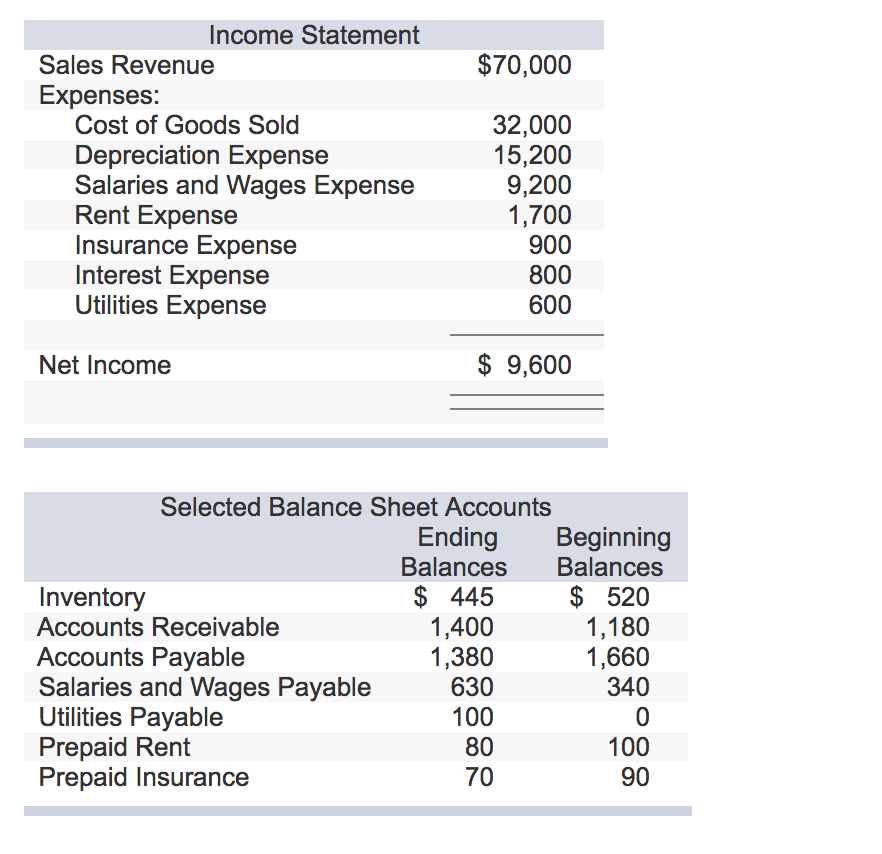

Balance Sheet Wages Payable - Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees. Salaries and wages payable are considered as a current liability on the balance sheet of the company. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. Wages payable is considered a current liability, since it is usually payable within the next 12 months. This means that it is. Download our mobile appbank reconciliation

This means that it is. Wages payable is considered a current liability, since it is usually payable within the next 12 months. Salaries and wages payable are considered as a current liability on the balance sheet of the company. Download our mobile appbank reconciliation Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees.

This means that it is. Wages payable is considered a current liability, since it is usually payable within the next 12 months. Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. Download our mobile appbank reconciliation Salaries and wages payable are considered as a current liability on the balance sheet of the company.

