Discounted Cash Flow Formula - Learn how to use the discounted cash flow method to determine the fair value of most types of investments, such as businesses, projects,. Learn how to use the discounted cash flow (dcf) formula to value a security or a project by discounting future expected cash flows. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of. Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a discount rate. What is discounted cash flow (dcf)?

Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a discount rate. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of. Learn how to use the discounted cash flow method to determine the fair value of most types of investments, such as businesses, projects,. What is discounted cash flow (dcf)? Learn how to use the discounted cash flow (dcf) formula to value a security or a project by discounting future expected cash flows.

Learn how to use the discounted cash flow (dcf) formula to value a security or a project by discounting future expected cash flows. Learn how to use the discounted cash flow method to determine the fair value of most types of investments, such as businesses, projects,. Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a discount rate. What is discounted cash flow (dcf)? Discounted cash flow (dcf) is a financial valuation method used to estimate the value of.

Discounted Cash Flow Model in Excel Solving Finance

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of. Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a discount rate. Learn how to use the discounted cash flow method to determine the fair value of most types of investments, such as businesses, projects,. What is discounted cash.

DCF Model Excel Free Template Macabacus

What is discounted cash flow (dcf)? Discounted cash flow (dcf) is a financial valuation method used to estimate the value of. Learn how to use the discounted cash flow method to determine the fair value of most types of investments, such as businesses, projects,. Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a.

Discounted Cash Flow Formula Intrinsic Value Stock Analysis Method

What is discounted cash flow (dcf)? Learn how to use the discounted cash flow (dcf) formula to value a security or a project by discounting future expected cash flows. Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a discount rate. Learn how to use the discounted cash flow method to determine the fair.

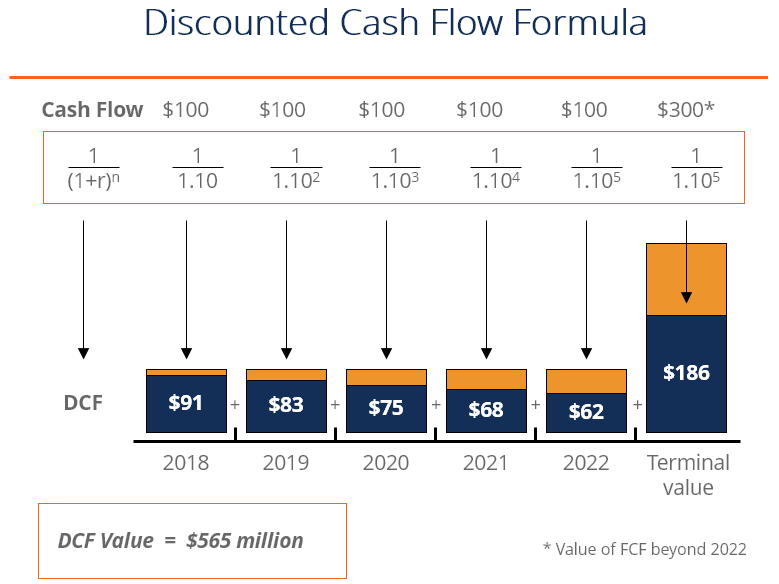

DCF Formula What Is It, Examples, How To Calculate, 52 OFF

Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a discount rate. What is discounted cash flow (dcf)? Learn how to use the discounted cash flow method to determine the fair value of most types of investments, such as businesses, projects,. Discounted cash flow (dcf) is a financial valuation method used to estimate the.

Discounted future cash flow calculator JohnAnnaleigh

What is discounted cash flow (dcf)? Discounted cash flow (dcf) is a financial valuation method used to estimate the value of. Learn how to use the discounted cash flow method to determine the fair value of most types of investments, such as businesses, projects,. Learn how to use the discounted cash flow (dcf) formula to value a security or a.

How to Apply Discounted Cash Flow Formula in Excel ExcelDemy

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of. Learn how to use the discounted cash flow (dcf) formula to value a security or a project by discounting future expected cash flows. What is discounted cash flow (dcf)? Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a.

