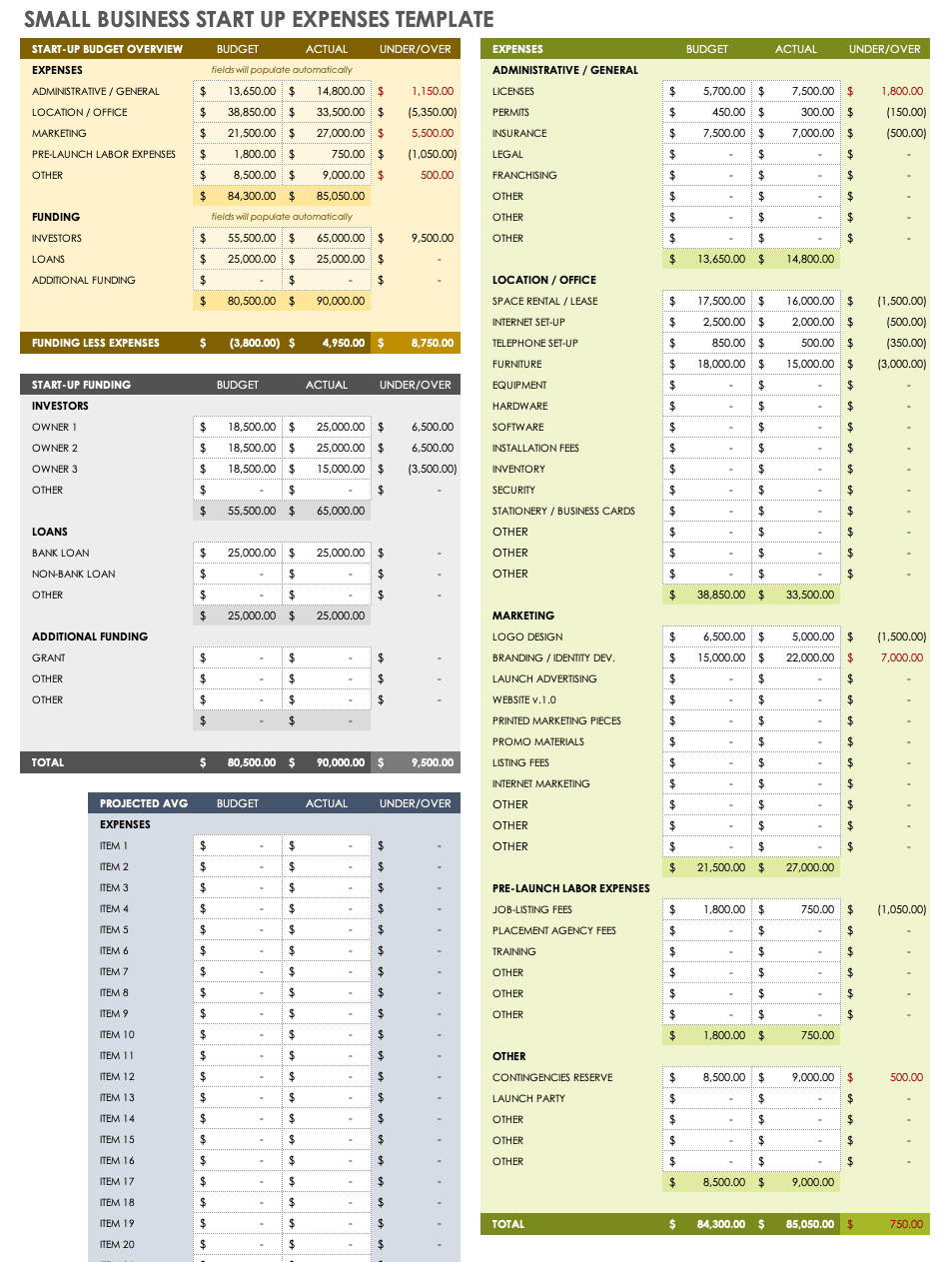

Small Business Expenses Spreadsheet Template Sampletemplate.my.id

In this article, we're going to chat about the best expense tracking tools for small businesses in 2024. Free payroll servicetime and attendance Free payroll servicetime and attendance We'll explore what makes each one tick. The first step to keep track of business expenses is to create a.

Business expense tracker small business expense tracker small

We'll explore what makes each one tick. Follow the steps below to properly track your business expenses. The first step to keep track of business expenses is to create a. Free payroll servicetime and attendance In this article, we're going to chat about the best expense tracking tools for small businesses in 2024.

In This Article, We're Going To Chat About The Best Expense Tracking Tools For Small Businesses In 2024.

Free payroll servicetime and attendance Follow the steps below to properly track your business expenses. Free payroll servicetime and attendance The first step to keep track of business expenses is to create a.