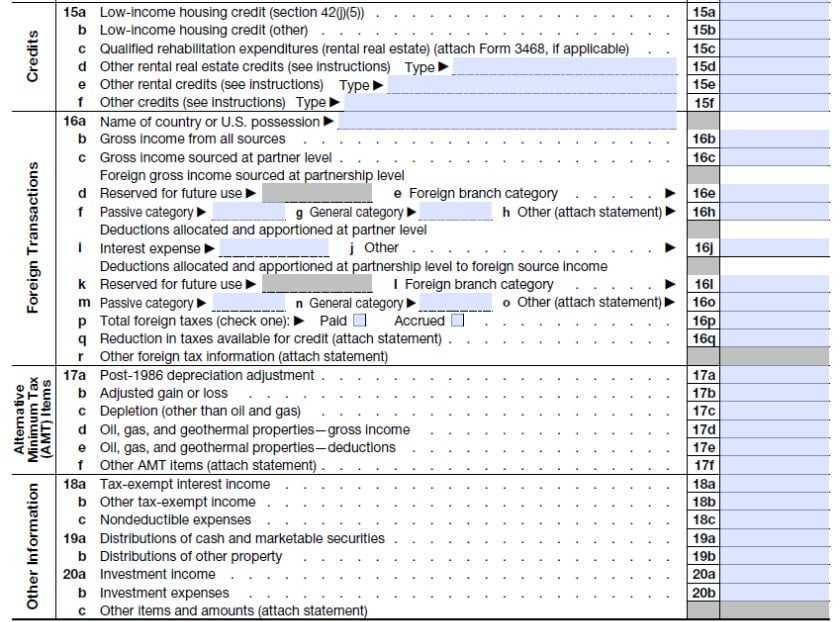

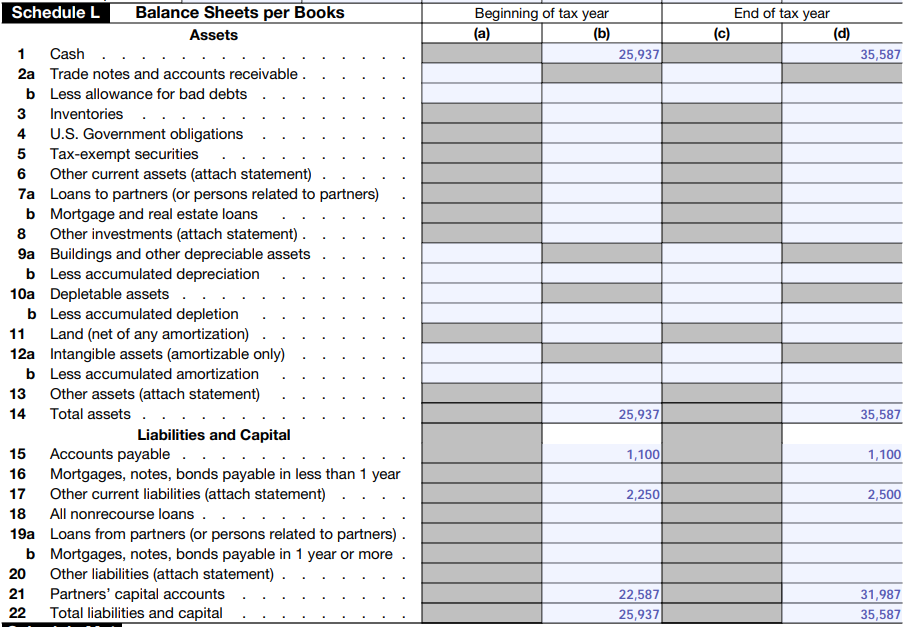

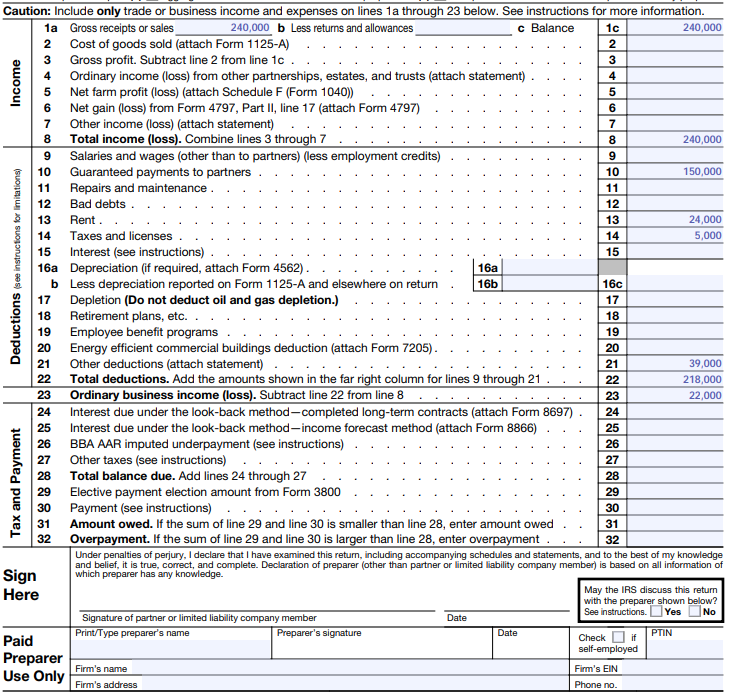

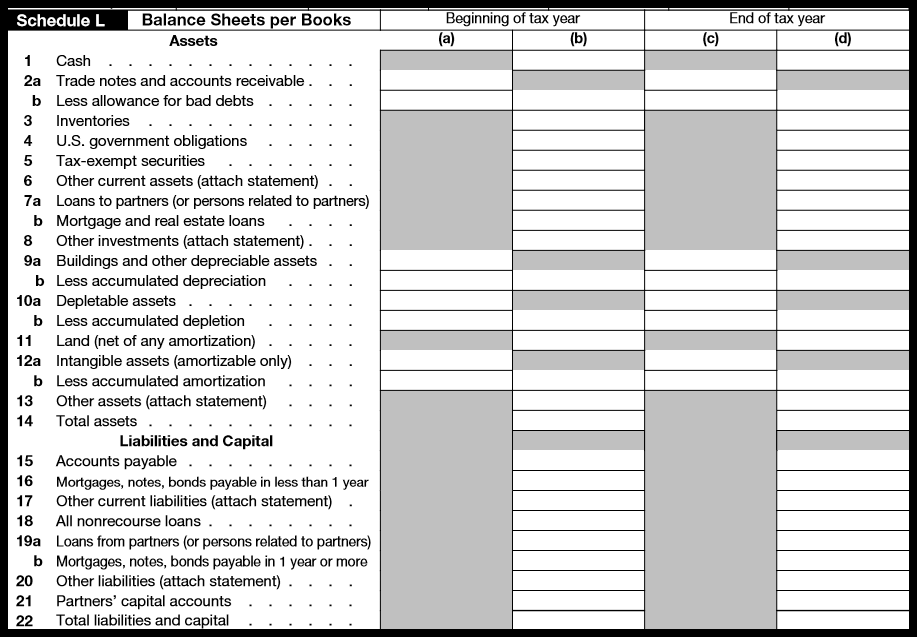

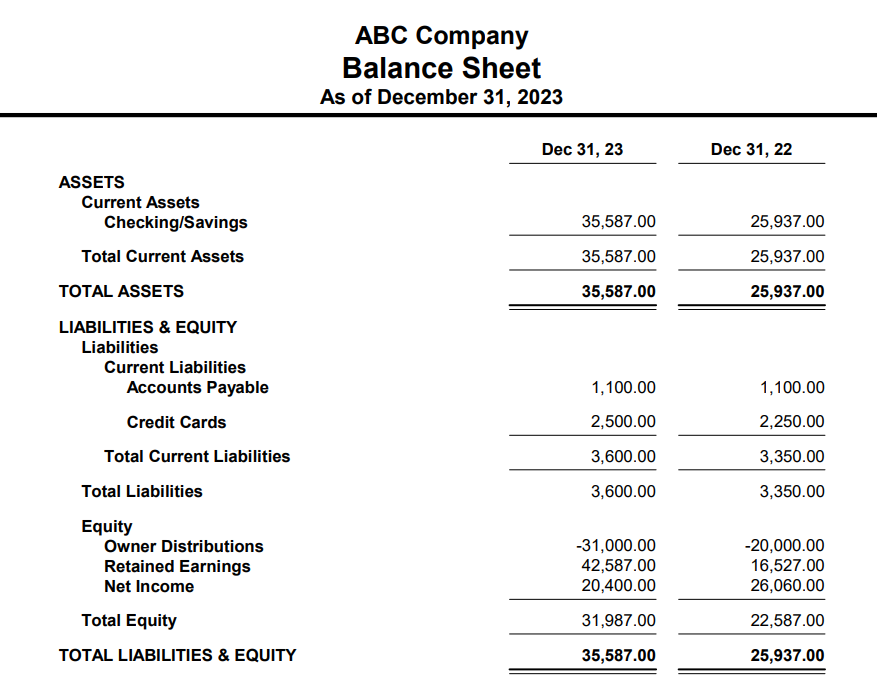

1065 Balance Sheet Requirements - A partnership has to complete a schedule l (balance sheet); Do i need to include a balance sheet with form 1065? When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Yes, partnerships are required to include a balance sheet (using. When a return is made for a partnership by a receiver,. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4.

Do i need to include a balance sheet with form 1065? A partnership has to complete a schedule l (balance sheet); Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Yes, partnerships are required to include a balance sheet (using. When a return is made for a partnership by a receiver,. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member.