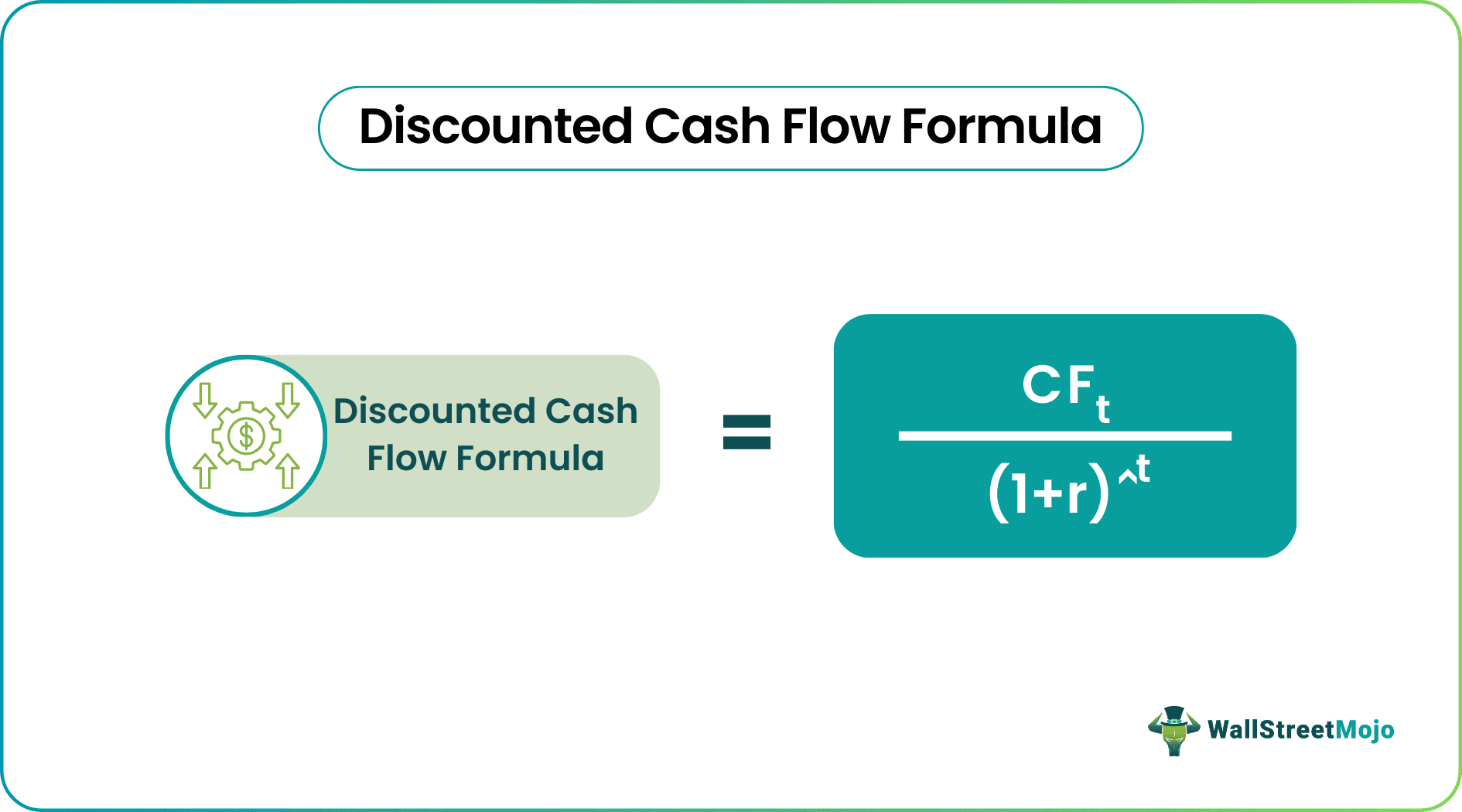

Discounted Cash Flow & its Importance

Learn how to use the discounted cash flow method to determine the fair value of most types of investments, such as businesses, projects,. Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a discount rate. Learn how to use the discounted cash flow (dcf) formula to value a security or a project by discounting.