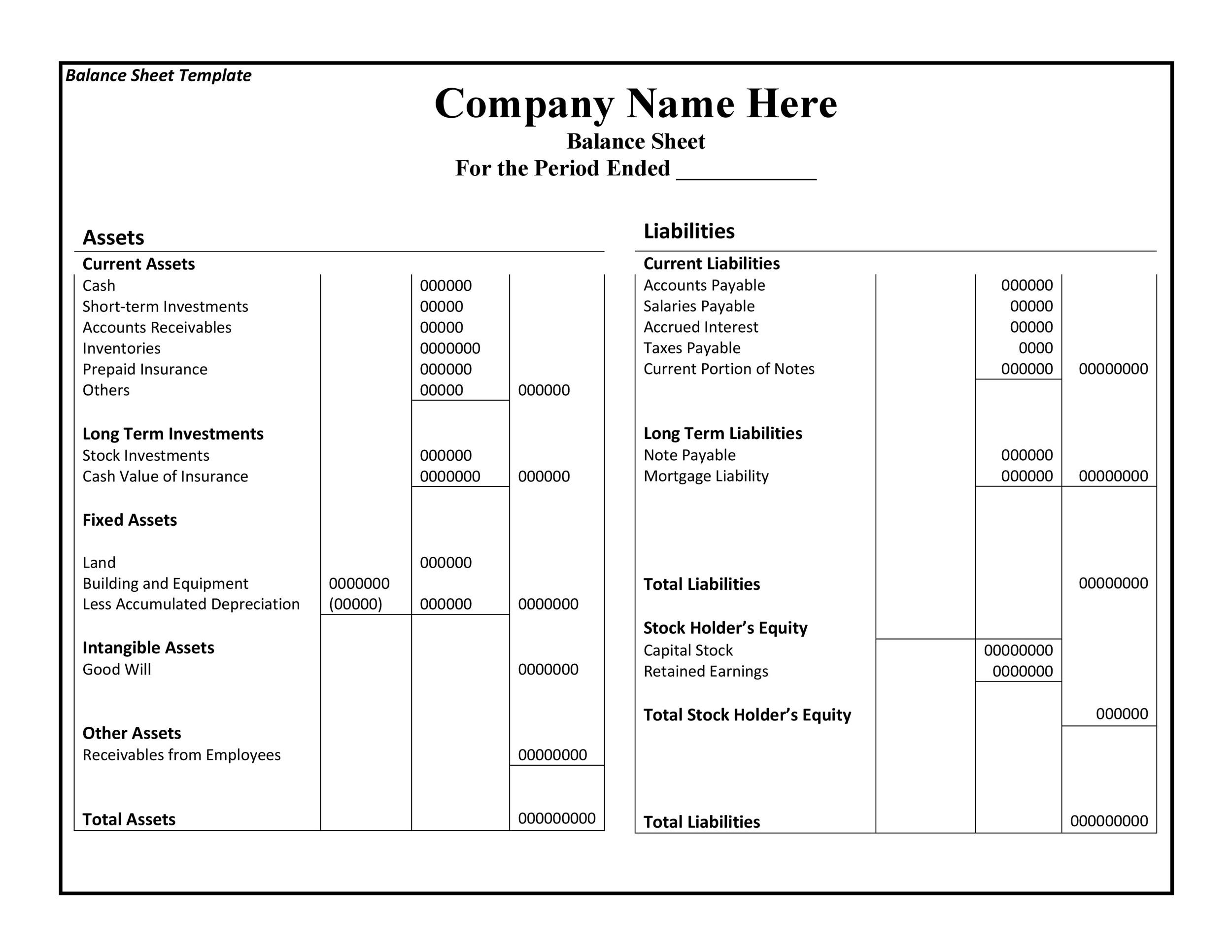

What Are Office Expenses And Supplies

Wages payable is considered a current liability, since it is usually payable within the next 12 months. This means that it is. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. Download our mobile appbank reconciliation Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees.

What Is Wages Payable On A Balance Sheet

This means that it is. Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees. Salaries and wages payable are considered as a current liability on the balance sheet of the company. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. Wages payable is considered a.

