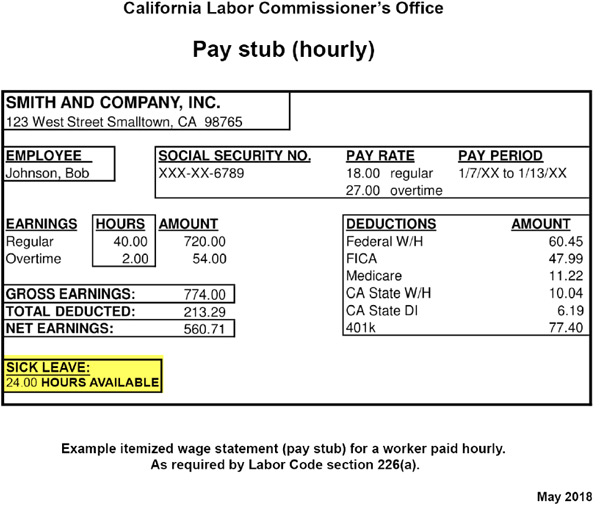

California Pay Slip Requirements - In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. Example itemized wage statement (pay stub) for a worker paid hourly. As required by labor code section 226(a). In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours.

Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Example itemized wage statement (pay stub) for a worker paid hourly. As required by labor code section 226(a). California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours.

In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. Example itemized wage statement (pay stub) for a worker paid hourly. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. As required by labor code section 226(a). California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours.

California Pay Stub Requirements 2025 Images References Sofia L Newman

In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Example itemized wage statement (pay stub) for a worker paid hourly. In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. California mandates detailed wage.