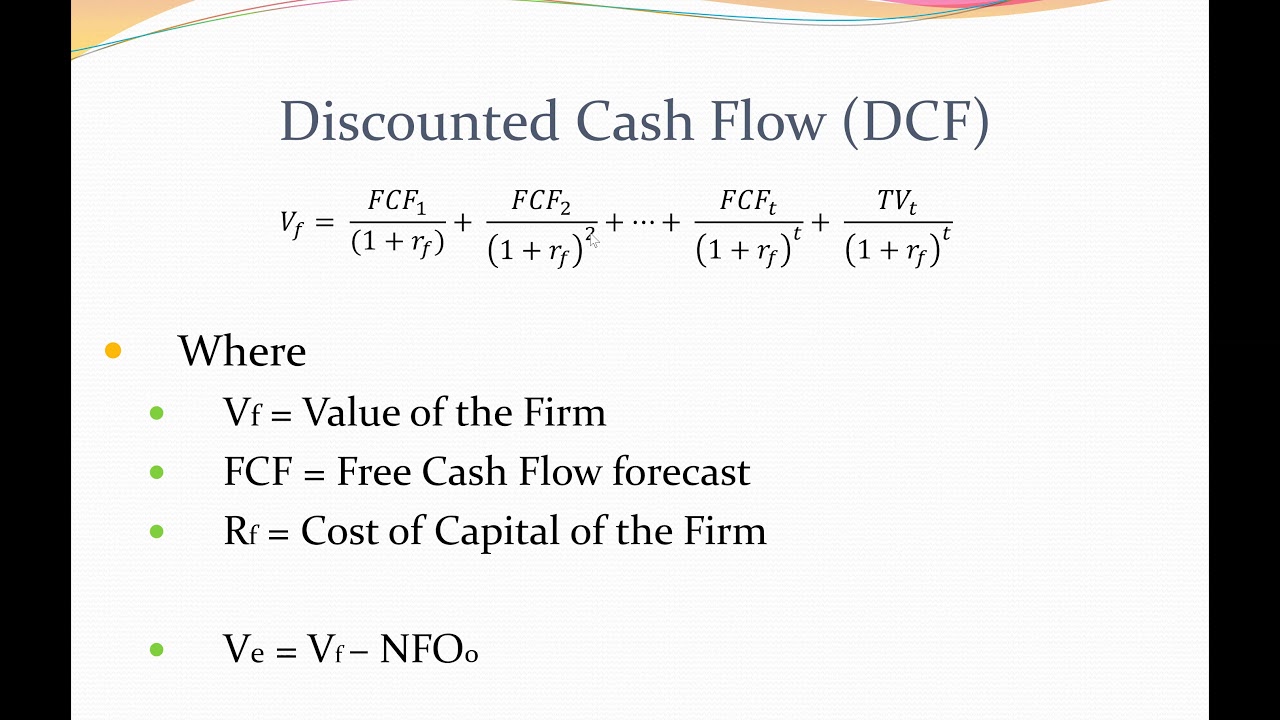

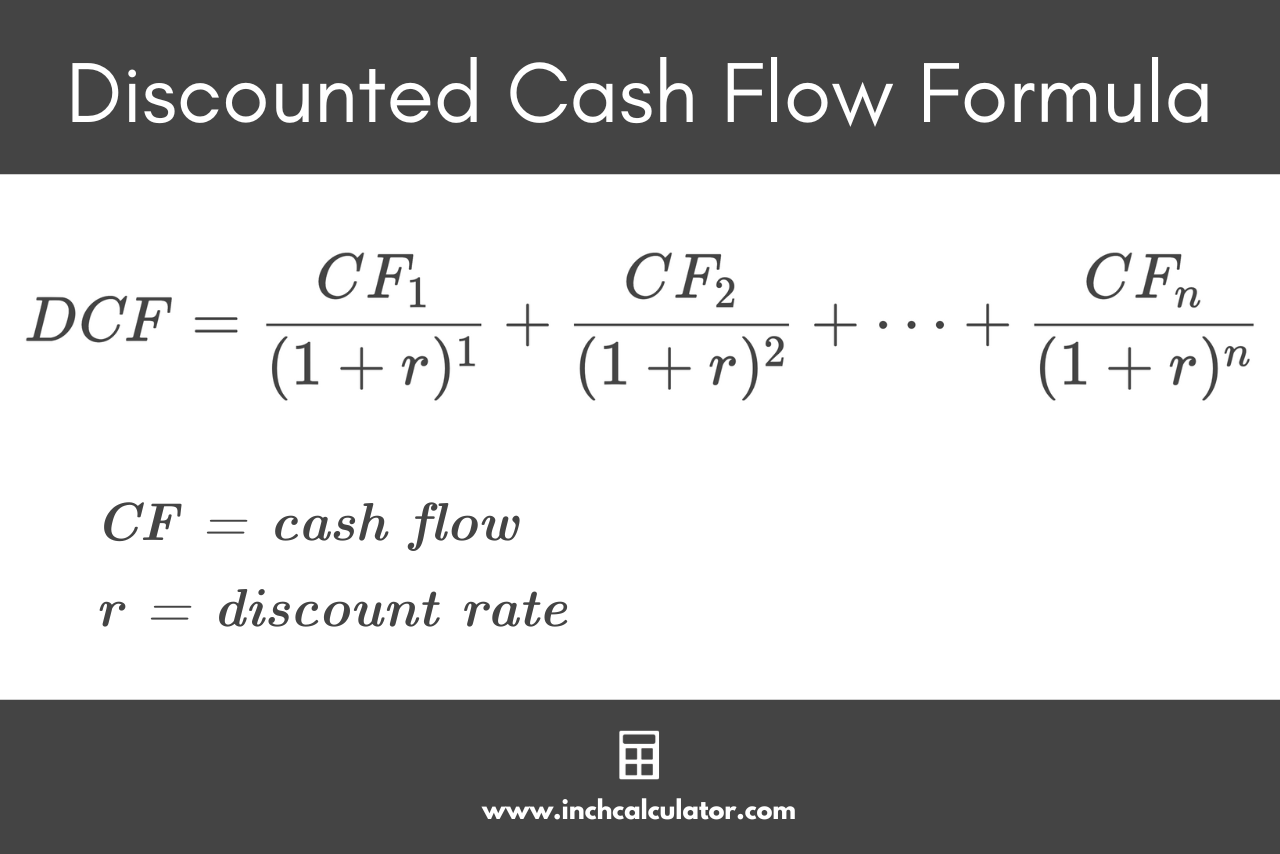

Discounted Cash Flow DCF Formula

Learn how to use the discounted cash flow (dcf) formula to value a security or a project by discounting future expected cash flows. What is discounted cash flow (dcf)? Discounted cash flow (dcf) is a financial valuation method used to estimate the value of. Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a.

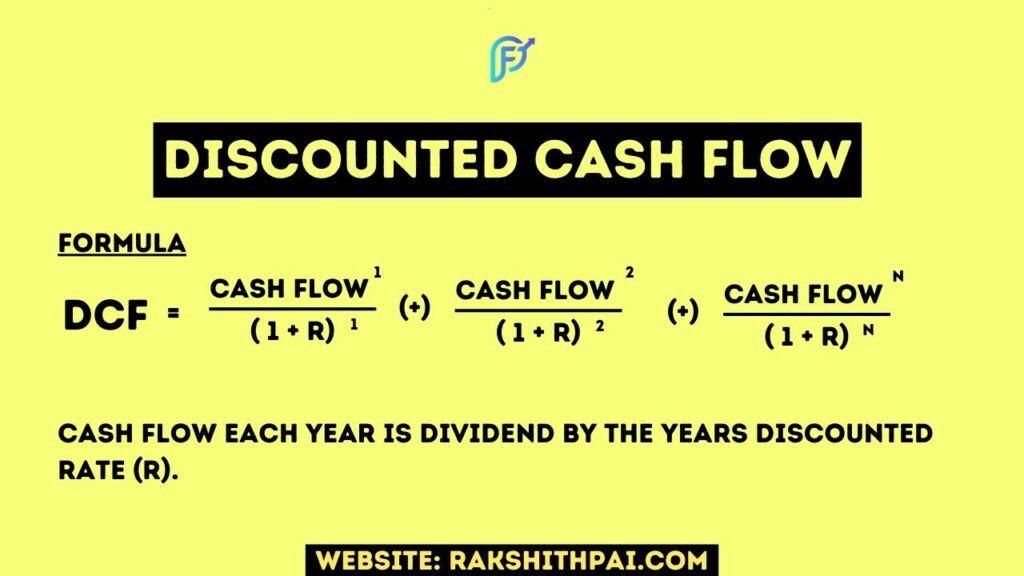

DCF Formula What Is It, Examples, How To Calculate

Learn how to use the discounted cash flow method to determine the fair value of most types of investments, such as businesses, projects,. Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a discount rate. Learn how to use the discounted cash flow (dcf) formula to value a security or a project by discounting.

Discounted Cash Flow Calculator Inch Calculator

Learn how to use the discounted cash flow (dcf) formula to value a security or a project by discounting future expected cash flows. What is discounted cash flow (dcf)? Discounted cash flow (dcf) is a financial valuation method used to estimate the value of. Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a.

What Is Discounted Cash Flow (Dcf)?

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of. Learn how to use the discounted cash flow method to determine the fair value of most types of investments, such as businesses, projects,. Discounted cash flow (dcf) analysis calculates the present value of expected future cash flows using a discount rate. Learn how to use the discounted cash flow (dcf) formula to value a security or a project by discounting future expected cash flows.