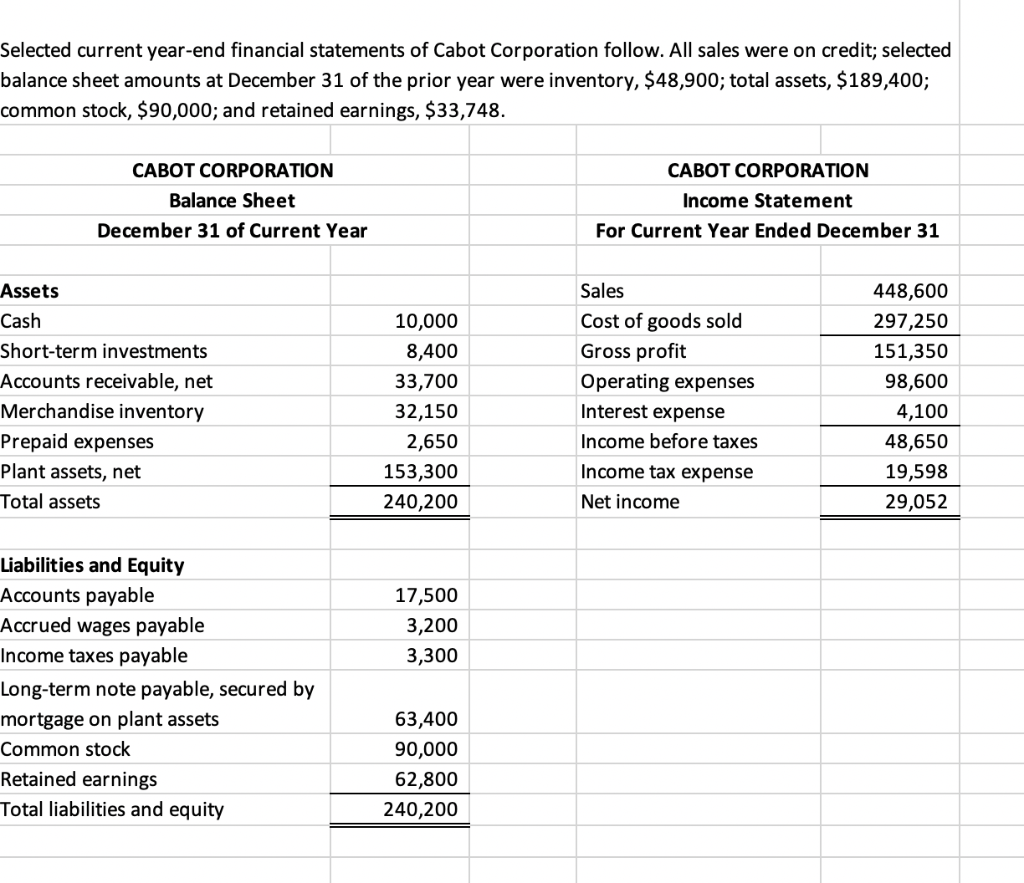

Salaries and Wages Payable on Balance Sheet VincenthasGuerrero

This means that it is. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. Download our mobile appbank reconciliation Wages payable is considered a current liability, since it is usually payable within the next 12 months. Salaries and wages payable are considered as a current liability on the balance.

Is wages payable on a balance sheet? Leia aqui Where does wages

Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. Salaries and wages payable are considered as a current liability on the balance sheet of the company. Download our mobile appbank reconciliation This means that it is. Wages payable is considered a current liability, since it is usually payable within.

Taxes Payable on Balance Sheet Owing Taxes — 1099 Cafe

Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees. Wages payable is considered a current liability, since it is usually payable within the next 12 months. Download our mobile appbank reconciliation This means that it is. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. Wages payable is considered a current liability, since it is usually payable within the next 12 months. Download our mobile appbank reconciliation Salaries and wages payable are.

38 Free Balance Sheet Templates & Examples Template Lab

Wages payable is considered a current liability, since it is usually payable within the next 12 months. Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees. Salaries and wages payable are considered as a current liability on the balance sheet of the company. Download our mobile appbank reconciliation This means that it is.

Is wages payable on a balance sheet? Leia aqui Where does wages

Salaries and wages payable are considered as a current liability on the balance sheet of the company. Download our mobile appbank reconciliation Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees. Wages payable is considered a current liability, since it is usually payable within the next 12 months. This means that it is.

What is the Difference Between Payroll Expenses and Payroll Liabilities

Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees. Wages payable is considered a current liability, since it is usually payable within the next 12 months. Download our mobile appbank reconciliation Salaries and wages payable are considered as a current liability on the balance sheet of the company. This means that it is.

Is wages payable on a balance sheet? Leia aqui Where does wages

Salaries and wages payable are considered as a current liability on the balance sheet of the company. This means that it is. Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees. Download our mobile appbank reconciliation Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a.

This Means That It Is.

Download our mobile appbank reconciliation Salaries and wages payable are considered as a current liability on the balance sheet of the company. Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees. Wages payable is considered a current liability, since it is usually payable within the next 12 months.