Azdor Gov Forms - 26 rows taxpayers can begin filing individual income tax returns through free file partners. You may use this form to authorize disclosure of confidential information relating to transaction. Personal income tax return filed by resident taxpayers. Welcome to arizona department of revenue 1099 form lookup service. You may file form 140 only if you. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing. You can view forms 1099. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,. 26 rows penalty abatement request:

26 rows taxpayers can begin filing individual income tax returns through free file partners. You may use this form to authorize disclosure of confidential information relating to transaction. You may file form 140 only if you. Personal income tax return filed by resident taxpayers. 26 rows penalty abatement request: Welcome to arizona department of revenue 1099 form lookup service. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,. You can view forms 1099.

Personal income tax return filed by resident taxpayers. 26 rows taxpayers can begin filing individual income tax returns through free file partners. Welcome to arizona department of revenue 1099 form lookup service. 26 rows penalty abatement request: You can view forms 1099. You may file form 140 only if you. You may use this form to authorize disclosure of confidential information relating to transaction. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,.

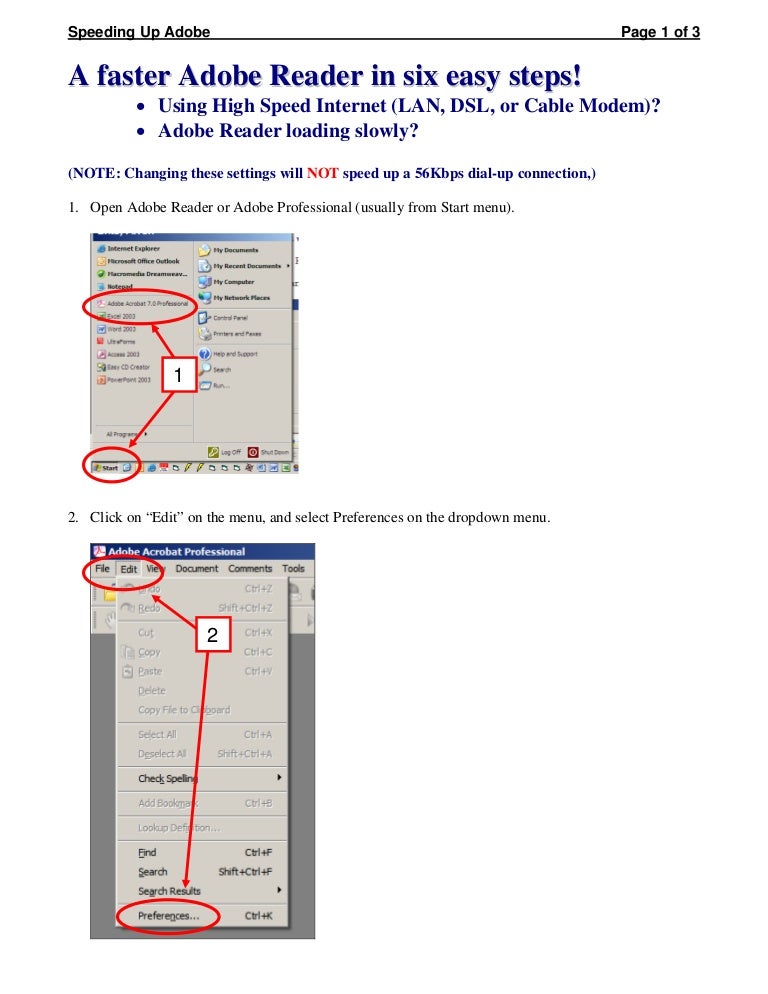

azdor.gov Forms .. ADOR Forms A_Faster_Adobe

You may file form 140 only if you. You can view forms 1099. You may use this form to authorize disclosure of confidential information relating to transaction. 26 rows taxpayers can begin filing individual income tax returns through free file partners. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,.

Fillable Online registrar arizona Individual Tax

Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,. 26 rows taxpayers can begin filing individual income tax returns through free file partners. Welcome to arizona department of revenue 1099 form lookup service. You may file form 140 only if you. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the.

azdor.gov Forms 140EZf PDF

Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing. 26 rows taxpayers can begin filing individual income tax returns through free file partners. 26 rows penalty abatement request: You can view forms 1099.

azdor.gov Forms 140SchANRf PDF

Personal income tax return filed by resident taxpayers. You may file form 140 only if you. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,. You may use this form to authorize disclosure of confidential information relating to.

azdor.gov Forms 140A(PYN)f PDF Free Download

Welcome to arizona department of revenue 1099 form lookup service. You may use this form to authorize disclosure of confidential information relating to transaction. You may file form 140 only if you. 26 rows penalty abatement request: 26 rows taxpayers can begin filing individual income tax returns through free file partners.