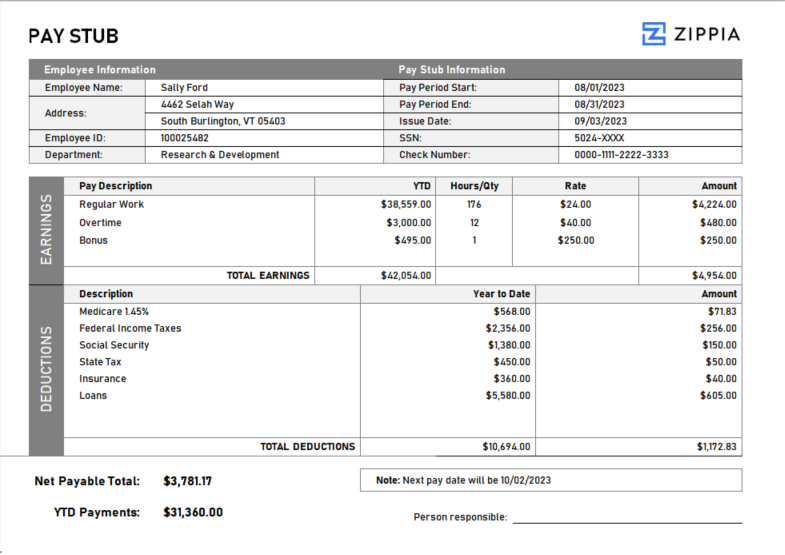

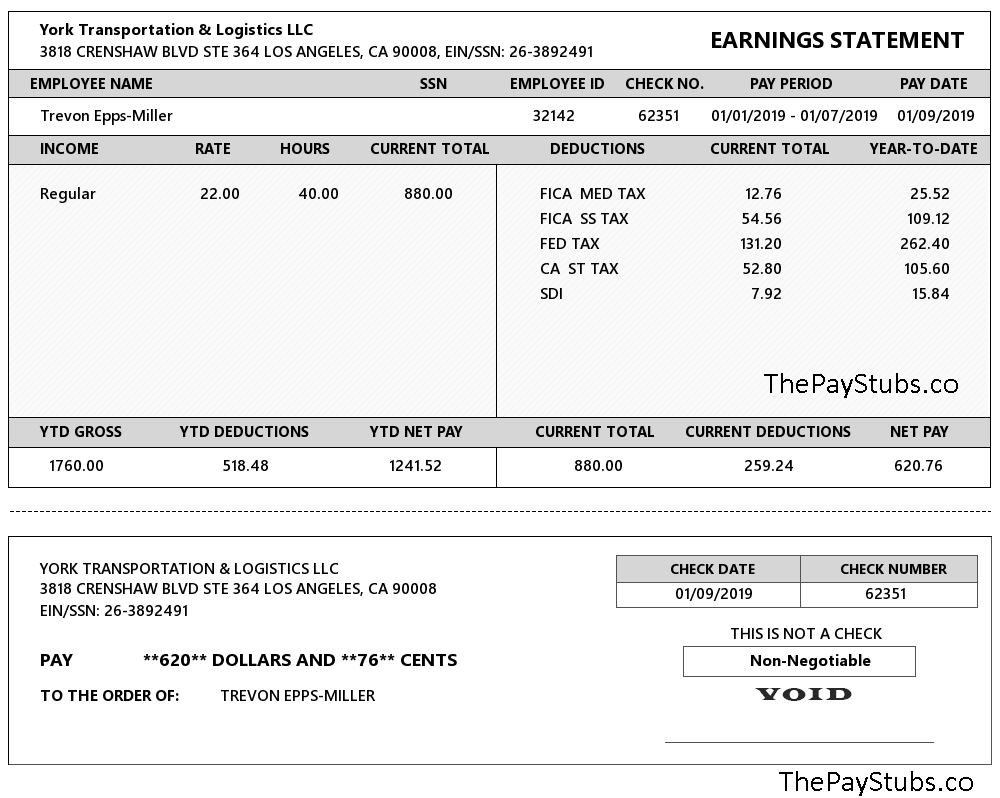

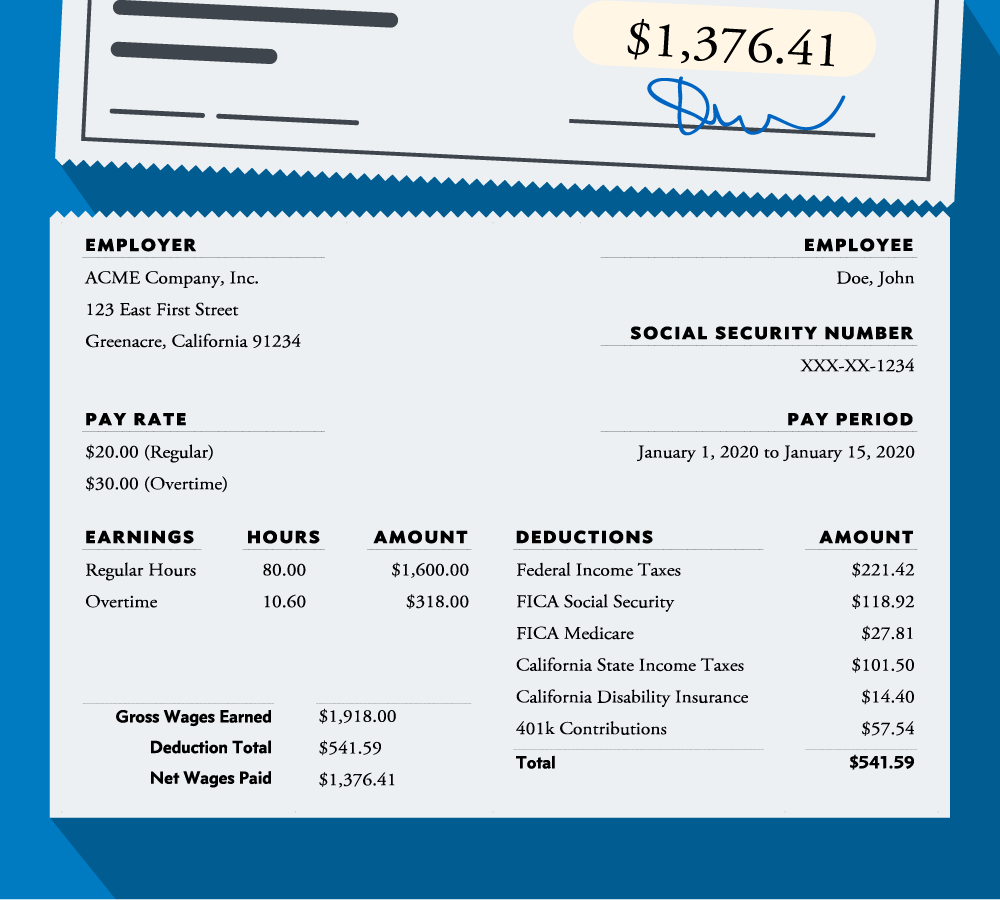

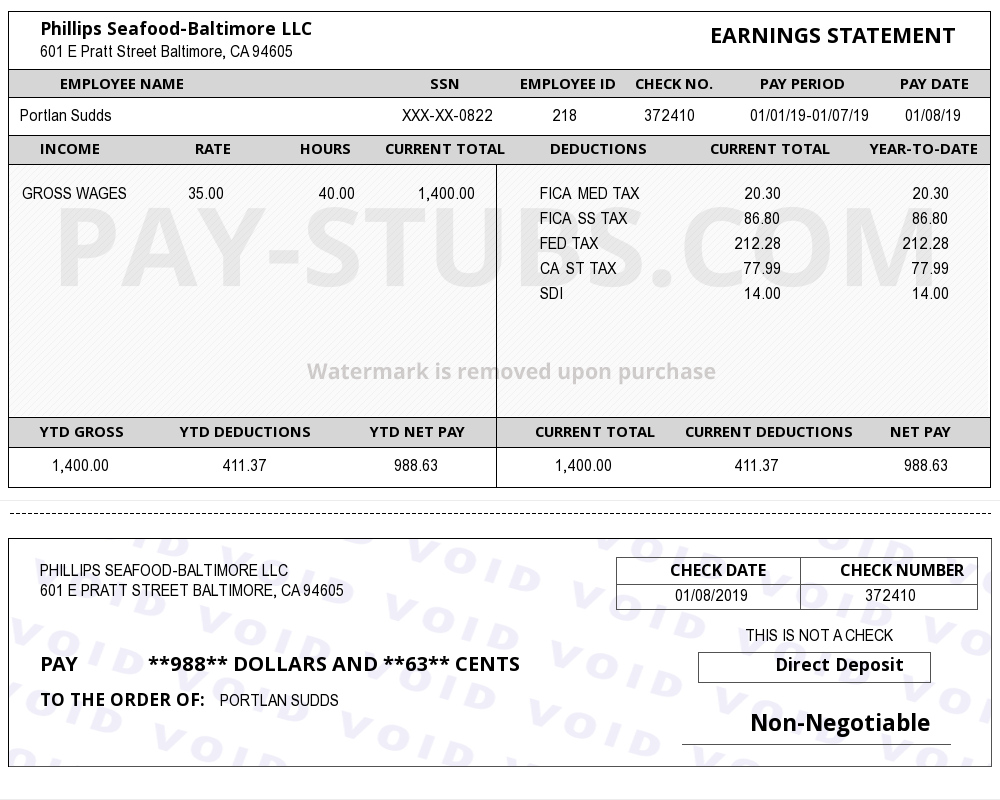

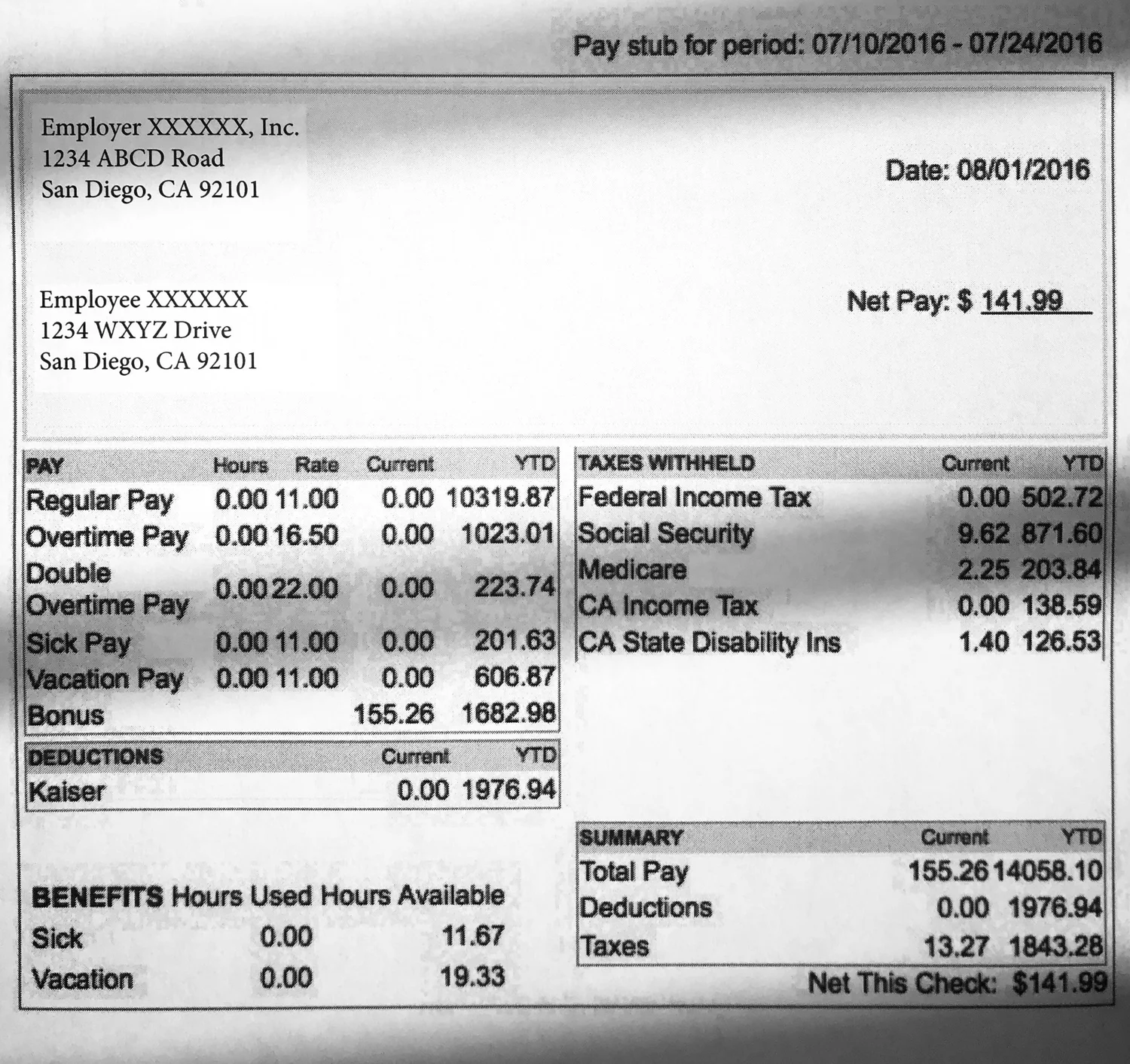

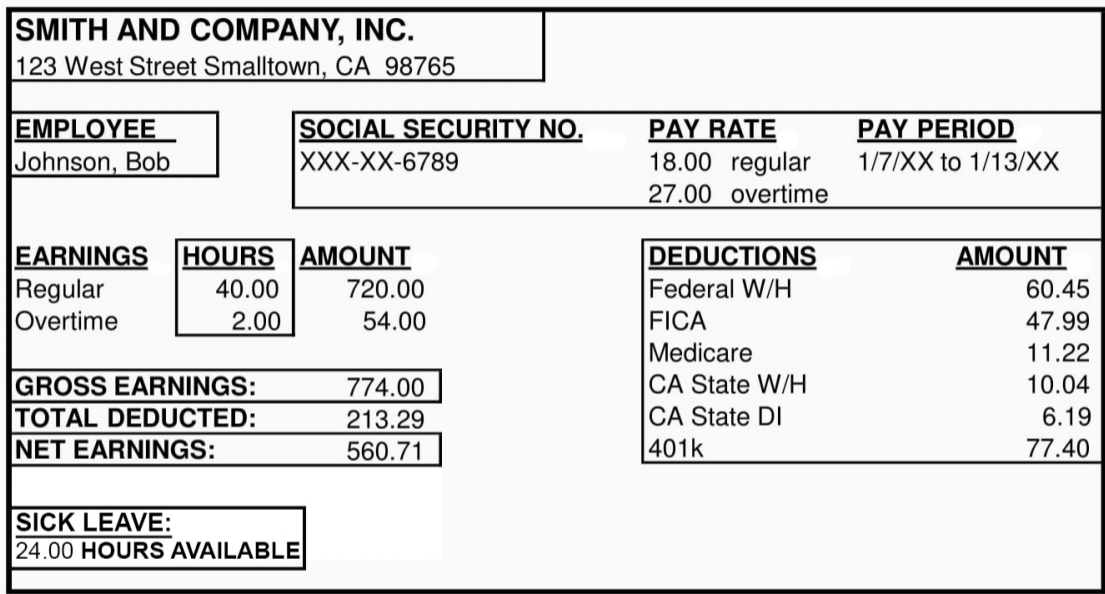

California Pay Stub Template

Example itemized wage statement (pay stub) for a worker paid hourly. In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. As required by labor code section 226(a). In california, wage statements, or pay stubs as they are more commonly known, must include specific details such.

California Pay Stub Template

In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and.

California Pay Stub Template

California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. As required by labor code section 226(a). In california, wages, with some exceptions (see table below), must be paid at least.

California Pay Stub Template