When a return is made for a partnership by a receiver,. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Yes, partnerships are required to include a balance sheet (using. Do i need to include a balance sheet with form 1065? A partnership has to complete a schedule l (balance sheet);

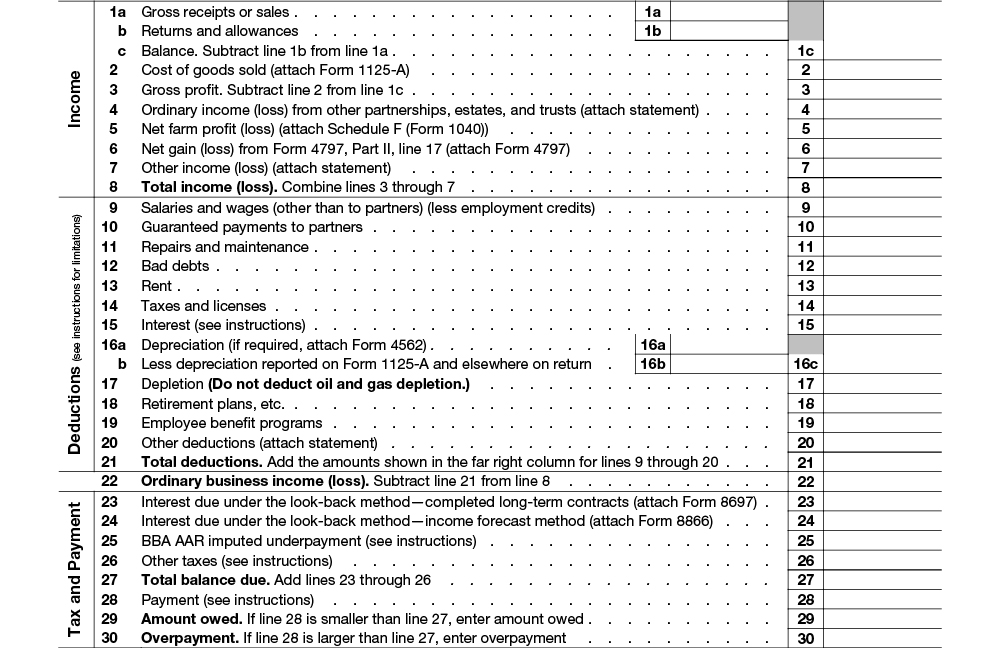

Form 1065 StepbyStep Instructions (+ Free Checklist)

Yes, partnerships are required to include a balance sheet (using. A partnership has to complete a schedule l (balance sheet); Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. When a.

Form 1065 StepbyStep Instructions (+Free Checklist)

When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line.

Form 1065 StepbyStep Instructions (+Free Checklist)

Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Do i need to include a balance sheet with form 1065? When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Form 1065 isn't considered to.

How To Complete Form 1065 US Return of Partnership

Yes, partnerships are required to include a balance sheet (using. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. Do i need to include a balance sheet with form 1065? Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. A.

IRS Form 1065 Schedules L, M1, and M2 (2020) Balance Sheets (L

Yes, partnerships are required to include a balance sheet (using. Do i need to include a balance sheet with form 1065? Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. When a return is made for a partnership by a receiver,. When the requirements for form 1065, schedule.

Form 1065 StepbyStep Instructions (+Free Checklist)

Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. A partnership has to complete a schedule l (balance sheet); When a return is made for a partnership by a receiver,. Do i need to include a balance sheet with form 1065? Yes, partnerships are required to include a balance sheet (using.

IRS Form 1065 Schedules L, M1, and M2 (2022) Balance Sheets (L

When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Do i need to include a balance sheet with form 1065? When a return is made for a partnership by a receiver,. Form 1065 isn't considered to be a return unless it's signed by a partner or.

How to fill out an LLC 1065 IRS Tax form

Yes, partnerships are required to include a balance sheet (using. Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. A partnership has to complete a schedule l (balance sheet); Do i need to include a balance sheet with form 1065? When the requirements for form 1065, schedule b, question 4 are met,.

Form 1065BU.S. Return of for Electing Large Partnerships

When a return is made for a partnership by a receiver,. Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. Form 1065 isn't considered to.

Form 1065 Instructions U.S. Return of Partnership

When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the. A partnership has to complete a schedule l (balance sheet); Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. Schedule l is required when the partnership does not meet.

A Partnership Has To Complete A Schedule L (Balance Sheet);

Do i need to include a balance sheet with form 1065? Form 1065 isn't considered to be a return unless it's signed by a partner or llc member. When a return is made for a partnership by a receiver,. When the requirements for form 1065, schedule b, question 4 are met, the balance sheet information isn't required with the return, per the.

Yes, Partnerships Are Required To Include A Balance Sheet (Using.

Schedule l is required when the partnership does not meet the four requirements outlined in schedule b (form 1065), line 4.