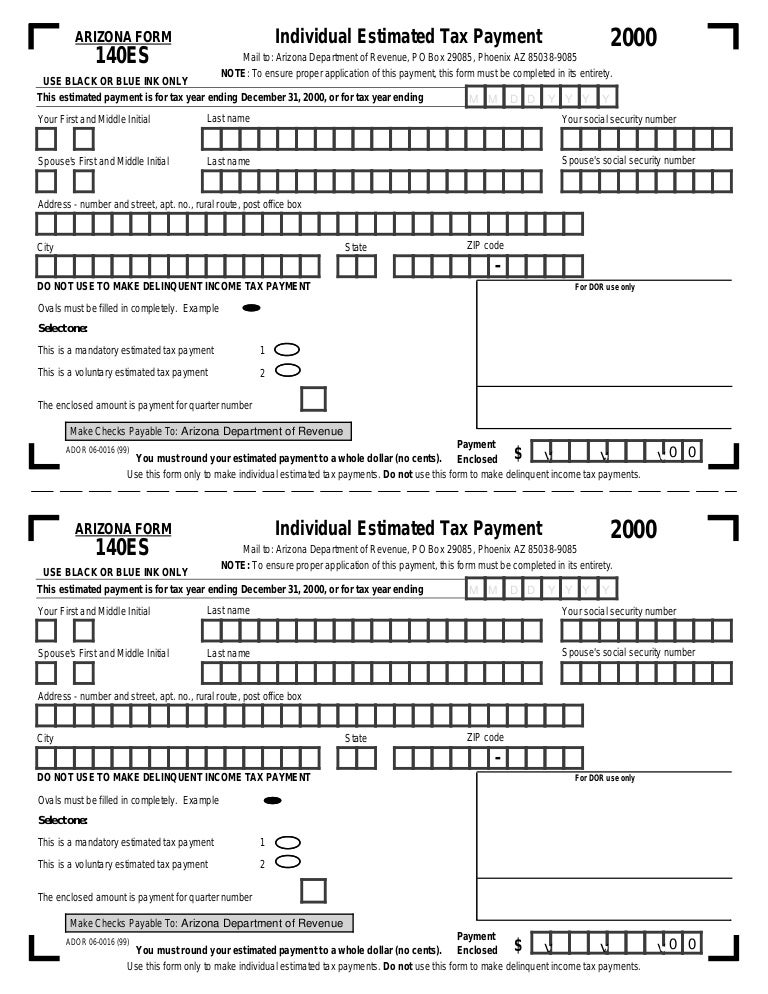

azdor.gov Forms .. ADOR Forms 140esf

Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,. You may file form 140 only if you. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing. You can view forms 1099. 26 rows taxpayers can begin filing individual income tax returns through free file partners.

azdor.gov Forms Sched_anrf PDF

You may use this form to authorize disclosure of confidential information relating to transaction. Personal income tax return filed by resident taxpayers. 26 rows penalty abatement request: 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing. You may file form 140 only if you.