California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours. Example itemized wage statement (pay stub) for a worker paid hourly. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. In california, wage statements, or pay stubs as they are more commonly known, must.

California Pay Stub Template

In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. As required by labor code section 226(a). In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. Learn what california employers must include on wage.

Paystub Generator

In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Example itemized wage statement (pay stub) for a worker paid hourly. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. In california, wages, with some exceptions (see table below), must be.

California Paystub Law (2025) CA employer refuses to give paystub?

Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Example itemized wage statement (pay stub) for a worker paid hourly. In california, wages, with some exceptions (see table below), must be.

Check Stub

In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. As required by labor code section 226(a). Example itemized wage statement (pay stub) for a worker paid hourly. California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours. Learn what california.

California Pay Stub Template

As required by labor code section 226(a). Example itemized wage statement (pay stub) for a worker paid hourly. In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Learn what california employers must include on wage statements to ensure compliance, avoid penalties, and provide clear. In california, wages, with.

As Required By Labor Code Section 226(A).

In california, wage statements, or pay stubs as they are more commonly known, must include specific details such as the employer’s. Example itemized wage statement (pay stub) for a worker paid hourly. In california, wages, with some exceptions (see table below), must be paid at least twice during each calendar month on the days designated in. California mandates detailed wage statements for every pay period, including employer and employee information, pay period dates, hours.