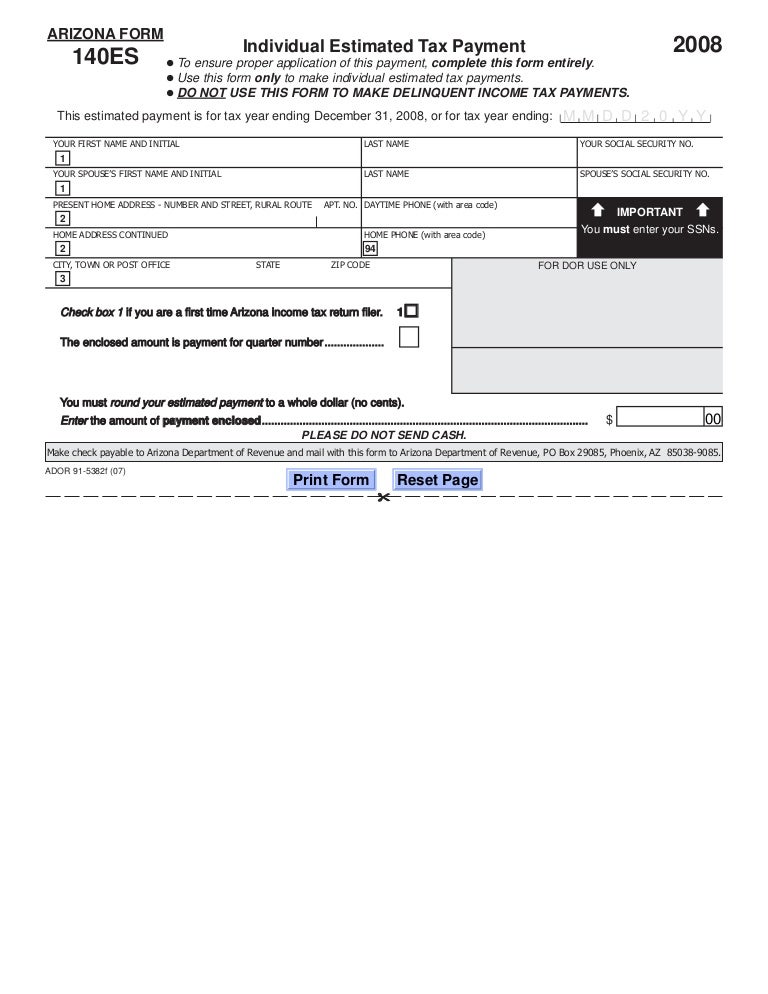

azdor.gov Forms .. ADOR Forms 140ES2008_f

26 rows penalty abatement request: Welcome to arizona department of revenue 1099 form lookup service. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing. 26 rows taxpayers can begin filing individual income tax returns through free file partners.

azdor.gov Forms .. ADOR Forms 140esi PDF

You may file form 140 only if you. You can view forms 1099. You may use this form to authorize disclosure of confidential information relating to transaction. 26 rows taxpayers can begin filing individual income tax returns through free file partners. 26 rows penalty abatement request:

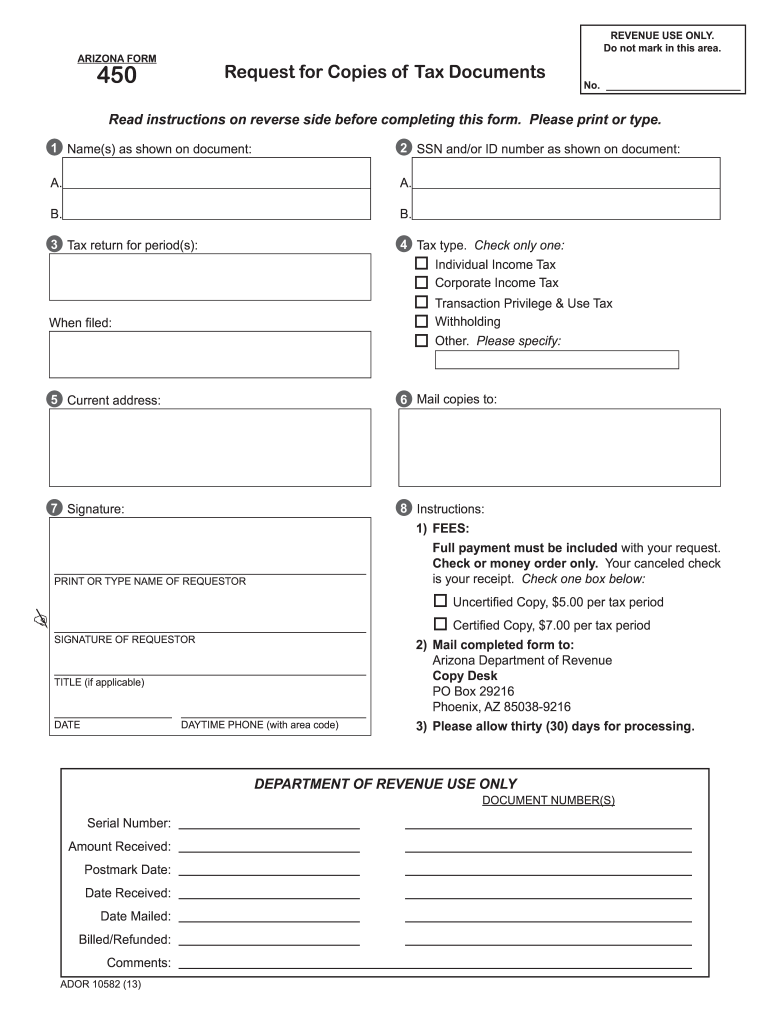

Arizona Department of Revenue Education and Compliance airSlate SignNow

Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,. You may use this form to authorize disclosure of confidential information relating to transaction. You can view forms 1099. 26 rows penalty abatement request: You may file form 140 only if you.

Personal Income Tax Return Filed By Resident Taxpayers.

You may use this form to authorize disclosure of confidential information relating to transaction. Aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes,. 26 rows taxpayers can begin filing individual income tax returns through free file partners. Welcome to arizona department of revenue 1099 form lookup service.

26 Rows Penalty Abatement Request:

You can view forms 1099. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing. You may file form 140 only if you.